Indian insurer Digit has filed for an initial public offering, looking to raise about $440 million even as many of its local peers have deferred plans to list publicly in the South Asia nation.

The Indian startup, whose valuation jumped to $3.5 billion in a Sequoia India-led financing round last year, said in a filing to the local regulator Tuesday that it plans to raise up to $157.5 million through issue of new shares while existing shareholders plan to sell about 109.45 million shares. It didn’t say exactly how much it is planning to raise in the public offering, but a person familiar with the matter told TechCrunch that the startup is eyeing to raise about $440 million in total.

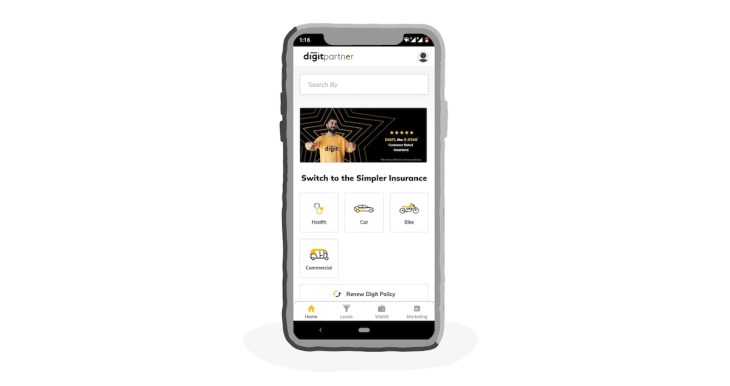

The five-year-old startup, which sells auto, health and travel insurance, is part of a group of firms that is attempting to expand the number of individuals in India that buy insurance coverage. Digit, founded by Kamesh Goyal, an ex-KPMG executive with over three-decade experience in the insurance industry, says it has simplified the process of buying insurance, allowing users the ability to self-inspect, claim submissions and process service requests from their smartphones.

“Digit simplifies insurance through a product-led growth. The thing about insurance is that it’s thought of as a commodity which makes pricing king – lower pricing gets adopted. But cheaper pricing is a race to the bottom. Digit’s products have enhanced coverage (without the baggage of traditional insurance models and data) and is often better priced, making it a compelling investment,” wrote Osborne Saldanha, a Bangalore-based fintech investor in a newsletter last year.

“Digit goes a step further and doubles down on service-led growth as well. In its 7th transparency report, Digit reported ‘average approval time for healthcashless claims in March 2021 was 1 hour and 8 minutes and for reimbursement claims was 2 hours and 1 minute. Our overall Claim Closure Rate for health was 96%.’ It settled 95+% of insurance claims across most products,” he added.

The startup, which also counts Fairfax Group, Indian cricketer Virat Kohli and TVS Capital among its backers, says its motor insurance coverage generated $413 million in gross written premium in the financial year that ended in March. “This level of premium accounted for a market share of 4.5% and 3.5%, respectively, of the total motor insurance premiums written by all non-life insurers in India,” it added.

The startup distributes its insurance through 32,600 partners, including nearly 31,000 point of sale agents and brokers.

Digit Insurance’s filing comes at a time when several local startups including budget hotel chain Oyo and financial services platform MobiKwik have delayed their IPO plans as they closely monitor the condition of the global market, which has reversed much of the gains from the 13-year bull run.

Sequoia India-backed Digit Insurance files for $440 million IPO – TechCrunch & Latest News Update

Sequoia India-backed Digit Insurance files for $440 million IPO – TechCrunch & More Live News

All this news that I have made and shared for you people, you will like it very much and in it we keep bringing topics for you people like every time so that you keep getting news information like trending topics and you It is our goal to be able to get

all kinds of news without going through us so that we can reach you the latest and best news for free so that you can move ahead further by getting the information of that news together with you. Later on, we will continue

to give information about more today world news update types of latest news through posts on our website so that you always keep moving forward in that news and whatever kind of information will be there, it will definitely be conveyed to you people.

Sequoia India-backed Digit Insurance files for $440 million IPO – TechCrunch & More News Today

All this news that I have brought up to you or will be the most different and best news that you people are not going to get anywhere, along with the information Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this made available to all of you so that you are always connected with the news, stay ahead in the matter and keep getting today news all types of news for free till today so that you can get the news by getting it. Always take two steps forward

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links