Robert Way/iStock Editorial via Getty Images

MUFG logo (MUFG)

Investment thesis

My portfolio is heavily tilted towards financials and real estate, with financials presently taking up 31% of my portfolio. These are banks, insurance, and investment companies located predominantly in Asia and Europe.

So far, I have not been invested in any Japanese companies, but I am interested to explore the possibility to get exposure to Japan. After all, it is the third largest economy in the world with many large well-known companies and a GDP per capita of USD 39,048.

I start at the top, with Japan’s largest bank which is Mitsubishi UFJ Financial Group, Inc., which is listed on Tokyo Stock Exchange. It also has an ADR listed on the NYSE under MUFG.

Let us start by looking at their most recent financial results.

Financial Results

MUFG delivered a net profit for the last Full Year ending 31 March 2022 of ¥1,130 billion, which equates to about USD 8.47 billion. This is up 46% from the year before.

The reason for this large jump in net profit was mainly a result of improved net interest income, thanks to the improvement of lending spread in Japan and overseas.

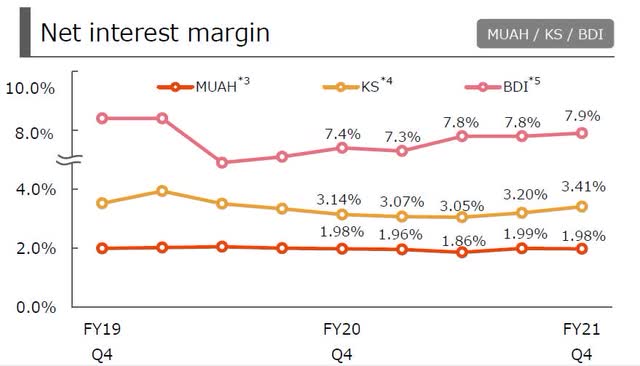

NIM of MUFG (MUFG’s latest financial report)

Their income from fees and commissions also increased both from the domestic and overseas asset management business.

The EPS was ¥88.45.

Based on its recent share price of ¥727, we get a low P/E of just 8.2.

Their ROE has been low for the last 10 years, although there has been some improvement last year and they do have a mid to long-term target to raise it further to the 9 to 10% level.

ROE over the last 10 years (MUFG’s last financial report)

We have all heard that Japan has lived in a very low-interest rate environment for a long time. It is always difficult to obtain good NIM in such an environment.

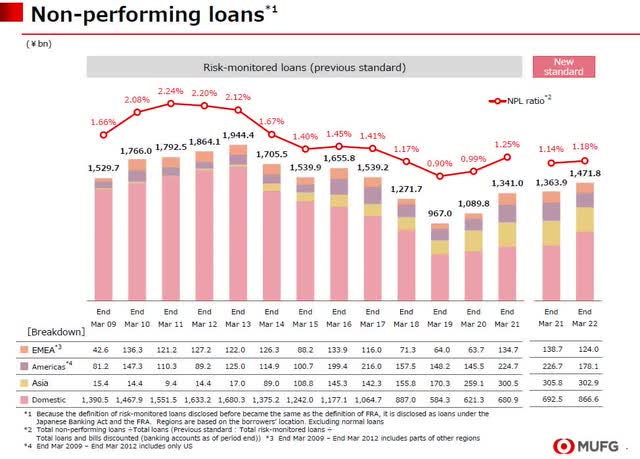

In terms of their lending business, the non-performing loans are in line with other large banks.

NPL status (MUFG’s last financial report)

Returning capital to shareholders

When a company has solid financials, good business prospects, and ample free cash generation, I think such companies should share a large part of this with the people that own the business.

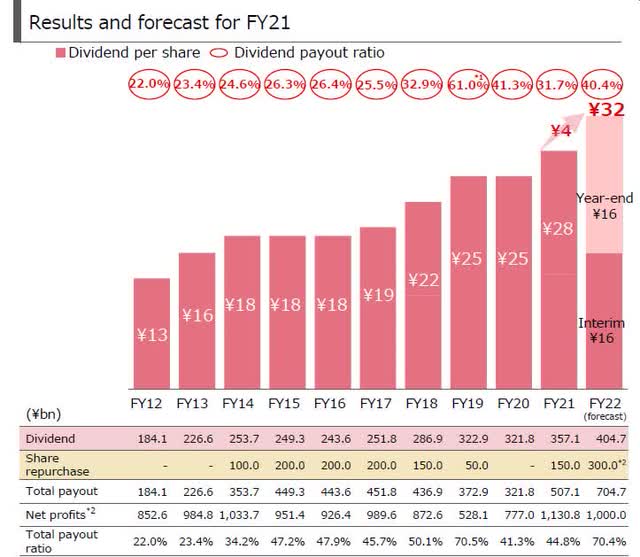

MUFG’s past records have been dismal, but there are clear signs of a change in their policy as the payout ratios have been growing over the years from just 22% to as much as 70% last year.

Returning capital to shareholders (MUFG’s last financial report)

Share repurchases have also taken place. They forecast to do ¥300 billion share buyback this year which is double what they did last year.

Comparison with other large global banks

How does it stack up against other large global banks?

After all, as an investor in this space, you have many companies to choose from.

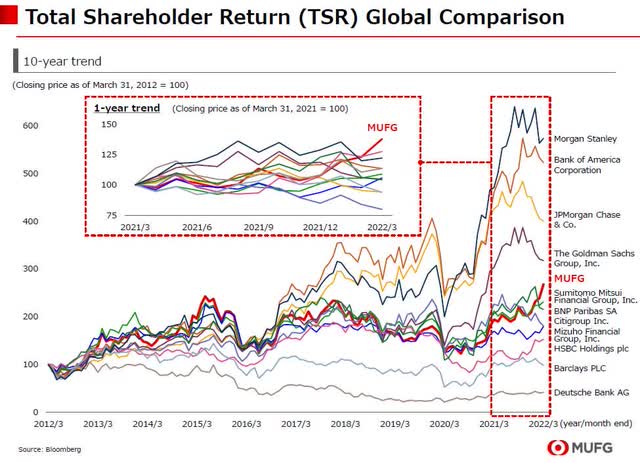

Total shareholder return (MUFG’s last financial report)

It is well worth noting that Morgan Stanley (MS) was the best performer here. What is important is that MUFG owns roughly 20% of MS. If MUFG did not hold this stake, they would have fallen further down on the list above.

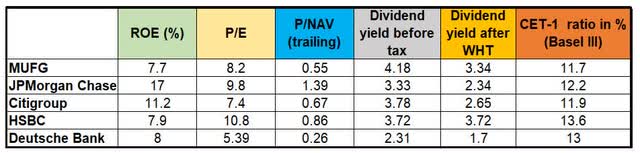

We can dig a bit deeper to see how they compare on other metrics, such as ROE, P/E, P/NAV, yield, and CET-1 ratios.

Comparison with other banks (Data from SA and each bank, compilation by author)

In my analysis, I always take into account any potential withholding tax on the dividend. This is based on my residence status in Singapore, and it will vary for other investors depending on where they reside.

Potential risks to the thesis

It is always good to ask yourself what are the risk to your thesis.

Some of the concerns I have with investing in Japanese companies have been that they have delivered quite low ROE in the past. A risk could be that they will find it hard to achieve their target of 9 to 10% ROE.

Another risk is that for companies that primarily depend on the domestic market, Japan does have a problem with demographics.

According to Wikipedia, the projection is that the population based on the current fertility rate will consist of 40% of people over the age of 65 by 2060, and the total population will fall by one-third from 128 million in 2010 to 87 million in 2060.

Conclusion

MUFG has certainly shown much improvement in its financial performance over the last year.

Is that reflected in the share price?

MUFG share price over 1 year (Yahoo Finance)

It is difficult for me to fathom why the share price in Japan has gone up 22.6% over the last year, while the ADR in New York is basically flat.

Hopefully, some of my avid readers can help me understand this.

From my point of view, it seems that the recent improvement in performance is reflected in the share price in Japan at this moment. If I were to buy it, it would be in Japan which has a 20% WHT while it is 30% in the U.S.

I would start my coverage of MUFG with a hold stance for now.

Mitsubishi UFJ: Improvements From Japan’s Largest Bank (NYSE:MUFG) & Latest News Update

Mitsubishi UFJ: Improvements From Japan’s Largest Bank (NYSE:MUFG) & More Live News

All this news that I have made and shared for you people, you will like it very much and in it we keep bringing topics for you people like every time so that you keep getting news information like trending topics and you It is our goal to be able to get

all kinds of news without going through us so that we can reach you the latest and best news for free so that you can move ahead further by getting the information of that news together with you. Later on, we will continue

to give information about more today world news update types of latest news through posts on our website so that you always keep moving forward in that news and whatever kind of information will be there, it will definitely be conveyed to you people.

Mitsubishi UFJ: Improvements From Japan’s Largest Bank (NYSE:MUFG) & More News Today

All this news that I have brought up to you or will be the most different and best news that you people are not going to get anywhere, along with the information Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this made available to all of you so that you are always connected with the news, stay ahead in the matter and keep getting today news all types of news for free till today so that you can get the news by getting it. Always take two steps forward

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links