Analysts are warning that earnings will not be as robust going ahead

Author of the article:

Bloomberg News

Stefanie Marotta

Article content material

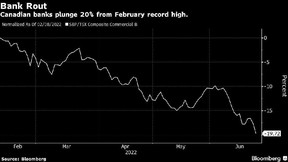

Canadian banks fell greater than 20 per cent from their record high set in early February as recession fears ship traders fleeing.

Advertisement 2

This commercial has not loaded but, however your article continues under.

Article content material

The S&P TSX Financials Sector Index and the S&P/TSX Commercial Banks Index, which tracks the nation’s eight largest lenders, each dropped Thursday, including to a different day of losses after inflation in Canada surged to a four-decade high and U.S. knowledge pointed to rising unemployment and slumping manufacturing and companies exercise.

Toronto-Dominion Bank, Canada’s second-largest lender, led losses because it dropped as a lot as 3.6 per cent to its lowest level in 9 months. Canadian Imperial Bank of Commerce and Bank of Nova Scotia fell as a lot as 3.4 per cent and three.3 per cent, respectively.

The business banks index hit its high on Feb. 8 and was one of many S&P TSX Composite Index’s strongest performers earlier than spiralling as Russia launched its battle in Ukraine on Feb. 24 and central banks warned of a possible financial downturn.

Advertisement 3

This commercial has not loaded but, however your article continues under.

Article content material

Analysts are warning that earnings will not be as robust going ahead. Canadian financial institution earnings estimates for 2023 may fall by 16 per cent on common within the case of an financial downturn, in accordance the RBC Capital Markets. Scotiabank and CIBC are among the many Big Six financial institution shares main losses this yr. Both banks, Canada’s third- and fifth-largest banks, may have additional to fall as they rebuild mortgage loss provisions beforehand launched as pandemic restrictions unwound earlier this yr.

Scotiabank’s core earnings per share for 2023 may decline essentially the most out of the group by 22.5 per cent, RBC analyst Darko Mihelic mentioned in a be aware to shoppers Tuesday. The financial institution has launched essentially the most performing reserves of the group, whereas Bank of Montreal and National Bank of Canada could be the least impacted, with every financial institution’s core EPS estimates falling by 12.6 per cent.

Advertisement 4

This commercial has not loaded but, however your article continues under.

Article content material

“NA and BMO would be good defensive stocks to own heading into a recession,” Mihelic mentioned. “BNS and CM would likely suffer under bigger earnings declines and some consternation around housing in Canada and generally higher loan loss concerns.”

-

Cloudier financial outlook is not denting the boldness of Canada’s big banks

-

OSFI retains financial institution capital buffer at 2.5% in ‘atmosphere of heightened uncertainty’

-

Transition to open banking will likely be bumpy however it’s value it, veteran of U.Okay. sector says

Inflation in Canada climbed to 7.7 per cent in May, reaching its highest level in 40 years, Statistics Canada mentioned on Wednesday. The soar bolsters expectations that the Bank of Canada will ship aggressive fee will increase subsequent month.

Advertisement 5

This commercial has not loaded but, however your article continues under.

Article content material

Even so, Canada’s banking regulator left a key capital requirement for giant lenders unchanged on Wednesday, indicating that it believes that the banks can take in potential losses at the same time as financial dangers mount.

Investors choose banks that get a head begin on increase their reserves, Mihelic mentioned.

“The banks that begin to proactively build reserves ahead of peers will be rewarded as long as there are not bank specific issues causing the reserve build,” he mentioned.

As recession fears mount and Canada’s housing market cools, analysts together with these at Barclays and Desjardins, have been chopping their worth targets on the nation’s largest lenders. Since early March 4, the common worth goal on the business banks index fell 6.3 per cent, with CIBC’s goal dropping 9.7 per cent.

Bloomberg.com

Share this text in your social community

Advertisement

This commercial has not loaded but, however your article continues under.

Financial Post Top Stories

Sign as much as obtain the every day high tales from the Financial Post, a division of Postmedia Network Inc.

Thanks for signing up!

A welcome electronic mail is on its method. If you do not see it, please test your junk folder.

The subsequent difficulty of Financial Post Top Stories will quickly be in your inbox.

We encountered a difficulty signing you up. Please attempt once more

Canada’s big banks plunge over 20% from record high on recession fears & More Latest News Update

Canada’s big banks plunge over 20% from record high on recession fears & More Live News

All this information that I’ve made and shared for you individuals, you’ll prefer it very a lot and in it we hold bringing subjects for you individuals like each time so that you just hold getting information info like trending subjects and also you It is our aim to have the ability to get

all types of stories with out going via us in order that we are able to attain you the newest and greatest information free of charge so to transfer forward additional by getting the knowledge of that information along with you. Later on, we are going to proceed

to present details about extra today world news update varieties of newest information via posts on our web site so that you just at all times hold shifting ahead in that information and no matter type of info will likely be there, it is going to positively be conveyed to you individuals.

Canada’s big banks plunge over 20% from record high on recession fears & More News Today

All this information that I’ve introduced as much as you or would be the most completely different and greatest information that you just persons are not going to get wherever, together with the knowledge Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you will get different varieties of information alongside together with your nation and metropolis. You will be capable of get info associated to, in addition to it is possible for you to to get details about what goes on round you thru us free of charge

so to make your self a educated by getting full details about your nation and state and details about information. Whatever is being given via us, I’ve tried to deliver it to you thru different web sites, which you’ll like

very a lot and if you happen to like all this information, then positively round you. Along with the individuals of India, hold sharing such information essential to your family members, let all of the information affect them and so they can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links