Released: 2022-05-04

Imports of products

$61.1 billion

March 2022

7.7%

(month-to-month change)

Exports of products

$63.6 billion

March 2022

6.3%

(month-to-month change)

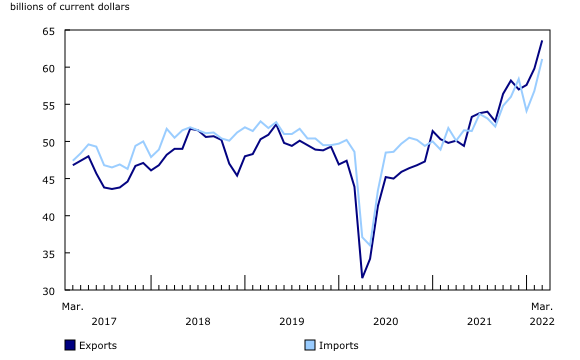

Canada’s merchandise commerce elevated considerably in March, with each imports and exports reaching document highs. Following a 4.8% enhance in February, imports jumped an additional 7.7% in March. Meanwhile, exports rose 6.3%, with power merchandise contributing greater than half of the rise. As a consequence, Canada’s merchandise commerce surplus with the world narrowed from $3.1 billion in February to $2.5 billion in March.

Consult the “International trade monthly interactive dashboard” to discover the latest outcomes of Canada’s international commerce in an interactive format.

Chart 1

Merchandise exports and imports

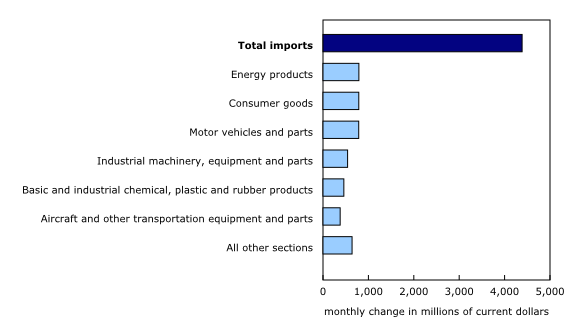

Widespread will increase in imports

Total imports rose 7.7% in March to a document excessive of $61.1 billion. Gains had been noticed in 9 of 11 product classes, with 8 posting will increase of greater than $100 million. In actual (or quantity) phrases, complete imports had been up 7.0%.

Chart 2

Contribution to the month-to-month change in imports, by product, March 2022

Imports of power merchandise posted vital positive factors in March, rising 26.3%. Higher imports of crude oil and bitumen (+39.9%) had been largely behind the rise, with each costs and volumes rising markedly. The enhance in imports of crude oil coincided with the Russian aggression in Ukraine and the ensuing sanctions in opposition to Russia, creating uncertainty round future availability of power merchandise. The United States is by far the highest supply for Canada’s crude oil imports, however substantial will increase in imports from Saudi Arabia and Nigeria had been additionally noticed in March.

Consumer items (+6.5%) had been additionally a contributor to the rise in complete imports in March. Increases had been noticed in a variety of sub-categories, with clothes, footwear and equipment (+15.9%) posting the biggest acquire. Imports for this product class have been unstable because the onset of the COVID-19 pandemic, with typical developments being disrupted by a number of components, leading to better month-to-month variations on a seasonally adjusted foundation.

Following a big lower in January, imports of motor automobiles and components had been up for a second consecutive month, rising 9.9% in March. Imports of passenger automobiles and light-weight vans (+19.2%) had been behind the rise in March, reflecting the latest ramp up in North American manufacturing of motor automobiles. Supply chain bottlenecks, particularly the worldwide semiconductor chip scarcity, have influenced imports throughout the motor automobiles and components class since early 2021.

Chart 3

Canadian imports and exports of passenger automobiles and light-weight vans

In March, substantial will increase in imports had been additionally noticed in a number of different classes, together with industrial equipment, gear and components (+8.8%), primary and industrial chemical, plastic and rubber merchandise (+8.8%), and plane and different transportation gear and components (+24.6%).

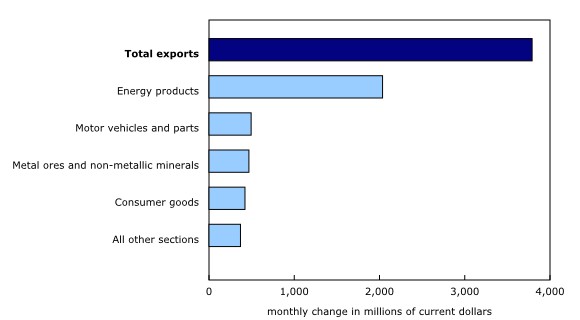

Export costs proceed to rise in March

Total exports elevated by 6.3% to $63.6 billion in March, surpassing the earlier document set in February by practically $4 billion. Excluding power merchandise, exports had been up 4.0% in March. Once once more, greater costs had been a key issue within the month, with complete exports in actual (or quantity) phrases up 1.1%. The value index for Canadian complete exports has elevated by greater than 30% since January 2021.

Chart 4

Contribution to the month-to-month change in exports, by product, March 2022

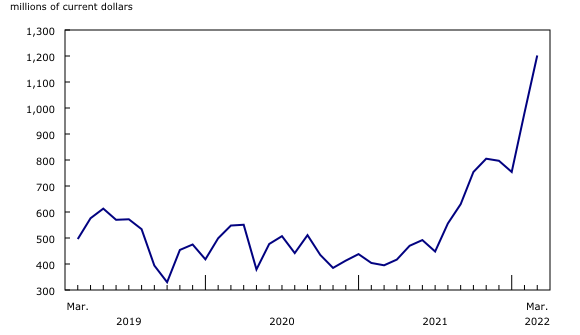

Exports of power merchandise rose 12.8% to a document $17.9 billion in March. Energy merchandise accounted for 28.2% of complete exports, a rise of just about 10 share factors from the share of 18.3% noticed in March 2021. Similar to February 2022, exports of crude oil (+14.8%) contributed most to the expansion in March. Market costs for crude oil skilled excessive volatility all through the month, however had been up considerably on common in March, because the battle in Ukraine and sanctions in opposition to Russia raised the extent of uncertainty surrounding world provide. Higher costs had been the principle issue behind the rise in Canadian crude oil exports in March, whereas volumes had been down. Exports of crude oil are estimated for the latest reference month, and these estimates are topic to bigger revisions throughout instances of excessive value volatility.

Chart 5

Canadian imports and exports of crude oil and bitumen

Exports of motor automobiles and components elevated by 7.9% in March. This motion was led by a rise in exports of passenger automobiles and light-weight vans (+8.3%). This mirrored greater manufacturing exercise all through North America, as automakers skilled a reprieve from provide chain points which were limiting output for a variety of months. Overall, Canadian manufacturing was much less affected in March by disruptions associated to semiconductor shortages, and exports of passenger automobiles and light-weight vans, not seasonally adjusted, reached their highest stage since November 2020.

Exports of metallic ores and non-metallic minerals elevated in March by 19.4% to a document $2.9 billion. Following a 30.1% acquire in February, exports of potash (+22.5%) contributed essentially the most to the rise in March. Demand for Canadian fertilizers has elevated because the Russian invasion of Ukraine and the ensuing sanctions which were imposed on commerce with Russia, pushing Canadian exports of potash to document ranges. Following three consecutive months of lows, exports of iron ores (+21.0%) elevated in March.

Chart 6

Canadian exports of potash

Trade surplus with the United States reaches an all-time excessive

Exports to the United States elevated by 7.7% in March, largely due to greater exports of crude oil. Meanwhile, imports from the United States elevated by 5.4%, primarily due to greater imports of power merchandise and motor automobiles and components. As a consequence, Canada’s commerce surplus with the United States widened from $10.9 billion in February to a document $12.6 billion in March.

When the common change charges of February and March are in contrast, the Canadian greenback gained 0.4 US cents relative to the American greenback.

Imports from China rise sharply for a second consecutive month

Imports from international locations aside from the United States had been up 11.5% in March, reaching a document $24.5 billion. Imports from China (+29.4%) posted the biggest acquire by far. Computers and cellphones, industrial equipment, and shopper items topped widespread will increase in imports from this nation.

Exports to international locations aside from the United States had been up 1.9% in March to $14.4 billion, which additionally constitutes a document. There had been greater exports to the United Kingdom (gold), Spain (pharmaceutical merchandise), South Korea (coal) and Germany (varied merchandise).

After the $7.9 billion deficit noticed in February, the merchandise commerce deficit with international locations aside from the United States reached a document $10.1 billion in March.

Chart 7

International merchandise commerce stability

Seventh consecutive quarterly enhance for each exports and imports

Total exports rose 5.5% within the first quarter of 2022, a seventh consecutive quarterly enhance. This motion was led by greater exports of power merchandise (+16.4%). These have been climbing persistently because the second quarter of 2020, primarily due to greater costs. Excluding power merchandise, complete exports had been up 2.0% within the first quarter of 2022. Exports of forestry merchandise and constructing and packaging supplies (+12.1%) additionally contributed to the quarterly enhance, primarily on greater costs.

Total imports rose 1.7% within the first quarter of 2022, additionally a seventh consecutive quarterly enhance. Despite the expansion in quarterly imports, the biggest motion of the quarter was a lower in motor automobiles and components (-5.8%). This decline was largely attributable to provide chain points which were current since early 2021. This lower was greater than offset by widespread will increase all through different product sections.

Canada’s quarterly merchandise commerce surplus widened from $2.5 billion within the fourth quarter of 2021 to $9.0 billion within the first quarter of 2022, a 3rd consecutive surplus, and the biggest since 2008.

Exports in fixed {dollars} (utilizing chained 2012 {dollars}) fell 2.5% within the first quarter of 2022, whereas quarterly imports in fixed {dollars} had been down 1.0%.

Revisions to February merchandise export and import knowledge

Imports in February, initially reported at $56.1 billion within the earlier launch, had been revised to $56.8 billion within the present reference month’s launch. Exports in February, initially reported at $58.7 billion within the earlier launch, had been revised to $59.8 billion within the present reference month’s launch, primarily as a result of estimates for crude oil had been changed with precise knowledge.

Monthly commerce in companies

In March, month-to-month service exports rose 2.9% to $11.9 billion. Service imports elevated 6.5% to $12.9 billion.

When international commerce in items and international commerce in companies had been mixed, exports elevated 5.8% to $75.5 billion in March, whereas imports had been up 7.5% to $74.0 billion. As a consequence, Canada’s commerce surplus with the world went from $2.5 billion in February to $1.4 billion in March.

Note to readers

Merchandise commerce is one element of Canada’s international stability of funds (BOP), which additionally contains commerce in companies, funding revenue, present transfers, and capital and monetary flows.

International commerce knowledge by commodity can be found on each a BOP and a customs foundation. International commerce knowledge by nation can be found on a customs foundation for all international locations and on a BOP foundation for Canada’s 27 principal buying and selling companions (PTPs). The record of PTPs relies on their annual share of complete merchandise trade—imports and exports—with Canada in 2012. BOP knowledge are derived from customs knowledge by adjusting for components akin to valuation, protection, timing and residency. These changes are made to adapt to the ideas and definitions of the Canadian System of National Accounts.

For a conceptual evaluation of BOP-based knowledge versus customs-based knowledge, see “Balance of Payments trade in goods at Statistics Canada: Expanding geographic detail to 27 principal trading partners.”

For extra info on these and different macroeconomic ideas, see the Methodological Guide: Canadian System of Macroeconomic Accounts (Catalogue quantity13-607-X) and the User Guide: Canadian System of Macroeconomic Accounts (Catalogue quantity13-606-G).

The knowledge on this launch are on a BOP foundation and are seasonally adjusted. Unless in any other case acknowledged, values are expressed in nominal phrases, or present {dollars}. References to costs are based mostly on combination Paasche (current-weighted) value indexes (2012=100). Movements inside combination Paasche costs might be influenced by adjustments within the share of values traded for particular items, with sudden shifts in buying and selling samples—as noticed at the moment with the COVID-19 pandemic—sometimes leading to massive actions in Paasche value indexes. Volumes, or fixed {dollars}, are calculated utilizing the Laspeyres components (2012=100), until in any other case acknowledged.

For info on seasonal adjustment, see Seasonally adjusted knowledge – Frequently requested questions.

Revisions

In common, merchandise commerce knowledge are revised on an ongoing foundation for every month of the present 12 months. Current-year revisions are mirrored in each the customs-based and the BOP-based knowledge.

The earlier 12 months’s customs-based knowledge are revised with the discharge of knowledge for the January and February reference months, and thereafter on a quarterly foundation. The earlier two years of customs-based knowledge are revised yearly, and revisions are launched in February with the December reference month.

The earlier 12 months’s BOP-based knowledge are revised with the discharge of knowledge for the January, February, March and April reference months. To stay per the Canadian System of Macroeconomic Accounts, revisions to BOP-based knowledge for earlier years are launched yearly in December with the October reference month.

Factors influencing revisions embody the late receipt of import and export documentation, incorrect info on customs varieties, the alternative of estimates produced for the power part with precise figures, adjustments in merchandise classification based mostly on extra present info, and adjustments to seasonal adjustment components. The seasonal adjustment parameters are reviewed and up to date yearly, and utilized with the October reference month launch.

For info on knowledge revisions for exports of power merchandise, see Methodology for Exports of Energy Products throughout the International Merchandise Trade Program.

Revised knowledge can be found within the applicable tables.

Real-time knowledge desk

The real-time knowledge desk 12-10-0120-01 can be up to date on May 16.

Next launch

Data on Canadian international merchandise commerce for April can be launched on July 7.

Products

The product “International trade monthly interactive dashboard” (Catalogue quantity71-607-X) is now obtainable. This new interactive dashboard is a complete analytical instrument that presents month-to-month adjustments in Canada’s international merchandise commerce knowledge on a balance-of-payments foundation, totally supporting the data introduced each month within the Daily launch.

The product “The International Trade Explorer” (Catalogue quantity71-607-X) is now obtainable on-line.

The Canadian International Merchandise Trade on-line database is now not obtainable. It has been changed by the Canadian International Merchandise Trade Web Application (Catalogue quantity71-607-X), a contemporary instrument that gives commerce knowledge customers with a variety of enhancements.

The up to date “Canada and the World Statistics Hub” (Catalogue quantity13-609-X) is now obtainable on-line. This product illustrates the character and extent of Canada’s financial and monetary relationship with the world utilizing interactive charts and tables. It offers easy accessibility to info on commerce, funding, employment and journey between Canada and a variety of international locations, together with the United States, the United Kingdom, Mexico, China, Japan, Belgium, Italy, the Netherlands and Spain.

Contact info

For extra info, or to investigate concerning the ideas, strategies or knowledge high quality of this launch, contact us (toll-free 1-800-263-1136; 514-283-8300; [email protected]) or Media Relations ([email protected]).