To print this text, all you want is to be registered or login on Mondaq.com.

On 28 June 2019, the Monetary Authority of Singapore

(“MAS”) introduced that it’s going to subject as much as 5 digital

banking licenses 1. This was a revolutionary transfer by

the MAS as digital financial institution licenses have been prolonged to

non-financial institution gamers and allowed banks to function in Singapore with

minimal bodily presence. The MAS recognises that the

banking panorama is present process a elementary transformation pushed

by three key forces: (i) pervasive cell web entry; (ii) the

rise of huge information; and (iii) the expansion of platform ecosystems as a

main new enterprise mannequin in finance. Hence, the digital banking

framework was launched to retain Singapore’s place as one

of the main monetary centres in Asia, and to permit for larger

competitors and spur larger innovation in finance.

The MAS hopes that competitors and innovation from

digital banks might be able to higher serve the wants of society and

the financial system within the following methods: (i) financing the expansion of

infrastructure in rising Asia, and more and more of

local weather-resilient, low-carbon investments; (ii) financing progress

enterprises and small-medium enterprises (“SMEs”); (iii)

decreasing prices and enhancing comfort for shoppers; (iv)

serving to folks to plan early and obtain monetary safety in

their later years; and (v) creating good jobs within the finance

sector. 2

The digital banking framework is along with any digital

banks that Singapore banking teams might already set up beneath the

current web-solely banks (“IOB”) framework. Under

the IOB framework launched in 2000,

Singapore-incorporated banking teams can arrange banking

subsidiaries to pursue new enterprise fashions, together with IOBs.

This permits a financial institution to resolve whether or not it desires to interact in such

actions inside the financial institution or via a separate subsidiary.

Singapore-incorporated banks may select to have a

joint-enterprise companion in establishing the subsidiary, as long as the

Singapore-incorporated banking group retains management over the

enterprise. 3

1. What is a digital financial institution and the way does it differ from a

conventional financial institution?

A digital financial institution can provide related companies to conventional banks,

besides that it’s only allowed to function one bodily place of

enterprise. Unlike conventional banks, a digital financial institution won’t have

bodily branches, automated teller

machines (“ATMs”) or money

deposit machines (“CDMs”), and all

banking companies can be completed on-line.

2. Who is allowed to function a digital

financial institution?

Currently, the MAS has awarded 4 digital financial institution licenses

to the next candidates: 4

(a) Digital Full Bank

- A consortium comprising Grab Holding Inc. and Singapore

Telecommunications Ltd. - An entity wholly-owned by Sea Ltd.

(b) Digital Wholesale Bank

- A consortium comprising Greenland Financial Holdings Group Co.

Ltd, Linklogis Hong Kong Ltd, and Beijing Co-operative Equity

Investment Fund Management Co. Ltd. - An entity wholly-owned by Ant Group Co. Ltd.

In contemplating the candidates for digital financial institution

licenses, MAS would have thought of whether or not the

candidates had a powerful worth proposition and revolutionary digital

enterprise mannequin to supply digital banking companies. 5

3. What are the forms of digital financial institution licenses

out there?

There are two forms of digital financial institution licenses beneath the digital

financial institution licensing framework – a digital full financial institution

(“DFB”) license and a digital wholesale

financial institution (“DWB”) license.

What are the important thing variations between DFBs

and DWBs?

The key variations between DFBs and DWBs are the sort

of banking actions which they will perform and the kind of

clients they will provide their services and products to.

Digital Full Bank License 6

|

Digital Wholesale Bank License

|

|

|---|---|---|

| Permissible actions | All banking companies | Only the proposed enterprise(es) outlined in its utility,

though it might subsequently search approval to broaden its enterprise scope 7 |

| Deposit restrictions | No restrictions on deposits |

|

| Other merchandise and choices to clients | All varieties | Businesses and non-retail clients solely, though MAS might

permit choices to retail clients on an distinctive foundation 8 |

Are DFBs allowed to supply the identical companies as

conventional full banks?

A full functioning DFB is allowed to supply the identical

companies as a conventional full financial institution. However, to minimise dangers to

retail depositors, permissible actions of a DFB will

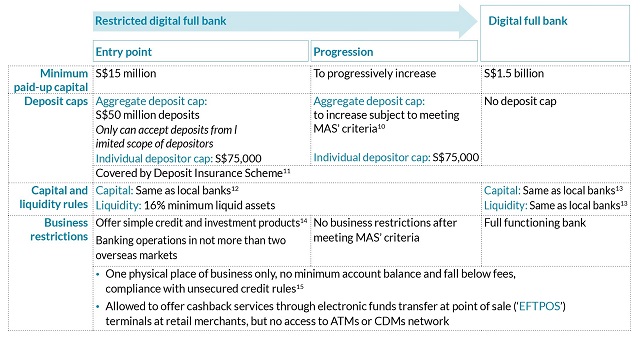

be phased in by way of a two-stage course of. A DFB will first

begin enterprise as a restricted DFB, which is topic to

restrictions on deposits and product choices. A

restricted DFB additionally has a decrease minimal paid-up capital

requirement in comparison with a full functioning DFB. Once a

restricted DFB has met all of the related milestones and

has been assessed to pose no important supervisory issues, it

will progress to a full functioning DFB.

While MAS doesn’t pre-decide a time interval inside

which a restricted DFB should progress to a full

functioning DFB, it usually expects a DFB to be

absolutely functioning inside 3-5 years from graduation of enterprise.

9 A excessive-stage abstract of the phased strategy is ready out

within the following diagram.

Source:

https://www.mas.gov.sg/-/media/Annex-A-Digital-Full-Bank-Framework.pdf

4. How do you apply for a digital financial institution

license?

Applications for a digital financial institution license should be made to

the MAS throughout the stipulated utility interval. The

first utility interval happened between 29 August 2019 and 31

December 2019. As the Singapore market is comparatively small, solely

4 digital financial institution licenses have been awarded for

now. MAS will proceed to observe market developments and

assessment the necessity to subject extra digital financial institution licences sooner or later.

16

Applicants for the DFB or DWB license should

meet the next necessities 17:

(a) Track report. At least one entity

within the applicant group has 3 or extra years of observe report in

working an current enterprise within the expertise or e-commerce

subject.

(b) Fit and correct standards. The

following individuals are match and correct 18:

- applicant group and their administrators;

- substantial shareholders 19 and 12% controllers

20 of the proposed digital financial institution; and - administrators and government officers 21 of the proposed

digital financial institution, when recognized 22.

( c ) Capital

necessities. Demonstrates the power to fulfill the

relevant minimal paid-up capital requirement on the onset and the

minimal capital funds requirement on an ongoing foundation. This will be

completed by submitting a written affirmation from shareholders of the

proposed digital financial institution on dedication of funds.

(d) Value proposition. Provides clear

worth proposition, incorporating the revolutionary use of expertise

to serve buyer wants and attain beneath-served segments of the

Singapore market.

(e) Sustainable enterprise

mannequin. Demonstrates that the proposed digital

financial institution’s enterprise mannequin is sustainable. The applicant should

present a 5-yr monetary projection of the proposed digital

financial institution, which should present a path in direction of profitability. The assumptions

of the monetary projection should be reviewed by an exterior and

impartial skilled.

(f) Orderly exit plan. Submits a

possible plan that may facilitate the orderly exit of the proposed

digital financial institution.

(g) Commitment from

shareholders. Shareholders of the proposed digital

financial institution decide to offering a letter of accountability and a letter of

endeavor that MAS might require in respect of the

operations of the proposed digital financial institution.

Digital Full Bank License

|

Digital Wholesale Bank License

|

|

|---|---|---|

| Who can apply |

|

|

| Minimum paid-up capital | S$1.5 billion | S$100 million (this is identical as current wholesale

banks) |

5. Are digital banks regulated otherwise from

conventional banks?

Generally talking, DFBs are topic to the identical regulatory

necessities as current full banks, whereas DWBs are topic

to the identical regulatory necessities as current wholesale banks.

These embody necessities referring to expertise dangers,

cash-laundering and terrorism financing dangers, and the conduct of

non-monetary companies.

As an current digital financial institution license holder, what are my

ongoing regulatory necessities?

Banking Act 1970 (“Banking Act”)

(a) Minimum capital necessities

All banks together with digital banks are required to fulfill the

prescribed minimal paid-up capital requirement and minimal capital

funds requirement on an ongoing foundation. Digital banks will even be

topic to the chance-primarily based capital adequacy necessities set out

beneath Notice 637 (Risk Based Capital Adequacy Requirements for

Banks Incorporated in Singapore). 23

(b) Changes in shareholding

Any one that needs to develop into a considerable shareholder, 12%

controller, 20% controller or oblique controller of a licensed

financial institution can be required to acquire prior approval from the

Minister-in-Charge of MAS 24. In specific

for DFB candidates, any in-principal

approvals (“IPA”) granted

by MAS can be on the idea of the shareholding

construction offered to MAS on the utility stage. As

such, if the change within the shareholding now not meets the

eligibility standards for Singaporean management, the IPA might

be revoked.

© Overseas expansions

Pursuant to part 12(3) of the Banking Act, a DWB is

required to acquire MAS’ approval to open a brand new department,

company or workplace in a spot exterior Singapore.

Risk Management

Digital banks ought to confer with MAS’ Framework for Impact

and Risk Assessment of Financial Institutions to higher perceive

how MAS assesses the influence of monetary establishments

25, and the forms of dangers which are usually relevant

to monetary establishments.

(a) Anti-Money Laundering (AML) and Countering the Financing

of Terrorism (CFT)

Financial establishments working in Singapore are required to

put in place sturdy controls to detect and deter the movement of

illicit funds via Singapore’s monetary system. Such

controls embody the necessity for monetary establishments to establish

and know their clients (together with useful homeowners), to conduct

common account critiques, and to observe and report any suspicious

transaction. 26

Digital banks can be topic to the identical AML/CFT and

sanctions-associated necessities relevant to the incumbent banks,

together with MAS’ Notice 626 on Prevention of Money

Laundering and Countering the Financing of Terrorism and its

corresponding pointers 27.

(b) Technology Risk

MAS has issued a set of Guidelines on Risk Management

Practices – Technology Risk 28 which units out

expertise danger administration rules and finest practices to information

the monetary establishments to ascertain sound and sturdy expertise

danger governance and oversight, in addition to keep IT and cyber

resilience. MAS has additionally issued Notice 644 (Notice on

Technology Risk Management) 29 on the necessities on

sustaining excessive availability, recoverability, information safety and

incident reporting, and Notice 655 (Notice on Cyber Hygiene)

30 on the important measures that banks should take to

mitigate the rising dangers of cyber threats.

Furthermore, within the wake of current SMS-phishing

scams, MAS and the Association of Banks in

Singapore (“ABS”) are additionally

introducing a set of extra measures to bolster the safety of

digital banking. 31

© Outsourcing Risks

As a digital financial institution might once in a while enter into preparations

with third celebration service suppliers to outsource sure enterprise

and assist features, it is usually required to have in place the

related governance and danger administration processes to establish and

handle the dangers arising from these outsourcing preparations.

Digital banks ought to confer with MAS’ Guidelines on

Outsourcing 32 that units out MAS’ expectations

of a monetary establishment that has entered or is planning to enter

into an association to outsource any of its enterprise features to a

service supplier.

Conduct of non-monetary companies

In September 2017, MAS sought public suggestions on its

proposal to refine its anti-commingling framework for banks in two

key points: (i) to streamline the circumstances and necessities for

banks to conduct or put money into permissible non-monetary companies;

and (ii) to permit banks to interact within the operation of digital

platforms that match consumers and sellers of client items or

companies, in addition to the net sale of such items and companies.

Digital banks ought to, when planning to conduct any non-monetary

companies, contemplate MAS’ Consultation Paper and Response

to Feedback Received on its Review of Anti-Commingling Framework

for Banks 33, which units out MAS’s coverage

in direction of banks’ conduct of non-monetary companies.

Securities and Futures Act

2001 (“SFA”) / Financial

Advisers Act 2001 (“FAA”)

Digital banks will even be anticipated to fulfill the related

regulatory necessities beneath the SFA and

the FAA and submit the related types the place it intends to

perform regulated actions beneath

the SFA 34 or monetary advisory companies

beneath the FAA 35. When submitting the related

kind, the digital financial institution is just not required to resubmit data that

was already offered in its utility to arrange a digital financial institution

(until there have been any modifications to the knowledge beforehand

offered).

6. Regional Developments

Hong Kong

Digital banks are termed as “virtual banks” in Hong

Kong, and outlined as “a financial institution which primarily delivers retail

banking companies via the web or different types of digital

channels as a substitute of bodily branches”. 36 As at 31

December 2021, the Hong Kong Monetary Authority has issued a complete

of 8 digital financial institution licenses. 37

Malaysia

On 2 July 2021, Bank Negara

Malaysia (“BNM”) introduced

that it had acquired 29 purposes for its digital banking

license and is ready to subject as much as 5 digital banking licenses in

early 2022. 38 Similar to Singapore’s strategy

in direction of DFBs, BNM implements a phased strategy

in direction of its digital banking license holders, such {that a} simplified

regulatory framework is utilized throughout its preliminary three to 5

years of operations, to permit the license holders to show

its viability and sound operations, and for BNM to

observe attendant dangers. 39

Indonesia

The Financial Services Authority (Otoritas Jasa

Keuangan) of Indonesia issued new laws in August

2021 to introduce its digital financial institution regulatory framework, which

permits for digital banking to be carried out by means of an

institution of a brand new digital financial institution, or a change of an

current standard financial institution right into a digital financial institution.

Philippines

The Central Bank (Bangko Sentral ng

Pilipinas) of the

Philippines (“BSP”) issued its

Guidelines on the Establishment of Digital Banks in December 2020

for the inclusion of “Digital Banks” as a definite

classification of banks and to set out its corresponding licensing

framework in its current Manual of Regulations for Banks. Similar

to Indonesia, the rules permit for the institution of a brand new

digital financial institution, or the conversion of an current financial institution to a digital

financial institution. 40 However, BSP introduced that as at 1

September 2021, it will cease accepting purposes for digital

banking licenses for 3 years, to permit the authorities to observe

the digital banking trade. The variety of digital banking

licenses issued can be capped at 7. 41

This article has been produced for basic informational

functions solely. The data contained on this article mustn’t

be construed as authorized recommendation and isn’t supposed to be a substitute

for authorized counsel on any material. No recipient of this

article ought to act or chorus from appearing on the idea of any

contents on this article with out in search of applicable authorized or different

skilled recommendation.

Footnotes

1

https://www.mas.gov.sg/news/media-releases/2019/mas-to-issue-up-to-five-digital-bank-licences

2

https://www.mas.gov.sg/news/speeches/2019/banking-liberalisations-next-chapter-digital-banks

3

https://www.mas.gov.sg/-/media/Digital-Bank-Licence/FAQs-on-DFB-and-DWB-Licences.pdf?la=en&hash=6883

4

https://www.mas.gov.sg/news/media-releases/2020/mas-announces-successful-applicants-of-licences-to-operate-new-digital-banks-in-singapore

5

https://www.mas.gov.sg/news/speeches/2019/banking-liberalisations-next-chapter-digital-banks

6 The data on this desk is offered on the

assumption that the DFB is a full

functioning DFB.

7 Generally, the permissible actions for a digital

wholesale financial institution are outlined within the Guidelines for Operation of

Wholesale Banks revealed by the MAS on 31 July

2008.

8 Non-retail clients confer with people who fall

inside the definition of “accredited investor” beneath the

Securities and Futures Act 2001. MAS doesn’t anticipate

a DWB to serve retail clients, comparable to offering

monetary recommendation to those people. On an distinctive

foundation, MAS might permit such choices, offered that there

is a powerful nexus and is critical to the applicant’s core

providing(s) to the non-retail section. An applicant with plans to

present any of such choices ought to spotlight accordingly in its

utility, and clarify how there’s a sturdy nexus and is

essential to the particular core providing(s) to the non-retail

section.

9

https://www.mas.gov.sg/-/media/Digital-Bank-Licence/Eligibility-Criteria-and-Requirements-for-Digital-Banks.pdf?la=en&hash=57410B76A3359791816B0A0BD592DF8EF2D37B33

10 Wholesale deposits won’t be topic to the

combination deposit cap as soon as the restricted full financial institution’s paid-up

capital reaches $100m (according to wholesale financial institution’s minimal

paid-up capital).

11 The Deposit Insurance Scheme will shield non-financial institution

depositors (together with people and sole proprietorships) within the

occasion of a financial institution’s failure by protecting

the SGD deposits positioned with a member financial institution, for as much as

S$75,000 per depositor per member financial institution.

12 6.5% CET1 Capital Adequacy Ratio (CAR), 10%

Total CAR, 2.5% capital conservation buffer (CCB), as much as 2.5%

countercyclical capital buffer (CCyB).

13 100% web steady funding ratio, 100% liquidity protection

ratio.

14 Interested events can confer with the Schedule to the

Securities and Futures (Capital Markets Products) Regulations 2018

for potential scope of permissible funding merchandise that may be

supplied.

15 Interested events can confer with MAS Notice

635 Unsecured Credit Facilities to Individuals and Banking (Credit

Card and Charge Card) Regulations 2013 for reference.

16

https://www.mas.gov.sg/-/media/Digital-Bank-Licence/FAQs-on-DFB-and-DWB-Licences.pdf?la=en&hash=6883

17

https://www.mas.gov.sg/-/media/Digital-Bank-Licence/Eligibility-Criteria-and-Requirements-for-Digital-Banks.pdf?la=en&hash=57410B76A3359791816B0A0BD592DF8EF2D37B33

18 See Guidelines on Fit and Proper Criteria.

19 “substantial shareholder” has the identical

that means as in part 81 of the Companies Act. It usually refers

to any one that can have a voting curiosity of a minimum of 5% within the

proposed digital financial institution.

20 “12% controller” means an individual, not being a

20% controller, who alone or collectively together with his

associates:

a holds not lower than 12% of the whole variety of issued

shares within the proposed digital financial institution; or

b) is able to management voting energy of not much less

than 12% within the proposed digital financial institution.

Please confer with part 15B of the Banking

Act.

21 “executive officer”, in relation to a

firm, means any individual, by no matter title described,

who:

a) is within the direct employment of, or appearing for or by

association with, the corporate; and

b) is anxious with or takes half within the administration of

the corporate on a day-to-day foundation.

Please confer with part 2 of the Banking Act.

22 The proposed digital financial institution’s board of administrators and

staff of government officers needn’t be absolutely fashioned at time of

utility.

23

https://www.mas.gov.sg/-/media/MAS/Regulations-and-Financial-Stability/Regulations-Guidance-and-Licensing/Commercial-Banks/Regulations-Guidance-and-Licensing/Notices/MAS-Notice-637-effective-1-January-2022.pdf

24 Sections 15A and 15B of the Banking Act

25

https://www.mas.gov.sg/-/media/MAS/News-and-Publications/Monographs-and-Information-Papers/Monograph—MAS-Framework-for-Impact-and-Risk-Assessment.pdf

26

https://www.mas.gov.sg/regulation/notices/notice-626

27 https://www.mas.gov.sg/regulation/notices/notice-626

and

https://www.mas.gov.sg/regulation/guidelines/guidelines-to-notice-626-on-prevention-of-money-laundering-and-cft-for-banks

28

https://www.mas.gov.sg/-/media/MAS/Regulations-and-Financial-Stability/Regulatory-and-Supervisory-Framework/Risk-Management/TRM-Guidelines-18-January-2021.pdf

29

https://www.mas.gov.sg/-/media/MAS/Notices/PDF/Notice-MAS-644.pdf

30

https://www.mas.gov.sg/-/media/MAS/Notices/PDF/MAS-Notice-655.pdf

31

https://www.mas.gov.sg/news/media-releases/2022/mas-and-abs-announce-measures-to-bolster-the-security-of-digital-banking

32

https://www.mas.gov.sg/-/media/MAS/Regulations-and-Financial-Stability/Regulatory-and-Supervisory-Framework/Risk-Management/Outsourcing-Guidelines_Jul-2016-revised-on-5-Oct-2018.pdf

33

https://www.mas.gov.sg/publications/consultations/2017/consultation-paper-on-review-of-anti-commingling-framework-for-banks

34 Form 26- Notice of Commencement of Business lodged

pursuant to Regulation 14(4) of the Securities and Futures

(Licensing and Conduct of Business) Regulations by individuals exempt

from holding a Capital Markets Services License beneath part

99(1)(a), (b), ( c ) and (d) of the SFA

35) Form 26 – Notice of Commencement of Business

lodged pursuant to Regulation 37(1) of the Financial Advisers

Regulations by individuals exempt from holding a Financial

Adviser’s License beneath Section 23(1)(a), (b), ©, (d) and

(e) of the FAA

36

https://www.hkma.gov.hk/media/eng/doc/key-information/press-release/2018/20180530e3a2.pdf

37

https://www.hkma.gov.hk/eng/key-functions/banking/banking-regulatory-and-supervisory-regime/virtual-banks/

38

https://www.bnm.gov.my/-/bnm-receives-29-applications-for-digital-bank-licenses

39

https://www.bnm.gov.my/documents/20124/938039/20201231_Licensing+Framework+for+Digital+Banks.pdf

40

https://www.bsp.gov.ph/Regulations/Issuances/2020/c1105.pdf

41

https://www.bloomberg.com/news/articles/2021-08-19/philippines-set-to-close-digital-bank-applications-for-3-years

The content material of this text is meant to supply a basic

information to the subject material. Specialist recommendation ought to be sought

about your particular circumstances.

The Evolution Of Banks In Singapore: Things You Need To Know About The Regulation Of Digital Banks – Financial Services & More Latest News Update

The Evolution Of Banks In Singapore: Things You Need To Know About The Regulation Of Digital Banks – Financial Services & More Live News

All this information that I’ve made and shared for you folks, you’ll prefer it very a lot and in it we hold bringing matters for you folks like each time so that you just hold getting information data like trending matters and also you It is our aim to have the ability to get

every kind of reports with out going via us in order that we will attain you the most recent and finest information totally free as a way to transfer forward additional by getting the knowledge of that information along with you. Later on, we are going to proceed

to offer details about extra today world news update forms of newest information via posts on our web site so that you just at all times hold shifting ahead in that information and no matter type of data can be there, it can positively be conveyed to you folks.

The Evolution Of Banks In Singapore: Things You Need To Know About The Regulation Of Digital Banks – Financial Services & More News Today

All this information that I’ve introduced as much as you or would be the most totally different and finest information that you just persons are not going to get wherever, together with the knowledge Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you may get different forms of information alongside along with your nation and metropolis. You will be capable to get data associated to, in addition to it is possible for you to to get details about what’s going on round you thru us totally free

as a way to make your self a educated by getting full details about your nation and state and details about information. Whatever is being given via us, I’ve tried to convey it to you thru different web sites, which you’ll like

very a lot and for those who like all this information, then positively round you. Along with the folks of India, hold sharing such information essential to your family members, let all of the information affect them and so they can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links