The fintech insurer aims to help Aussies tackle cost of living pressures offering comprehensive vehicle insurance charged per kilometre travelled.

Comprehensive car insurance customers pay KOBA an upfront fee of approximately $300 to cover damage to their vehicle while it’s parked, and then insurance is calculated on a per-kilometre-travelled basis.

KOBA notes usage is measured through a small matchbox-sized device called a KOBA Rider that attaches to a car’s OBD port.

An OBD port is often located in the driver footwell beneath the steering wheel and is usually used to diagnose electrical or engine faults.

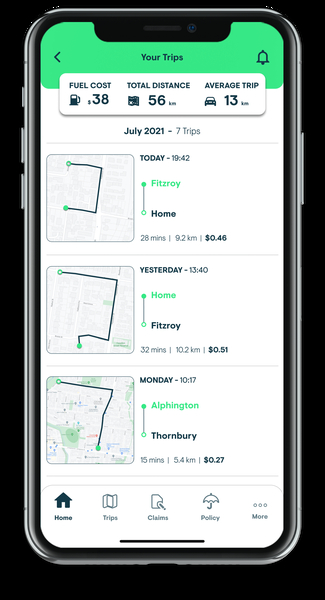

The attachment then communicates with the KOBA smartphone app to automatically calculate driving distances and charges a per-kilometre rate for each trip.

The KOBA app, pictured below, works similar to Uber in that users can see the breakdown of their trips.

Source: KOBA

KOBA Founder Andrew Wong said people are using their cars less since the pandemic, with some still working from home a couple of days a week while others are taking advantage of borders reopening to fly overseas.

“Their car is sitting there, unused and costing money,” Mr Wong said.

“If you’re driving less and for shorter distances why should you be paying the same for car insurance as everybody else?

“In the current climate, it’s a great way for people to keep track of their insurance expenses because they can see the cost as it happens.”

KOBA insurance costs – does it make sense?

KOBA notes customers can pay from as little as 3 cents ($0.03) per kilometre, with total cost calculated at the end of each month.

Further, if a motorist travels more than 250 km per day, KOBA says it will bear the cost of the remaining kilometres travelled.

The same is applied if one drives more than 1,750 km per month, with KOBA fronting the bill for the rest of the month’s kilometres.

ABS data suggests passenger vehicles drive an average of 11,100km per year, or 925km per month.

Using this average and assuming no daily trips exceed 250km, the base policy would cost $633 per year ($333 distance insurance plus $300 parked insurance).

No matter the insurer, policy costs are highly dependent on age of driver, experience, faults, location and other factors.

KOBA insurance details

KOBA is underwritten by eric insurance, with some of its coverage including:

- Accidental loss (including theft)

- Accidental damage that occurs during the policy period as a result of accidental damage, collision, fire or explosions, flood or water, storm or hail, theft or attempted theft, vandalism or malicious act and earthquakes.

- New car replacement – if your car is written off in the first 24 months of its registration and has fewer than 40,000km on the odometer, KOBA replace it with a new one.

- Emergency travel and accommodation for up to $500 for your accommodation and travel if you are more than 200 kilometres from home and your car cannot be driven.

- Baby seats – damage to baby seats as a result of a claim up to $500 per item and a maximum of $1,000 in total.

- Hire car following a theft for eligible claims, up to a maximum of 14 days, by as much as $70 per day.

For full details on the ins and outs of KOBA’s policy and to make a decision as to whether this product is right for you, be sure to check out KOBA’s product disclosure statement.

Advertisement

In the market for a new car? The table below features car loans with some of the lowest interest rates on the market.

|

Lender |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|||||||||||||

|

|

Variable | New | 1 year | More details | |||||||||

| FEATUREDNO ONGOING FEES |

New – Special

|

||||||||||||

New – Special

|

|||||||||||||

|

|

Fixed | New | 2 years | More details | |||||||||

| QUICK APPLICATION PROCESS WITH NO FEES |

New Vehicle Fast Loan Low Rate

|

||||||||||||

New Vehicle Fast Loan Low Rate

|

|||||||||||||

|

|

Fixed | New, Used | 99 years | More details | |||||||||

| APPLY ONLINE |

Car Loan

|

||||||||||||

Car Loan

|

|||||||||||||

|

|

Variable | New | 1 year | More details | |||||||||

| FEATUREDAPPLY ONLINE | |||||||||||||

Electric and Hybrid Car Loan

|

|||||||||||||

- Approval in 24 hours

- No ongoing fees, no discharge fee

- Flexible repayment options

*Comparison rates based on a loan of $30,000 for a five-year loan term. Warning: this comparison rate is true only for this example and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Rates correct as of August 8, 2022. View disclaimer.

Image by Sarah Brown via Unsplash