Since the pandemic, financial institutions have increased their exposure to the cryptocurrency sector so they can provide crypto investment opportunities to their clients.

The cryptocurrency sector is going through a tumultuous time. Since the crypto crash in May 2022, the value of the crypto market cap has been on a decline. Between November 2021 and the end of July 2022, the cap declined by 65%. Despite this difficult time, there is a growing interest from institutional and retail investors to gain exposure to the market.

Crypto as an investment instrument

GlobalData’s 2022 Financial Services Consumer Survey revealed that consumers around the world are showing interest in the cryptocurrency sector. This interest is primarily driven by the motivation to use cryptocurrency as an investment instrument. 77.4% of global respondents who reported having cryptocurrency said that they were motivated to earn profits from it, while only 18.5% of respondents reported using it as a payment tool.

The crypto sector has gathered a lot of interest from consumers and institutional investors since the pandemic. PWC’s 4th Annual Global Crypto Hedge Fund Report 2022 reported that the assets under management (AUM) of crypto hedge funds surveyed was $4.1bn in 2021, 8% higher than the previous year. Though hedge funds are taking exposure to the crypto market, they are limiting their exposure, as approximately 57% of hedge funds investing in crypto have less than 1% of total AUM invested in the sector. The high volatility of the sector makes cryptocurrency a risky asset in which to invest. One of the main strategies that hedge funds are adopting with cryptocurrencies is a market-neutral strategy, which aims to generate profit no matter the direction of the market by mitigating risk through the use of derivative products.

Lack of regulatory framework

In addition to the volatility, the crypto sector’s lack of a proper regulatory framework is preventing financial institutions from significantly increasing their position within it. This lack of regulation causes uncertainty in the longer strategies that funds can adopt or the types of cryptocurrencies they can invest in. Regulations in the sector could create stability by reducing speculation, which is partly responsible for the high volatility. Furthermore, regulations can increase investor confidence in the sector, as protection schemes and coverage can be introduced to make trades and investments safer and bring the sector under the oversight of regulatory bodies.

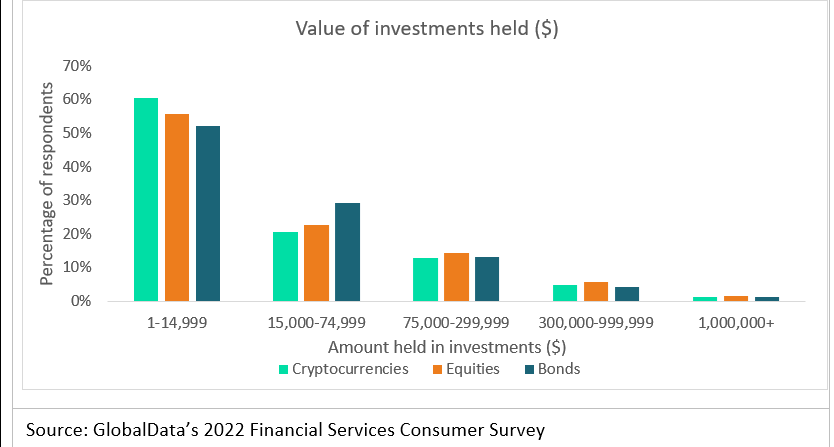

According to GlobalData’s 2022 Financial Services Consumer Survey, approximately 60% of respondents who hold cryptocurrencies hold less than $15,000 of crypto investments, with 41% holding less than $5,000.

This is much higher than the proportion of respondents with holdings of less than $15,000 in both equities (56%) and bonds (52%). Investors who are including cryptocurrencies into their portfolio are doing so by taking small positions in the market. This limits the impact on their investment if the crypto market were to crash.

The cryptocurrency sector is finally getting attention from financial institutions who are looking to capitalise on its growth. Though their investments are currently limited, they are likely to grow their position, especially when governments finally introduce regulatory frameworks.

Figure 1: There is an appetite for crypto investments as 60% of surveyed crypto holders hold less than $15,000 in crypto, higher than bonds and equities

Chris Dinga is payments analyst at GlobalData

cryptocurrency attracts institutional investments: Retail Banker International & Latest News Update

cryptocurrency attracts institutional investments: Retail Banker International & More Live News

All this news that I have made and shared for you people, you will like it very much and in it we keep bringing topics for you people like every time so that you keep getting news information like trending topics and you It is our goal to be able to get

all kinds of news without going through us so that we can reach you the latest and best news for free so that you can move ahead further by getting the information of that news together with you. Later on, we will continue

to give information about more today world news update types of latest news through posts on our website so that you always keep moving forward in that news and whatever kind of information will be there, it will definitely be conveyed to you people.

cryptocurrency attracts institutional investments: Retail Banker International & More News Today

All this news that I have brought up to you or will be the most different and best news that you people are not going to get anywhere, along with the information Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this made available to all of you so that you are always connected with the news, stay ahead in the matter and keep getting today news all types of news for free till today so that you can get the news by getting it. Always take two steps forward

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links