FerreiraSilva/iStock Editorial through Getty Images

Petrobras (NYSE:PBR) is a widely known firm and the biggest crude oil producer in Brazil. The firm constantly takes benefit of Brazil’s robust oil reserves. However, its politicization has continued to place strain on the corporate and its capacity to drive shareholder rewards. As we’ll see all through this text, the corporate’s worthwhile asset portfolio nonetheless makes it a worthwhile long-term funding.

Petrobras Campos Basin

Petrobras’ manufacturing has been declining since a 2009 peak of greater than 1.5 million barrels / day.

Petrobras

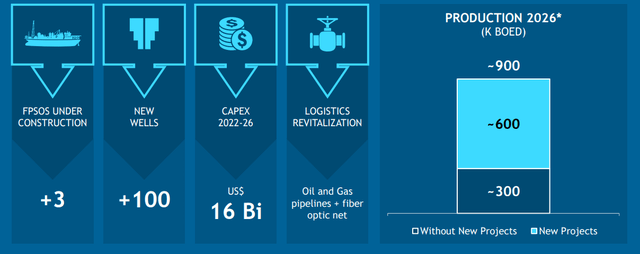

The Campos Basin is huge. It’s answerable for greater than 75% of all offshore oil produced from Brazil thus far. The firm is trying to spend greater than $16 billion on this revitalization, an indication of the energy of the corporate’s portfolio and the restoration in its steadiness sheet of the previous decade of manufacturing.

While the basin will probably by no means return again to its 2009 highs, the huge >$3 billion / 12 months in capex for the basin alone will add 3 FPSOs, replace logistics, and improve 2026 manufacturing by three-fold from 300 thousand to 900 thousand barrels / day for the corporate. The firm might be paying $73 / annual barrel produced in capex, an inexpensive charge.

Given this plan, we count on the Campos Basin to stay a considerable portion of Petrobras’ present portfolio and earnings.

Petrobras 1Q 2022 Performance

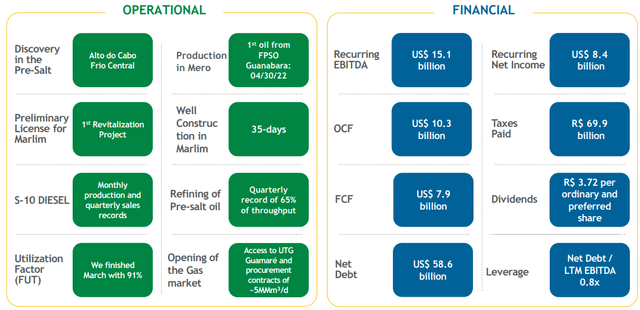

Petrobras has continued to carry out properly and the corporate had a blowout quarter within the 1Q 2022.

Petrobras had an extremely robust quarter. The firm has continued to make new discoveries and FPSOs have continued to assist further manufacturing. The firm is specializing in constructing its whole asset pipeline from manufacturing to refining to client gross sales. While greater sale costs have harm opinions concerning the firm, the corporate has continued to carry out.

Financially, the corporate has taken its debt to <$60 billion with a web debt / LTM EBITDA of <1.0x. The firm’s OCF is at greater than $40 billion annualized and regardless of not having insubstantial debt, the corporate’s FCF yield is at greater than 30% primarily based on its market capitalization and greater than 20% primarily based on its enterprise worth.

The firm’s continued monetary energy and enhancements all through the quarter assist spotlight the corporate’s energy.

Petrobras Financial Picture Improvement

Petrobras’ monetary energy is supported by the corporate’s vital YoY monetary enhancements.

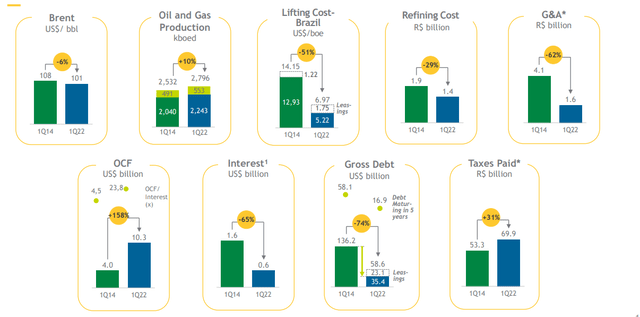

Over the previous 8 years, with minimal assist from the federal government, Petrobras’ monetary image has improved dramatically. Despite a 6% drop in Brent costs (and never counting inflation on prices) from the place they have been 8 years in the past, the corporate’s different elements have improved dramatically. Oil and gasoline manufacturing has elevated 10%.

Lifting prices have declined 51% and refining prices 29%. The firm has improved its monetary portfolio and in consequence diminished the curiosity its paying by 65%. Gross debt has been diminished by an astounding 74% or an virtually $70 billion discount (roughly $10 billion annualized). This has helped the Brazilian authorities as properly by taxes paid.

The firm’s present enterprise worth is now lower than $150 billion.

Petrobras Shareholder Return Potential

Petrobras has the power to generate huge shareholder rewards. Despite the corporate’s capital spending of $10+ billion yearly, the corporate’s annualized FCF is nearly $32 billion. That implies a FCF yield of greater than 20%. The firm is paying substantial dividends from this FCF whereas persevering with to enhance its monetary portfolio.

From this money circulate the corporate has the power to drive substantial shareholder rewards, making it a worthwhile funding.

Thesis Risk

The largest threat to the thesis right here is crude oil costs. Petrobras has one of many strongest monetary photos within the business relative to its valuation, supported by the corporate’s continued punishments for its ties to the Brazilian authorities. Those dangers are price paying shut consideration to by buyers within the present atmosphere.

Conclusion

Petrobras has a novel portfolio of belongings. The firm has lately introduced a plan to revitalize the Campos Basin spending $16 billion price of capital to take action. That will lead to 2026 manufacturing being 3x what it might be with out that revitalization. The firm’s general manufacturing and revenue potential is anticipated to stay robust.

The firm has considerably improved its monetary portfolio over the previous many years. The firm’s new debt load is extremely manageable however we count on the corporate to proceed lowering it. At the identical time we count on the corporate to additionally aggressively give attention to shareholder returns making the corporate a worthwhile funding.

Petrobras: Brazil Discount Makes This A Better Investment (NYSE:PBR) & More Latest News Update

Petrobras: Brazil Discount Makes This A Better Investment (NYSE:PBR) & More Live News

All this information that I’ve made and shared for you individuals, you’ll prefer it very a lot and in it we hold bringing subjects for you individuals like each time so that you just hold getting information data like trending subjects and also you It is our objective to have the ability to get

every kind of reports with out going by us in order that we are able to attain you the newest and greatest information without spending a dime so as to transfer forward additional by getting the knowledge of that information along with you. Later on, we are going to proceed

to present details about extra today world news update varieties of newest information by posts on our web site so that you just all the time hold shifting ahead in that information and no matter form of data might be there, it’s going to undoubtedly be conveyed to you individuals.

Petrobras: Brazil Discount Makes This A Better Investment (NYSE:PBR) & More News Today

All this information that I’ve introduced as much as you or would be the most totally different and greatest information that you just individuals are not going to get anyplace, together with the knowledge Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you may get different varieties of information alongside along with your nation and metropolis. You will be capable of get data associated to, in addition to it is possible for you to to get details about what’s going on round you thru us without spending a dime

so as to make your self a educated by getting full details about your nation and state and details about information. Whatever is being given by us, I’ve tried to carry it to you thru different web sites, which you will like

very a lot and for those who like all this information, then undoubtedly round you. Along with the individuals of India, hold sharing such information essential to your family members, let all of the information affect them they usually can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links