Don’t miss CoinDesk’s Consensus 2022, the must-attend crypto & blockchain pageant expertise of the 12 months in Austin, TX this June 9-12.

Good morning. Here’s what’s taking place:

Prices: Bitcoin returned to the place it began the weekend.

Insights: Singapore’s rising crypto regulatory scrutiny has raised considerations amongst institutional traders.

Technician’s take: BTC’s buying and selling vary might persist into the next week.

Catch the newest episodes of CoinDesk TV for insightful interviews with crypto trade leaders and evaluation. And join for First Mover, our day by day publication placing the newest strikes in crypto markets in context.

Prices

Bitcoin (BTC): $38,594 +2.2%

Ether (ETH): $2,844 +3.9%

Biggest Gainers

Biggest Losers

There aren’t any losers in CoinDesk 20 in the present day.

Bitcoin returns to late Friday ranges

Bitcoin traders continued their current dour temper this weekend amid macroeconomic uncertainty and a broadly anticipated, half-point rate of interest hike by the U.S. central financial institution this week.

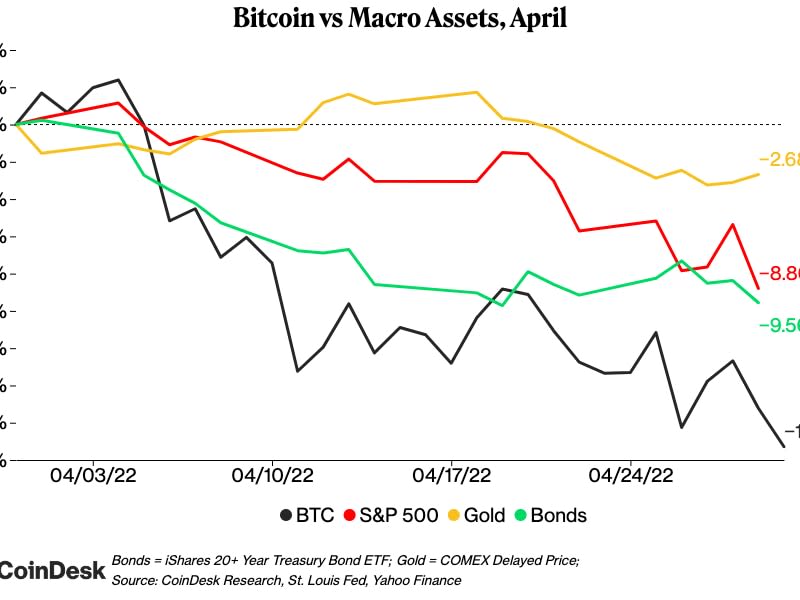

The largest cryptocurrency by market cap was not too long ago buying and selling at about $38,400, up 2.2% for the previous 24 hours, however roughly the place it began the weekend. Bitcoin completed April down 17%, its worst month but in a ragged 2022 for cryptos.

Ether, the second-largest crypto by market cap, adopted the same weekend sample and was buying and selling at roughly $2,840, up about 3.9% over yesterday however little modified from late Friday. Most different main cryptos had been not too long ago rising. Terra’s luna token and SOL climbed over 5% and seven%, respectively at one level. Popular meme coin DOGE jumped almost 6%. Trading was gentle as is commonly the case on weekends.

“At the moment, there are no major bullish catalysts on the horizon and BTC is likely to grind in this range or break down lower before more aggressive accumulation can begin,” Joe DiPasquale, CEO of fund supervisor BitBull Capital, wrote to CoinDesk. “The lack of bullish catalysts is still evident and U.S. equities have shown weakness as well as the U.S. dollar index rose. All these factors continue to weigh down BTC.”

DiPasquale famous that the Federal Reserve’s seemingly resolution to attempt to tame inflation by way of a extra hawkish charge enhance “could result in price volatility.” The Fed can be anticipated to elucidate the way it will cut back its portfolio of mortgage and Treasury securities, which ballooned to $9 trillion throughout the pandemic.

Crypto declines in current days have largely dovetailed with main inventory indexes as traders veer away from riskier property. The tech-heavy Nasdaq plunged 4% on Friday. The S&P 500 and Dow Jones Industrial Average had been off 3.6% and a pair of.7%, respectively. Gold was up barely. The Nasdaq 100, an index of largely tech, biotech and health-care firms, plummeted 13% in April.

Economic development has slowed worldwide, a results of Russia’s unprovoked invasion of Ukraine. On Friday, the European Union reported that the economies of 19 nations that use the euro grew by simply 0.2% throughout the first quarter. The information adopted the announcement that the U.S. financial system had grown by a sluggish 0.4% over the identical interval. Rising vitality costs and provide chain delays exacerbated by the Russian offensive have hampered companies worldwide.

With bitcoin failing to carry the $42,000 stage final week, DiPasquale was measured in his expectations for the approaching days. “We have continued to see $38K levels acting as support but continued testing of this range may result in a breakdown toward $35K-$32K,” he wrote, including: “Bulls will want to see the bleeding stop and serious buyers stepping in before they can be confident of a trend reversal.”

Markets

S&P 500: 4,131 -3.6%

DJIA: 32,977 -2.7%

Nasdaq: 12,334 -4.1%

Gold: $1,896 +.08%

Insights

Singapore’s much less crypto pleasant surroundings

Three Arrows Capital is the newest crypto agency that’s determined to name Singapore quits and transfer to Dubai.

“The energy in Dubai’s digital asset industry is electric right now,” fund co-founder Su Zhu advised CoinDesk throughout the Crypto Bahamas convention. “We have decided to move our Three Arrows headquarters to Dubai, and I’m looking forward to meeting more technology startups.”

“For a while, Singapore was making pro-crypto decisions, but now something’s changed course,” added Kyle Davies, the fund’s different co-founder.

To make certain, on paper Singapore hasn’t superior any new guidelines that might have an effect on a fund like Three Arrows Capital. The authorities has been clear that its coverage place is to create a “conducive environment for such activities to flourish in Singapore.”

But that’s for institutional capital. The Monetary Authority of Singapore has additionally been clear that it doesn’t approve of retail traders getting deeply concerned in crypto.

“We have taken a tough line on unfettered access to retail public because retail investors should not be dabbling in cryptocurrencies. Many global regulators share similar concerns about retail exposure to cryptocurrencies,” Ravi Menon, the company’s managing director, mentioned in a current interview, including that it has granted retail crypto licenses however they arrive with strict phrases and situations.

Funds like Three Arrows Capital don’t deal instantly with retail crypto, as they aren’t open to non-institutional or non-accredited funding.

So why the lengthy face?

It may need one thing to do with DeFiance Capital, considered one of Three Arrows’ friends within the metropolis.

In March, DeFiance Capital was positioned on an Investor Alert List by MAS. DeFiance Capital isn’t positive why that occurred, and MAS gained’t give CoinDesk a transparent reply.

Putting a fund on an investor alert listing, which has unfavourable connotations, and never explaining the reasoning, isn’t a great look.

It additionally is likely to be the start of issues in doing enterprise in Singapore.

Visas for overseas employees are more and more tough to realize, and the logical narrative of the town being a large beneficiary of Hong Kong’s capital and expertise flight isn’t essentially shaping up with these in conventional finance additionally Dubai as the subsequent hub as an alternative of Singapore.

At the identical time, Dubai is making the relocation course of as simple as potential with visas sponsored by the Dubai International Financial Centre (DIFC) particular financial zone processed in lower than every week. Plus, the DIFC has a parallel authorized system

Technician’s take

Bitcoin Momentum Weakens; Support at $35K-$37K

Bitcoin is testing help at round its 100-week transferring common, though upside momentum has slowed over the previous month. The cryptocurrency might stay in a large buying and selling vary till a decisive breakout or breakdown happens.

BTC is on monitor for an 18% decline this month and is down about 40% from its all-time excessive of almost $69,000 reached in November.

Most technical indicators are impartial on the day by day and weekly chart and bearish on the month-to-month chart. That might enhance the chance of a breakdown in value, particularly if help at $37,500 fails to carry.

A collection of upper value lows since Jan. 24 has supported shopping for exercise on dips. Still, resistance at $46,710 has capped rallies over the previous three months.

For now, BTC is on watch for a countertrend reversal sign subsequent week, per the DeMARK indicators, which usually precedes a short upswing in value.

Important occasions

8:30 a.m. HKT/SGT(12:30 UTC): Jibun (Japan) Bank manufacturing PMI (April)

9:30 a.m. HKT/SGT(1:30 a.m. UTC): Australia and New Zealand Banking Group job ads (April)

1 p.m. HKT/SGT(5 a.m. UTC): Japan client confidence index (April)

CoinDesk TV

In case you missed it, right here is the latest episode of “The Hash” on CoinDesk TV:

Ukraine Launches Website for NFT Donations, Panama Passes Crypto Law and More

Earlier this week, “The Hash” hosts mentioned prime tales, together with the Ukrainian authorities’s new initiative to make use of NFT (non-fungible token) donations within the struggle towards Russia, Panama’s new crypto legislation and personal fairness funding agency Apollo’s new rent for its digital asset division.

Headlines

Swiss National Bank Owns No Bitcoin, however Could Buy within the Future, Chairman Says: While bitcoin in the present day does not meet norms for forex reserves, mentioned Thomas Jordan, there is no technical bar to purchases.

Please Don’t Buy a ‘KYC’d’ Wallet for the Bored Apes Team’s Otherside Mint: Yuga Labs’ lengthy awaited “Otherside” NFT sale has spawned a secondary market for specifically registered Ethereum addresses. Caveat emptor.

Dubai Real Estate Developer to Accept Crypto Payments Amid UAE Push for Crypto Hub Status: Several of the world’s largest crypto exchanges have flocked to the emirates in the previous few months.

NFT Subscriptions Are Better Paywalls: Turning subscriptions right into a bearer asset is healthier for everybody, says our media columnist. This article is a part of CoinDesk’s Payments Week.

Bitcoin Payments Remain in Their Infancy however There Are Green Shoots Everywhere: Can cryptocurrencies, stablecoins and CBDCs coexist as strategies of fee? Industry leaders shine a lightweight on the way forward for crypto funds. This piece is a part of CoinDesk’s Payments Week.

Longer reads

How Human-Centered Design Can Fix Crypto Payments: Web 3 ought to steal design concepts from Web 2, Grace “Ori” Kwan says in a CoinDesk Payments Week op-ed.

Today’s crypto explainer: How to Stake LUNA on the Terra Protocol

Other voices: Crypto Is Winning, and Bitcoin Diehards Are Furious About It (The Verge)

Said and heard

“There’s a fascinating discussion to be had about whether what Hwang did was full-blown fraud, but I won’t bother trying to outdo Matt Levine on that front. Instead, I want to focus on the financial mechanics of what Archegos was up to, and why it’s extremely important for cryptocurrency holders or traders to understand.” (CoinDesk columnist David Z. Morris) … “Yet, that surface-level assessment misses some striking new adoption trends that aren’t easily apparent to mainstream commentators. Minorities and various other marginalized groups are turning to crypto as a tool and developing unique, new innovative uses for it – often at a faster pace than communities that have traditionally had more privileged access to resources. This experience demands a careful approach to fostering diversity. We must not throw the baby out with the bathwater.” (CoinDesk Chief Content Officer Michael Casey) … “The broad selloff has erased trillions of dollars in market value from the tech-heavy gauge, with investors souring on shares of everything from software and semiconductor companies to social-media giants.” (The Wall Street Journal) … “The closings and demands for constant checks and vigilance, especially in Shanghai, have ignited public frustration, exhausted local officials and medical workers, and sapped economic momentum.” (The New York Times)

CORRECTED (May 2, 06:21 UTC): Corrects title of Three Arrow co-founder within the third graph of the “Insights” sub-header.

Singapore’s Distaste for Retail Crypto Spooks Institutional Money & More Latest News Update

Singapore’s Distaste for Retail Crypto Spooks Institutional Money & More Live News

All this information that I’ve made and shared for you individuals, you’ll prefer it very a lot and in it we maintain bringing matters for you individuals like each time so that you just maintain getting information info like trending matters and also you It is our objective to have the ability to get

every kind of reports with out going by way of us in order that we are able to attain you the newest and finest information for free as a way to transfer forward additional by getting the knowledge of that information along with you. Later on, we are going to proceed

to offer details about extra today world news update kinds of newest information by way of posts on our web site so that you just at all times maintain transferring ahead in that information and no matter type of info shall be there, it’ll positively be conveyed to you individuals.

Singapore’s Distaste for Retail Crypto Spooks Institutional Money & More News Today

All this information that I’ve introduced as much as you or would be the most totally different and finest information that you just individuals are not going to get anyplace, together with the knowledge Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you may get different kinds of information alongside along with your nation and metropolis. You will be capable to get info associated to, in addition to it is possible for you to to get details about what’s going on round you thru us for free

as a way to make your self a educated by getting full details about your nation and state and details about information. Whatever is being given by way of us, I’ve tried to deliver it to you thru different web sites, which you will like

very a lot and if you happen to like all this information, then positively round you. Along with the individuals of India, maintain sharing such information essential to your family members, let all of the information affect them and so they can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links