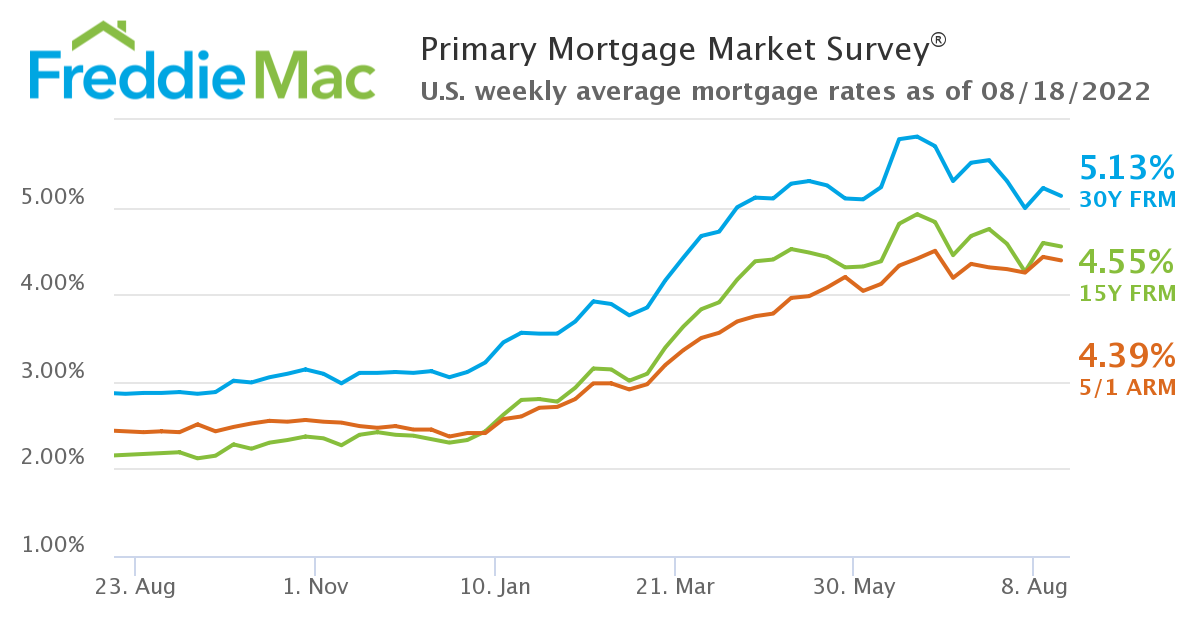

After a week of shooting above the 5%-mark after dipping to 4.99%, Freddie Mac reported that the 30-year, fixed-rate mortgage (FRM) averaged 5.13% with an average 0.8 point as of August 18, 2022, down from last week when it averaged 5.22%. A year ago at this time, the 30-year FRM averaged 2.86%.

Continued erratic rate trends continue to plague the housing market, as also this week, the Mortgage Bankers Association (MBA) reported that overall application activity fell to a 22-year low for the week ending August 12, 2022, down 2.3% week-over-week.

“Inflation appears to be beyond its peak, which has stopped the rapid increase in mortgage rates that the housing market was experiencing earlier this year,” said Sam Khater, Freddie Mac’s Chief Economist. “The market continues to absorb the cumulative impact of the large price and rate increases that led to a plunge in affordability. As a result, over the rest of the year purchase demand likely will continue to drag, supply will modestly increase, and home price growth will decelerate.”

Earlier this week, the National Association of Home Builders (NAHB)/Wells Fargo Housing Opportunity Index (HOI) reported that just 42.8% of new and existing homes sold between the beginning of April and end of June were affordable to families earning the U.S. median income of $90,000—a steep decline from the 56.9% of homes sold in Q1 of 2022 that were affordable to median-income earners.

“For real estate markets, late summer spotlights a tentative transition toward a post-pandemic normal,” said Realtor.com Manager of Economic Research George Ratiu. “Based on Realtor.com’s weekly data, many homeowners are pulling back from selling their homes, concerned about missing the pricing peak, especially as the share of listed homes with price reductions gains ground. After picking up in the last couple of months, new listings are retreating, slowing the rebalancing process. However, the shift toward a calmer market continues, highlighted by the further moderation in price gains which made a noticeable move toward single-digit territory last week.”

The erratic nature of rates has kept many away from purchasing a home, as Redfin has reported a sixth consecutive month of homebuyer competition decline, to levels last seen at the outset of the COVID-19 pandemic outbreak. According to Redfin, 44.3% of home offers written by their agents faced competition in July 2022, compared to a rate of 50.9% reported in June 2022, and down from 63.8% year-over-year.

One bright spot to all these combative forces is a sudden rise in the nation’s housing inventory. One reason for the dip in competition is the fact that the price of a median single-family home hit $400,000 for the first time on record—then surpassed it—finally settling at $413,500 by the end of Q1, according to data from the National Association of Realtors (NAR). In the study, NAR specifically identified 148 of the top 185 metropolitan areas (80%) that posted double-digit price gains, up from 70% recorded during Q1 of 2022.

“For today’s buyers, housing affordability is a critical challenge,” said Ratiu. “At today’s 30-year fixed rate, the buyer of a median-priced home is looking at approximately $2,000 for a monthly payment, a 53% jump from a year ago. With wages rising at an average of 5.3% year-over-year, many Americans looking to buy a home are finding that goal slipping farther away. Within this context, it is not surprising that—thanks to the flexibility of hybrid employment—many people are looking to take advantage of geography in their home buying process.”

Also this week, Freddie Mac reported the 15-year FRM at 4.55% with an average 0.7 point, down from last week when it averaged 4.59%. A year ago at this time, the 15-year FRM averaged just 2.16%. Also the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.39% with an average 0.3 point, down from last week when it averaged 4.43%. A year ago at this time, the five-year ARM averaged 2.43%.

“Mortgage rates are mirroring the zig-zag movement of the 10-year Treasury, as capital markets react to the positive economic numbers, while under the shadow of two quarters of negative GDP growth,” noted Ratiu. “July’s retail sales data showed resilient consumer spending, despite the highest inflation seen in four decades. The insights round out a spate of recent indicators which highlight a steady economy amid recession concerns. With gas prices taking a noticeable step back last month, there are expectations that inflation may slowly abate in the second half of the year. In addition, moderating home price and rent growth may further contribute to a slowdown in consumer prices.”

Inconsistent Mortgage Rates Dip Once Again & Latest News Update

Inconsistent Mortgage Rates Dip Once Again & More Live News

All this news that I have made and shared for you people, you will like it very much and in it we keep bringing topics for you people like every time so that you keep getting news information like trending topics and you It is our goal to be able to get

all kinds of news without going through us so that we can reach you the latest and best news for free so that you can move ahead further by getting the information of that news together with you. Later on, we will continue

to give information about more today world news update types of latest news through posts on our website so that you always keep moving forward in that news and whatever kind of information will be there, it will definitely be conveyed to you people.

Inconsistent Mortgage Rates Dip Once Again & More News Today

All this news that I have brought up to you or will be the most different and best news that you people are not going to get anywhere, along with the information Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this made available to all of you so that you are always connected with the news, stay ahead in the matter and keep getting today news all types of news for free till today so that you can get the news by getting it. Always take two steps forward

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links