Some say volatility, quite than debt, is one of the best ways to consider danger as an investor, however Warren Buffett famously stated that ‘Volatility is much from synonymous with danger.’ When we take into consideration how dangerous an organization is, we at all times like to take a look at its use of debt, since debt overload can result in damage. We be aware that PowerCell Sweden AB (publ) (STO:PCELL) does have debt on its stability sheet. But is that this debt a priority to shareholders?

What Risk Does Debt Bring?

Debt is a software to assist companies develop, but when a enterprise is incapable of paying off its lenders, then it exists at their mercy. If issues get actually dangerous, the lenders can take management of the enterprise. However, a extra regular (however nonetheless costly) scenario is the place an organization should dilute shareholders at an affordable share worth merely to get debt below management. By changing dilution, although, debt may be an especially good software for companies that want capital to put money into development at excessive charges of return. When we study debt ranges, we first think about each money and debt ranges, collectively.

View our newest evaluation for PowerCell Sweden

What Is PowerCell Sweden’s Debt?

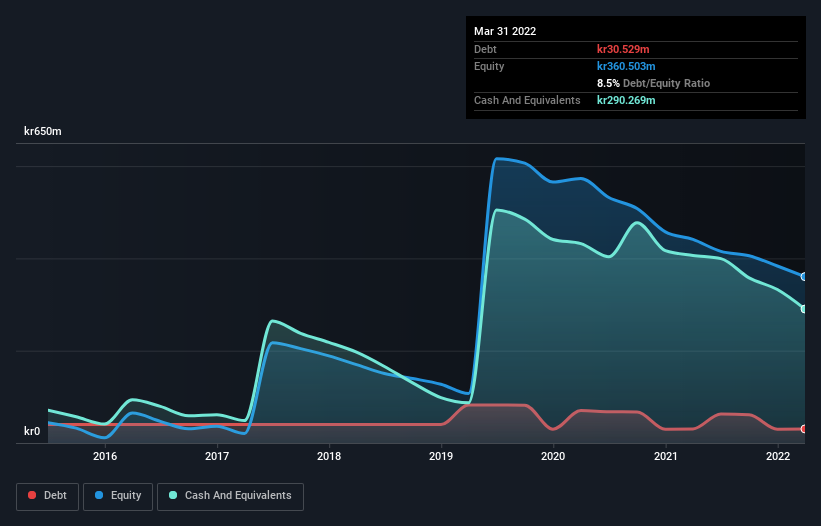

The chart under, which you’ll be able to click on on for larger element, exhibits that PowerCell Sweden had kr30.5m in debt in March 2022; about the identical because the yr earlier than. But then again it additionally has kr290.3m in money, resulting in a kr259.7m internet money place.

How Healthy Is PowerCell Sweden’s Balance Sheet?

We can see from the newest stability sheet that PowerCell Sweden had liabilities of kr74.6m falling due inside a yr, and liabilities of kr59.4m due past that. Offsetting these obligations, it had money of kr290.3m in addition to receivables valued at kr72.5m due inside 12 months. So it may boast kr228.8m extra liquid property than whole liabilities.

This brief time period liquidity is an indication that PowerCell Sweden might in all probability repay its debt with ease, as its stability sheet is much from stretched. Simply put, the truth that PowerCell Sweden has extra cash than debt is arguably a superb indication that it may handle its debt safely. There’s little question that we be taught most about debt from the stability sheet. But finally the long run profitability of the enterprise will determine if PowerCell Sweden can strengthen its stability sheet over time. So in case you’re targeted on the long run you possibly can take a look at this free report exhibiting analyst revenue forecasts.

Over 12 months, PowerCell Sweden reported income of kr160m, which is a achieve of fifty%, though it didn’t report any earnings earlier than curiosity and tax. Shareholders in all probability have their fingers crossed that it may develop its technique to earnings.

So How Risky Is PowerCell Sweden?

By their very nature corporations which might be shedding cash are extra dangerous than these with an extended historical past of profitability. And the very fact is that during the last twelve months PowerCell Sweden misplaced cash on the earnings earlier than curiosity and tax (EBIT) line. Indeed, in that point it burnt by means of kr113m of money and made a lack of kr83m. With solely kr259.7m on the stability sheet, it could seem that its going to wish to lift capital once more quickly. With very stable income development within the final yr, PowerCell Sweden could also be on a path to profitability. By investing earlier than these earnings, shareholders tackle extra danger within the hope of larger rewards. When analysing debt ranges, the stability sheet is the plain place to begin. But finally, each firm can include dangers that exist outdoors of the stability sheet. These dangers may be arduous to identify. Every firm has them, and we have noticed 2 warning indicators for PowerCell Sweden you need to learn about.

Of course, in case you’re the kind of investor who prefers shopping for shares with out the burden of debt, then do not hesitate to find our unique listing of internet money development shares, in the present day.

Have suggestions on this text? Concerned concerning the content material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We purpose to deliver you long-term targeted evaluation pushed by elementary knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Is PowerCell Sweden (STO:PCELL) Using Debt In A Risky Way? & More Latest News Update

Is PowerCell Sweden (STO:PCELL) Using Debt In A Risky Way? & More Live News

All this information that I’ve made and shared for you folks, you’ll prefer it very a lot and in it we maintain bringing matters for you folks like each time so that you just maintain getting information data like trending matters and also you It is our purpose to have the ability to get

all types of stories with out going by means of us in order that we are able to attain you the most recent and finest information free of charge so that you could transfer forward additional by getting the knowledge of that information along with you. Later on, we’ll proceed

to provide details about extra today world news update forms of newest information by means of posts on our web site so that you just at all times maintain shifting ahead in that information and no matter sort of data will likely be there, it’ll positively be conveyed to you folks.

Is PowerCell Sweden (STO:PCELL) Using Debt In A Risky Way? & More News Today

All this information that I’ve introduced as much as you or would be the most completely different and finest information that you just persons are not going to get anyplace, together with the knowledge Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you will get different forms of information alongside together with your nation and metropolis. You will be capable to get data associated to, in addition to it is possible for you to to get details about what’s going on round you thru us free of charge

so that you could make your self a educated by getting full details about your nation and state and details about information. Whatever is being given by means of us, I’ve tried to deliver it to you thru different web sites, which you’ll like

very a lot and in case you like all this information, then positively round you. Along with the folks of India, maintain sharing such information essential to your family members, let all of the information affect them and so they can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links