Singapore Telecommunications Limited (SGX:Z74) simply launched its newest full-year report and issues will not be wanting nice. Singapore Telecommunications missed earnings this time round, with S$16b income coming in 2.1% under what the analysts had modelled. Statutory earnings per share (EPS) of S$0.12 additionally fell in need of expectations by 11%. Following the end result, the analysts have up to date their earnings mannequin, and it will be good to know whether or not they suppose there’s been a powerful change within the firm’s prospects, or if it is enterprise as common. We thought readers would discover it attention-grabbing to see the analysts newest (statutory) post-earnings forecasts for subsequent 12 months.

Check out our newest evaluation for Singapore Telecommunications

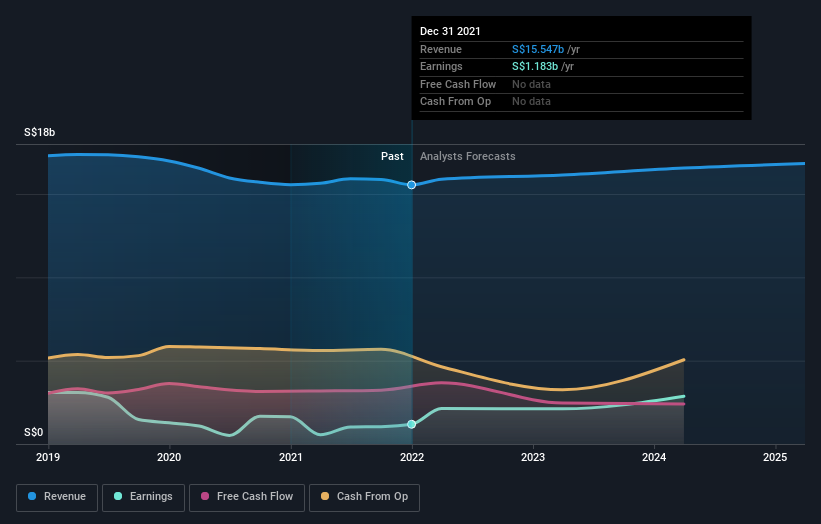

Taking into consideration the newest outcomes, the present consensus from Singapore Telecommunications’ 16 analysts is for revenues of S$16.1b in 2023, which might mirror an affordable 3.8% improve on its gross sales over the previous 12 months. Statutory earnings per share are predicted to leap 97% to S$0.14. In the lead-up to this report, the analysts had been modelling revenues of S$16.2b and earnings per share (EPS) of S$0.16 in 2023. The analysts appear to have change into just a little extra damaging on the enterprise after the newest outcomes, given the small dip of their earnings per share numbers for subsequent 12 months.

The consensus worth goal held regular at S$3.15, with the analysts seemingly voting that their decrease forecast earnings will not be anticipated to result in a decrease inventory worth within the foreseeable future. That’s not the one conclusion we are able to draw from this knowledge nevertheless, as some buyers additionally like to contemplate the unfold in estimates when evaluating analyst worth targets. Currently, essentially the most bullish analyst values Singapore Telecommunications at S$4.40 per share, whereas essentially the most bearish costs it at S$2.70. These worth targets present that analysts do have some differing views on the enterprise, however the estimates don’t range sufficient to counsel to us that some are betting on wild success or utter failure.

Another manner we are able to view these estimates is within the context of the larger image, similar to how the forecasts stack up in opposition to previous efficiency, and whether or not forecasts are roughly bullish relative to different corporations within the business. One factor stands out from these estimates, which is that Singapore Telecommunications is forecast to develop quicker sooner or later than it has up to now, with revenues anticipated to show 3.8% annualised progress till the top of 2023. If achieved, this could be a a lot better end result than the two.3% annual decline over the previous 5 years. By distinction, our knowledge means that different corporations (with analyst protection) in an identical business are forecast to see their income develop 3.5% per 12 months. So it seems like Singapore Telecommunications is predicted to develop at about the identical charge as the broader business.

The Bottom Line

The greatest concern is that the analysts lowered their earnings per share estimates, suggesting enterprise headwinds may lay forward for Singapore Telecommunications. They additionally reconfirmed their income estimates, with the corporate predicted to develop at about the identical charge as the broader business. The consensus worth goal held regular at S$3.15, with the newest estimates not sufficient to have an effect on their worth targets.

Following on from that line of thought, we expect that the long-term prospects of the enterprise are rather more related than subsequent 12 months’s earnings. At Simply Wall St, we’ve a full vary of analyst estimates for Singapore Telecommunications going out to 2025, and you may see them free on our platform right here..

You ought to at all times take into consideration dangers although. Case in level, we have noticed 2 warning indicators for Singapore Telecommunications you need to be conscious of.

Have suggestions on this text? Concerned concerning the content material? Get in contact with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to carry you long-term targeted evaluation pushed by elementary knowledge. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Earnings Miss: Singapore Telecommunications Limited Missed EPS By 11% And Analysts Are Revising Their Forecasts & More Latest News Update

Earnings Miss: Singapore Telecommunications Limited Missed EPS By 11% And Analysts Are Revising Their Forecasts & More Live News

All this information that I’ve made and shared for you folks, you’ll prefer it very a lot and in it we preserve bringing subjects for you folks like each time so that you just preserve getting information data like trending subjects and also you It is our objective to have the ability to get

every kind of reports with out going via us in order that we are able to attain you the newest and greatest information at no cost so that you could transfer forward additional by getting the data of that information along with you. Later on, we are going to proceed

to present details about extra today world news update forms of newest information via posts on our web site so that you just at all times preserve transferring ahead in that information and no matter type of data might be there, it is going to positively be conveyed to you folks.

Earnings Miss: Singapore Telecommunications Limited Missed EPS By 11% And Analysts Are Revising Their Forecasts & More News Today

All this information that I’ve introduced as much as you or would be the most completely different and greatest information that you just persons are not going to get anyplace, together with the data Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you will get different forms of information alongside along with your nation and metropolis. You will have the ability to get data associated to, in addition to it is possible for you to to get details about what’s going on round you thru us at no cost

so that you could make your self a educated by getting full details about your nation and state and details about information. Whatever is being given via us, I’ve tried to carry it to you thru different web sites, which you will like

very a lot and should you like all this information, then positively round you. Along with the folks of India, preserve sharing such information essential to your family members, let all of the information affect them they usually can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links