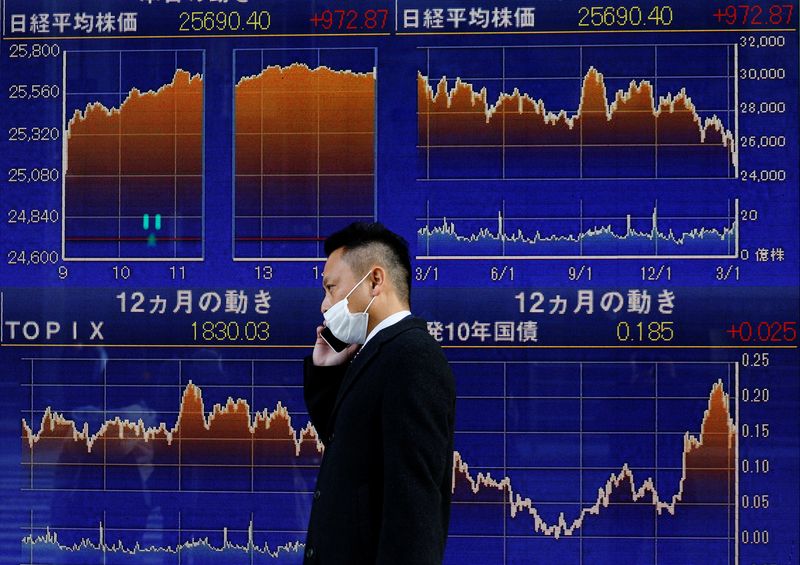

© Reuters. A person sporting a protecting masks, amid the coronavirus illness (COVID-19) outbreak, walks previous an digital board displaying graphs (prime) of Nikkei index outdoors a brokerage in Tokyo, Japan, March 10, 2022. REUTERS/Kim Kyung-Hoon

2/2

By Herbert Lash and Danilo Masoni

NEW YORK/MILAN (Reuters) -World shares wavered and bond yields slid on Tuesday after a shock fee hike in Australia unsettled traders, however Target Corp (NYSE:)’s warning on profit margins additionally included plans to slash costs, an indication that inflation could also be peaking.

Target lower its quarterly profit margin forecast and stated it could supply deeper reductions to clear stock as decades-high inflation saps shopper demand.

The shock forecast revision despatched shares of the retailer 3.5% decrease and knocked the retail sector of the pan-European STOXX index down 0.9% because the announcement at first weighed on broader markets.

But Wall Street shares rebounded and European fairness markets trimmed losses as traders noticed Target’s plans as finally pointing to slowing inflation.

“Target cuts both ways. On the one hand obviously it’s negative news for Target. But on the other it’s one of the first large signals that inflation may be peaking,” stated Rick Meckler, a accomplice at Cherry Lane Investments.

“Of course, this is the scenario of a soft landing. That we raise rates, that it reins in inflation some, but it doesn’t stop the economy,” he stated.

The MSCI’s benchmark for world shares () shed 0.27%, whereas the index misplaced 0.21%.

Anthony Saglimbene, world market strategist at Ameriprise Financial (NYSE:), stated Target’s announcement urged extra firms will lay the groundwork for lowered earnings.

“We could see an earnings recession this year without seeing an economic recession, which would mean we would get zero earnings growth,” he stated. “That’s a headwind for stocks.”

On Wall Street, the was down 0.05%, the dipped 0.07% and the dropped 0.07%.

The Reserve Bank of Australia raised rates of interest by 50 foundation factors – probably the most in 22 years – and flagged extra tightening forward because it strikes to restrain surging inflation.

The Federal Reserve additionally has tightened financial coverage and the European Central Bank is predicted to start out later this week.

“Central bankers are playing catch up with the fact that inflation is very, very high and they need to kind of tamp it down through higher rates,” Saglimbene stated.

The yield on fell 6.6 foundation factors to 2.972%, beneath the important thing 3% threshold forward of knowledge on Friday anticipated to indicate nonetheless excessive U.S. inflation.

A excessive studying would agency up expectations that the Fed might elevate charges greater than the anticipated 50 foundation factors improve at its upcoming coverage assembly subsequent week and in July.

In Europe, benchmark 10-year German bund yields additionally dipped 4.1 foundation factors however held close to Monday’s highs forward of the ECB assembly on Thursday. They final traded at 1.288%.

British Prime Minister Boris Johnson survived a no-confidence vote amongst his Conservative Party’s lawmakers on Monday, however the skinny margin of victory spurred discuss of a transfer to exchange him, hitting sterling and gilts.

“The vote casts significant doubt about his tenure as leader,” stated JP Morgan economist Allan Monks.

“Assuming he can buy enough time, the outcome increases the chance that fiscal policy is loosened further in an attempt to turn the situation around. If not, he could yet be forced out with the Conservatives electing a new leader (and hence prime minister),” he added.

Ten-year gilt yields hit a seven-year excessive at 2.265% and had been final nearly flat on the day.

In overseas alternate markets, nerves forward of the U.S. inflation knowledge stored the greenback in demand.

The fell 0.068%, with the euro unchanged at $1.0694 on expectations of a hawkish ECB tilt.

The U.S. forex rose to its the best since 2002 in opposition to the yen and was final up 0.46% after the Bank of Japan governor promised assist for the economic system and straightforward financial coverage whilst costs begin to rise.

Sterling was final buying and selling at $1.2578, up 0.38% on the day.

The Australian greenback gained as a lot as 0.76% simply after the supersized RBA fee hike, however shortly shed positive aspects to commerce flat on the day.

Oil costs rose in a seesaw session on Tuesday because the market weighed threat sentiment in opposition to provide issues and the prospect of upper demand after leisure of China’s COVID curbs.

just lately rose 0.73% to $119.36 per barrel and was at $120.36, up 0.71% on the day.

Stocks waver on Target profit warning, bond yields slip By Reuters & More Latest News Update

Stocks waver on Target profit warning, bond yields slip By Reuters & More Live News

All this information that I’ve made and shared for you folks, you’ll prefer it very a lot and in it we preserve bringing matters for you folks like each time so that you simply preserve getting information info like trending matters and also you It is our purpose to have the ability to get

all types of stories with out going by us in order that we will attain you the newest and greatest information free of charge so to transfer forward additional by getting the data of that information along with you. Later on, we’ll proceed

to offer details about extra today world news update kinds of newest information by posts on our web site so that you simply at all times preserve transferring ahead in that information and no matter type of info can be there, it would undoubtedly be conveyed to you folks.

Stocks waver on Target profit warning, bond yields slip By Reuters & More News Today

All this information that I’ve introduced as much as you or would be the most totally different and greatest information that you simply individuals are not going to get anyplace, together with the data Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you will get different kinds of information alongside together with your nation and metropolis. You will be capable to get info associated to, in addition to it is possible for you to to get details about what goes on round you thru us free of charge

so to make your self a educated by getting full details about your nation and state and details about information. Whatever is being given by us, I’ve tried to deliver it to you thru different web sites, which you’ll like

very a lot and should you like all this information, then undoubtedly round you. Along with the folks of India, preserve sharing such information essential to your family members, let all of the information affect them they usually can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links