UK growth to slow whereas inflation jumps

The UK is predicted to present the joint-fastest growth in the G7 this 12 months, regardless of having its growth estimate reduce from 4.7% to 3.7%. However, the outlook will worsen quickly, in accordance to the IMF.

The Washington-based lender mentioned that it expects GDP growth of just one.2% in 2023, simply over half the speed beforehand anticipated.

That will imply the UK will face the weakest growth and the best inflation of any G7 nation in 2023, the IMF mentioned.

Closing abstract: IMF predicts sickly world economic system and UK slowdown

The message from the International Monetary Fund’s conferences in Washington to the world economic system is grim: Russia’s invasion of Ukraine will dangle over all the things, inflicting increased costs and slowing exercise.

The IMF downgraded growth forecasts internationally, with 2022 GDP growth now anticipated at 3.6%, down from January’s prediction of 4.4%.

UK financial growth is predicted to match the US in 2022, however in 2023 it will hunch to the underside of the league desk of comparable economies in the G7, the IMF mentioned. It will even face the best inflation.

The information will add to the stress on the UK authorities, which is already below extreme pressure following the unprecedented fines for Prime Minister Boris Johnson and chancellor Rishi Sunak for prison breaches of lockdown laws.

Add in slower growth and better costs and it may very well be much more politically poisonous when power costs rise once more in the winter. Labour’s shadow chancellor Rachel Reeves mentioned the IMF information confirmed that authorities coverage was fallacious, though she didn’t give particulars on how:

NEW: The IMF’s financial outlook exhibits the UK is forecast to have the slowest growth in the G7 subsequent 12 months.

Once once more, the Conservative financial technique of low growth and excessive taxes is laid naked.

Labour will tax pretty, spend correctly and get our economic system rising.

— Rachel Reeves (@RachelReevesMP) April 19, 2022

UK power firms are additionally calling for the federal government to step in with a serious intervention to assist customers pay for increased costs, amid considerations that gas poverty may enhance quickly.

ScottishPower’s boss, Kevin Anderson, mentioned he wished a “social tariff” to reduce £1,000 off payments for poorer prospects, though that will imply eradicating the value cap for better-off households, a coverage that would probably profit power firms.

You can proceed to comply with the Guardian’s reside protection from around the globe:

In the Russia-Ukraine conflict: Russian troops seize jap metropolis as the battle for the Donbas area begins

In UK politics, MPs will vote on Thursday in a debate relating to claims Johnson lied to parliament, the speaker has introduced

In the US, Joe Biden will talk about the Russia-Ukraine conflict in a video name with allies

Thank you as ever for following, and do be a part of us tomorrow for extra reside protection of enterprise, economics and monetary markets. JJ

Russian central financial institution governor vows court docket motion to entry frozen foreign money reserves

Russia’s authorities will problem freezing orders on a lot of its overseas foreign money reserves in court docket, in accordance to its central financial institution chief.

Elvira Nabiullina, governor of the Central Bank of the Russian Federation, mentioned Russia would problem asset freezes below sanctions by the US, EU, UK and others which have prevented it from accessing up to $300bn (£230bn) of its reserves – nearly half of the overall.

The freeze on reserves has been one of many Western allies’ most financially damaging strikes in response to Vladimir Putin’s invasion of Ukraine, limiting Russia’s capacity to slow the steep drops in the worth of the rouble in opposition to different currencies.

Russian information company Interfax on Tuesday quoted Nabiullina at a dialogue of the central financial institution’s annual report with the Communist Party of the State Duma. She reportedly mentioned:

Of course, that is an unprecedented ‘freeze’ of the gold and foreign exchange reserves, so we can be making ready all lawsuits, and we’re making ready to file them, as that is unprecedented on a world scale, for the gold and foreign exchange reserves of such a big nation to have been frozen. […]

But our reserves haven’t been seized, they’ve been ‘frozen’, we can’t make use of them, however they haven’t been taken away, expropriated or seized, however ‘frozen’ and we are going to in fact be difficult this in all cases.

Russia has beforehand confirmed itself adept at utilizing courts, together with the profitable pursuit of Sergei Pugachev, a former senior Kremlin official who ran an election marketing campaign for Putin, in London courts to declare possession of UK property Russia claimed was purchased with stolen funds.

Former president Dmitry Medvedev, who advises Vladimir Putin on nationwide safety issues, mentioned this month that Russian companies whose property had been topic to sanctions would take authorized motion in the US, EU and elsewhere. His declare was later backed up by Russia’s finance minister, Anton Siluanov.

Nabiullina was quoted as saying that the central financial institution’s reserves had been “essentially divided into two parts”. She mentioned the primary a part of the reserves, in {dollars}, euros and kilos, was supposed to shield the home market from monetary crises, and the second, in gold and yuan, in the occasion of a geopolitical disaster.

The report made no point out of Russia’s invasion of Ukraine.

For the UK’s prospects, it is price noting that the IMF GDP downgrade for 2023 can be the largest of the G7, suggesting that its economists suppose issues have worsened rapidly.

The IMF mentioned:

In the United Kingdom, GDP growth for 2022 is revised down 1 proportion level—consumption is projected to be weaker than anticipated as inflation erodes actual disposable revenue, whereas tighter monetary circumstances are anticipated to cool funding.

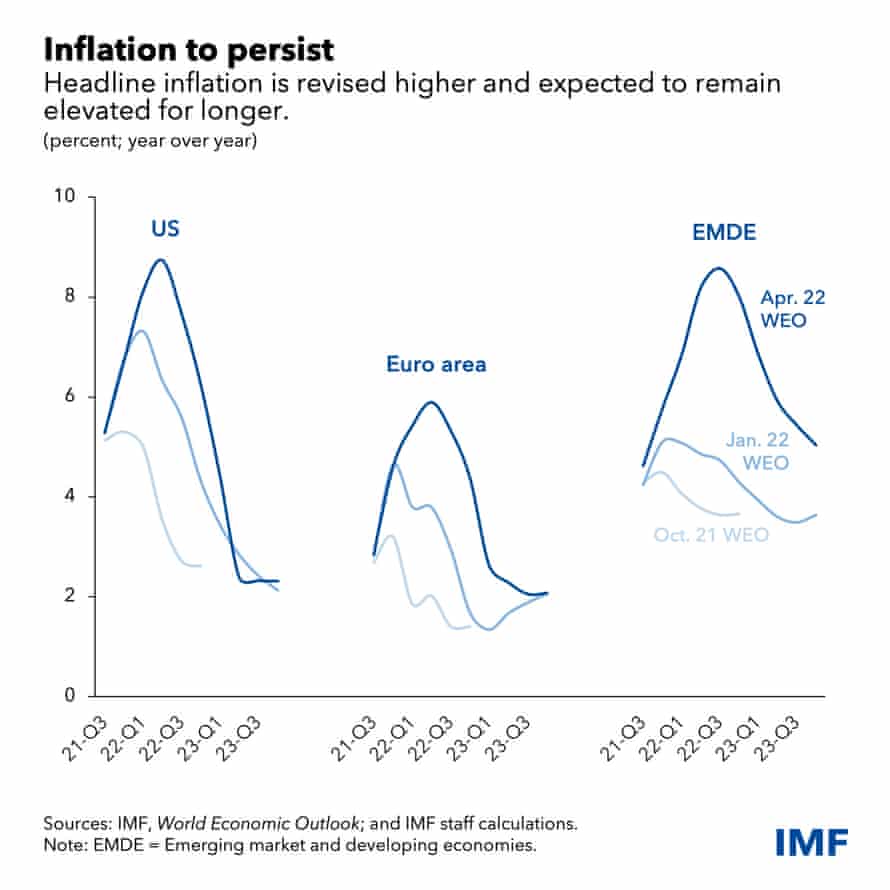

The US Federal Reserve and different central banks are how to tame inflation. Here is the IMF’s view of how value will increase will hit internationally.

It is in the US the place inflation is predicted to spike highest. The US was already thought to be “running hot” by many economists following the actually huge fiscal stimulus created in its pandemic response. Now the IMF sees inflation hitting nearly 9% by the summer season.

But it’s additionally price noting the large bounce in the newest inflation forecasts in so-called rising markets and growing economies. That has been pushed by meals and gas costs, each of which have been vastly affected by the conflict in Ukraine.

Larry Elliott

First it was rising inflationary pressures brought on by supply-side bottlenecks. Then it was the arrival of the brand new Omicron variant in the direction of the tip of 2021. Now it is the conflict in Ukraine, one thing not anticipated when the Washington-based organisation final printed its evaluation in January however which dominates the IMF’s world financial outlook.

The IMF additionally warns the conflict has exacerbated two difficult coverage dilemmas, one going through central banks and one troubling finance ministers.

You can learn the complete evaluation from the Guardian’s economics editor, Larry Elliott, right here:

Here is the IMF’s information desk outlining the primary forecasts at its spring conferences in Washington.

Beyond the foremost economies, it is price noting the deep recession that Russia is predicted to have this 12 months and subsequent following its efficient isolation from a lot of the worldwide economic system below Vladimir Putin.

Putin’s conflict on Ukraine is the largest identified unknown in the forecasts.

Pierre-Olivier Gourinchas, the IMF’s analysis division director, mentioned:

Uncertainty round these projections is appreciable, well-beyond the standard vary. Growth may slow down additional whereas inflation may exceed our projections if, for example, sanctions lengthen to Russian power exports.

UK growth to slow whereas inflation jumps

The UK is predicted to present the joint-fastest growth in the G7 this 12 months, regardless of having its growth estimate reduce from 4.7% to 3.7%. However, the outlook will worsen quickly, in accordance to the IMF.

The Washington-based lender mentioned that it expects GDP growth of just one.2% in 2023, simply over half the speed beforehand anticipated.

That will imply the UK will face the weakest growth and the best inflation of any G7 nation in 2023, the IMF mentioned.

IMF downgrades international GDP growth forecast from 4.4% to 3.6%

Larry Elliott

The International Monetary Fund has reduce its international growth forecasts due to the conflict in Ukraine, warning that Russia’s invasion may lead to the fragmentation of the world economic system into rival blocs.

In a half-yearly replace, the IMF mentioned prospects had worsened “significantly” in the previous three months as it lowered its growth estimate for 2022 from 4.4% to 3.6%.

The Washington-based physique mentioned each member of the G7 group of main industrialised nations and the larger growing nations would develop much less quickly this 12 months than beforehand anticipated, and there was a robust danger of a good worse final result.

You can learn the complete report right here:

Another step in the decline in UK-Russia relations: the Treasury has mentioned it plans to revoke the Moscow Stock Exchange’s standing as a recognised inventory change in response to Russia’s invasion of Ukraine.

The transfer which might take away some tax aid for buyers, in accordance to Reuters. Yet it is the symbolism that’s arguably extra necessary, after 20 years throughout which the UK pushed for nearer hyperlinks between the City of London and Russia. In specific, 31 firms – together with a number of the titans of the Russian state-controlled power advanced – had share devices listed on the London Stock Exchange.

The UK’s monetary secretary to the Treasury, Lucy Frazer, mentioned in a press release:

Revoking Moscow Stock Exchange’s recognised standing sends a transparent message – there isn’t any case for brand spanking new investments in Russia.

For all of the considerations about provide chains and considerations over a potential US recession, it appears like US housing market is motoring alongside.

US housebuilders began on 1.79m new properties in March, nudging up from the earlier month and nearly 50,000 greater than economists anticipated, in accordance to the US Census Bureau.

But then once more we already knew that exterior shocks are the largest lights flashing crimson on international economists’ radars.

When did you realise you had been out of your depth? asks Conservative MP Richard Fuller.

We realised in the autumn of final 12 months that it was a really difficult time for the corporate, and we would have liked to change the fundraising course of to a sale course of, Wood says.

Darren Jones says he senses Wood’s private remorse over the enterprise’s failure, however asks do you know it was a high-risk mannequin? Wood says:

I can guarantee you we by no means adopted a high-risk strategy and had been keen to danger the corporate failing.

Up till the autumn of final 12 months we had not seen a big danger.

Hindsight is a superb factor, however with the good thing about hindsight what we might have finished is start these funding conversations sooner, full a funding spherical in 2020 throughout the pandemic, have elevated collateral and have the opportunity to hedge out for longer intervals of time.

We didn’t object to takeover gives earlier than the collapse in search of a better valuation, Wood says.

He says he can’t give a view on what the administrator will do if no sale is agreed in the subsequent few months.

After an extended pause, he says: “I don’t think it’s responsible for me to share details of a sales process that is ongoing in a public forum.”

Wood is requested about his continued wage of 1 / 4 of one million kilos. Labour MP Andy McDonald asks: “Is that morally justifiable?”

Wood says he’s doing all the things he can to minimise the prices to taxpayers.

“Quite frankly I think a lot of us find that absolutely staggering,” McDonald says.

Wood argues that Bulb collapsed in half as a result of it was unable to entry hedging markets of bigger rivals.

That meant it was unable to hedge in opposition to the large rises in wholesale power costs that triggered chaos in the business – and pushed 29 suppliers into chapter 11. Bulb is the largest casualty thus far.

Wood argued that it was taken abruptly, like different suppliers. “We saw the business model as very realistic,” he mentioned.

He added: “We were not using customer credit balances to finance growth.”

Bulb founder apologises for firm’s collapse

Next up in entrance of MPs is Hayden Wood, chief government and co-founder of Bulb Energy, the power supplier which collapsed in November. The collapse has meant that taxpayers have had to put apart £1.7bn.

Wood mentioned:

I’m very sorry with the way in which issues turned out with Bulb.

Darren Jones, the chair of the enterprise committee, has requested how a lot cash he invested. Wood mentioned he put in “all of my personal savings in 2015”.

Jones then requested about his wage. Wood responded that it stays £250,000 per 12 months – the identical as earlier than the corporate’s collapse – after he was requested to keep on by directors.

In associated information, oil markets have been jumpy on Tuesday – benchmark North Sea crude costs have dropped by 1.4%.

Brent crude had solely dipped earlier on Tuesday morning, however has now fallen by $1.50 per barrel to $111.72. West Texas Intermediate, the North American benchmark, is down by 1.5% to $106.51.

Among the numerous shifting elements in the meanwhile are provide worries from Libya and uncertainty over when Shanghai’s business will restart absolutely amid strict lockdowns. Reuters reported:

Oil costs see-sawed on Tuesday as buyers fretted over tight international provides after Libya halted some exports and as factories in Shanghai ready to reopen put up a Covid-19 shutdown, easing some demand worries.

Prices got here below stress with the greenback buying and selling at a contemporary two-year excessive. A firmer buck makes commodities priced in {dollars} costlier for holders of different currencies.

One of the large political questions throughout the cost-of-living/power disaster has been whether or not the UK ought to introduce a windfall tax on oil and gasoline producers whose income are in many circumstances booming.

Unsurprisingly, the gas producers are in opposition to that.

Chris O’ Shea, chief government of Centrica, which additionally owns oil and gasoline manufacturing in Norway, mentioned:

A one-off windfall tax has I believe in the previous been proven to deter funding, so I’d counsel a root and department assessment of that after which determine what greatest provides us the end result that we’re searching for.