One of the characteristics of the tax reform that will be promoted in the Petro Government is that its bases are known even before his election as president. Progressivity, the idea of a multipurpose cadastre and taxes on unproductive large estates are pillars that the current Head of State has been sharing for years.

With their appointments in the Ministry of Finance and in the Directorate of National Taxes and Customs (Dian), José Antonio Ocampo -today the Ministry of Finance- and Luis Carlos Reyes -now director of the Dian- have weeks hinting at what would be included in the tax reform which are expected to be filed today in the Congress of the Republic.

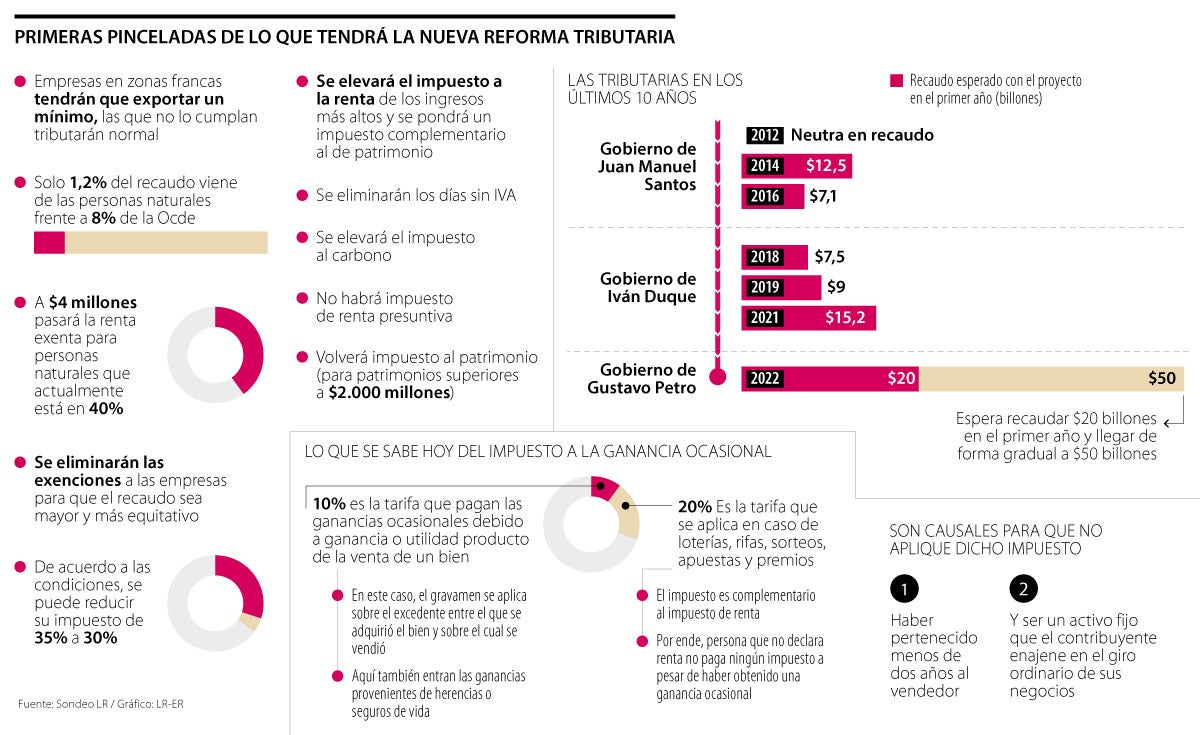

Among the key points that have been advanced is that the VAT rates related to the basic basket of food and essential consumer goods will not be affected. In the case of Income, it was announced that the threshold for tax filers of natural persons would not be reduced, which today is located at $50.8 million per year, equivalent to $4.2 million effective monthly.

Progressiveness

What is actually a progressive tax reform? In a few simple words, it is a reform whose taxes take into account the income of each citizen. In this way, the population is divided into groups according to tax capacity and each one pays -or not- rent according to it.

Although the definition focuses on the tax on the income of natural persons, the concept transcends the entire group of taxes. For example, in the case of cell phone plans, which was a trend in recent daysputting a tax on said service would not go along the path of progressivity.

It is for no other reason than last week that Ocampo stated that this is a tax that “doesn’t work anymore”, because “it doesn’t make sense” when you take into account that it is a service that even the group of people with the least income.

Taxes that do not go

The tax on mobile plans and sugary drinks were just some of the first taxes to be discussed around the country. Although there is still no clarity about the second, because both Ocampo and Reyes have said yes and no on several occasions, it is certain that the first is not going.

A couple of weeks ago, when Reyes was about to hand over his position as director of the Fiscal Observatory of the Javeriana University, he told LR that said tax was not applicable, since its social impact was quite considerable since it was a service that was not distinguished from strata or income levels.

Ocampo, on the other hand, affirmed in a radio interview that this was already a discarded tax and that therefore Colombians could rest assured that it was not going to be taxed.

Companies

Meanwhile, regarding the companies, Reyes was also emphatic. “Currently the exemptions they enjoy are distributed unequally and unequally among the companies.” This is why the Dian under his charge will seek to eliminate all existing exemptions to increase collection.

There, the new director of Dian stated that with all the benefits, the companies “generally large” end up paying around 20% of their ‘really’ levied rate (35%). This is why your office will seek to eliminate said exemptions and, in this way, 95% of companies would pay less taxes, at the cost of a greater and “more equitable” collection.

Natural people

According to the Organization for Economic Cooperation and Development (Ocde), in the country the proportion of people who pay rent is reduced to 5%. The income that this represents compared to GDP, they affirmed, is about 1.2%, while the organization’s average is 8.1%.

In this regard, in a conversation with the British newspaper Financial Times, Ocampo stated that the tax collection reforms promoted by the new government will target people with more income and not companies, which have “high rates.”

The statements of Luis Carlos Reyes focused on this same line. In an interview with CM&, the new director of Dian stated that no natural person You will have exempt income once 40% of your income exceeds $4 million and that “people with incomes below $10 million have nothing to worry about because they will not touch each other.”

Occasional Earnings and ZZ.FF.

Minister Ocampo stressed that, as reported in LR, a minimum export requirement will be imposed on free zones so that they maintain the tax benefit. And, those who do not meet the quota, must pay income above 35% like any other company in the country.

The tax on occasional gains, on the other hand, would increase to 20% for both goods and prizes derived from games of chance. Currently the tax for goods is 10% and for game prizes it reaches 20%.

Productivity that finances social programs against hunger and poverty

Ocampo has been precise that the country must “reindustrialize” and promote sectors such as tourism, health services, manufacturing and agriculture. “It cannot be that the country continues to export only the same fruit that it has exported since the beginning of the 20th century.” The fight against poverty and hunger will also be tried to reduce from the portfolio. “This is an important point for the government and it is almost a fact that we will have programs to deal with it.” It is expected to be accompanied by more – or better – subsidies for the poorest families.