:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/24O6GF5OZVASTJEH3W5JMFDZT4.jpg)

Woodfibre LNG staff look out over Howe Sound on the mission’s industrial website close to Squamish, B.C.John Lehmann/Woodfibre LNG

From Darrin Marshall’s viewpoint, a mountain stands in the way in which of Woodfibre LNG’s objective of transport liquefied pure gasoline abroad from Canada’s West Coast.

As FortisBC’s mission director for a new pipeline that will feed Woodfibre LNG’s proposed export terminal, he has devised plans to bore via the mountain close to Squamish, B.C., about 65 kilometres north of Vancouver.

Mr. Marshall, dwarfed by the mountain as he stands on a spit of land that extends into the Squamish River, factors to the realm the place a tunnel-boring machine could be positioned subsequent yr. Woodfibre LNG is positioned on the website of a former pulp mill on the west aspect of Howe Sound, which leads to the Pacific Ocean. “The most prudent option is to extend the tunnel all the way to the site,” he stated.

Woodfibre LNG’s state of affairs is emblematic of export proposals in Canada. The overwhelming majority of LNG tasks over the previous decade have been mired in pricey logistical problems which have thwarted or delayed contractors. It has turn out to be an ordeal to construct pipelines for transporting pure gasoline to proposed terminals, which might supercool pure gasoline into liquid kind.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/MRN2M6PUHVBFDHCAL2I2KW7FQM.JPG)

Darrin Marshall is FortisBC’s Eagle Mountain Woodfibre Gas Pipeline Project director.DARRYL DYCK/The Globe and Mail

FortisBC lately proposed to assemble a tunnel with two pipelines inside, operating 9 kilometres beneath the Skwelwil’em Squamish estuary wildlife administration space and thru Monmouth Ridge Mountain. There could be a second tunnel-boring machine at Woodfibre LNG’s website.

The want is getting extra pressing. Companies and governments need to speed up plans for LNG exports after Russia’s invasion of Ukraine in February. The struggle has upended world vitality markets, leaving Europe scrambling to scale back its dependence on pure gasoline from Russia.

Canada has a golden alternative to assist Europe. But getting into the LNG export sport requires deep pockets and a sturdy mindset for putting dangerous bets on terminals that sometimes take a minimum of 5 years to assemble – assuming builders have already got their pipeline route plans firmed up.

There can also be higher blowback to deal with. Opposition to pipelines and terminals from environmentalists and key Indigenous leaders has mounted.

In brief, though Canada is the world’s sixth-largest producer of pure gasoline, it isn’t in any place to assist Europe rapidly and immediately with LNG provides.

“These companies realize that because of a lack of infrastructure, it’s very difficult to do these projects,” stated Omar Mawji, a Toronto-based analyst with the Institute for Energy Economics and Financial Analysis.

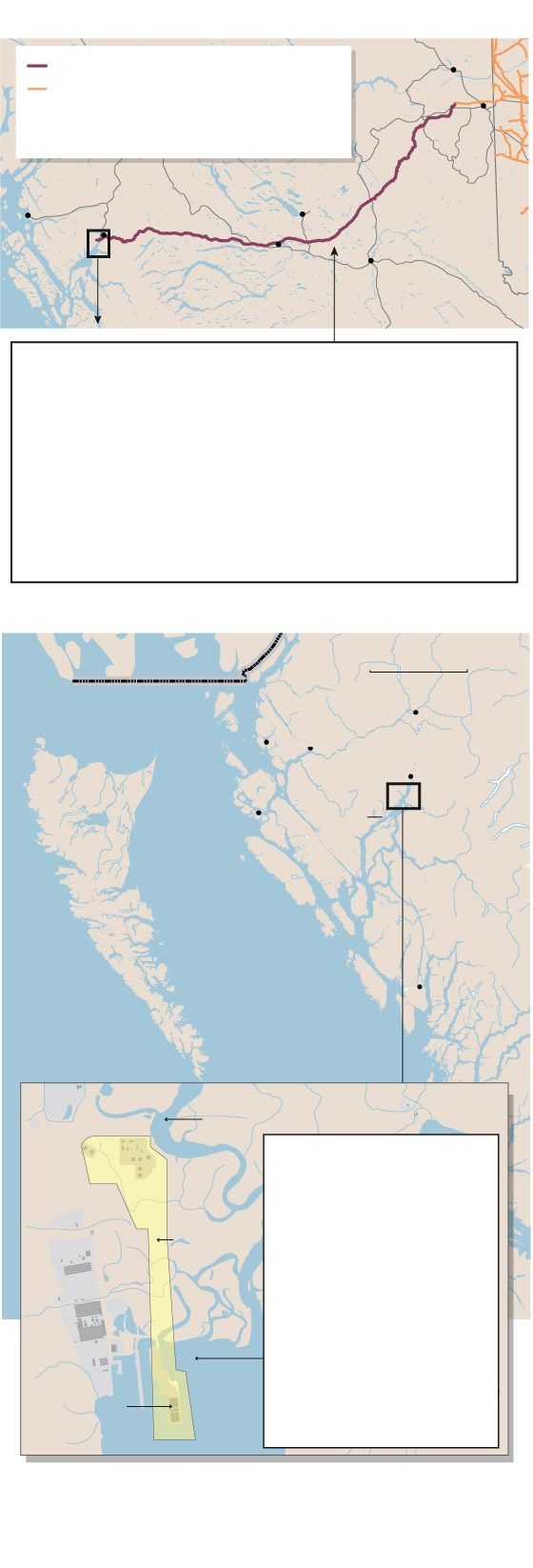

Coastal GasHyperlink pipeline mission

TC Energy Corp.’s Nova Gas

Transmission Ltd. (NGTL)

present system

TC Energy Corp.’s Coastal GasHyperlink pure gasoline

pipeline mission has the assist of all 20 elected

Indigenous band councils alongside the 670-kilometre

route from northeast B.C. to Kitimat. But the Office

of the Wet’suwet’en, ruled by hereditary

chiefs, opposes the pipeline mission, saying Indige-

nous authority rests with hereditary leaders, not

elected ones, over a giant section of the route.

Royal Dutch Shell PLC is

the most important accomplice in

LNG Canada, with a 40

per cent stake. The

different companions are:

Malaysia’s state-owned

Petronas (25 per cent),

PetroChina (15 per cent),

Japan’s Mitsubishi Corp.

(15 per cent) and South

Korea’s Kogas

(5 per cent).

brent jang and JOHN SOPINSKI/THE GLOBE AND MAIL

SOURCE: lng canada; royal dutch shell;

coastalgaslink.com

Coastal GasHyperlink pipeline mission

TC Energy Corp.’s Nova Gas

Transmission Ltd. (NGTL)

present system

TC Energy Corp.’s Coastal GasHyperlink pure gasoline pipeline

mission has the assist of all 20 elected Indigenous band

councils alongside the 670-kilometre route from northeast

B.C. to Kitimat. But the Office of the Wet’suwet’en, gov-

erned by hereditary chiefs, opposes the pipeline mission,

saying Indigenous authority rests with hereditary leaders,

not elected ones, over a giant section of the route.

Royal Dutch Shell PLC is

the most important accomplice in LNG

Canada, with a 40 per cent

stake. The different companions

are: Malaysia’s state-

owned Petronas (25

per cent), PetroChina (15

per cent), Japan’s Mitsubi-

shi Corp. (15 per cent) and

South Korea’s Kogas

(5 per cent).

brent jang and JOHN SOPINSKI/THE GLOBE AND MAIL

SOURCE: lng canada; royal dutch shell; coastalgaslink.com

Coastal GasHyperlink pipeline mission

TC Energy Corp.’s Nova Gas Transmission

Ltd. (NGTL) present system

TC Energy Corp.’s Coastal GasHyperlink pure gasoline pipeline mission has the assist of

all 20 elected Indigenous band councils alongside the 670-kilometre route from

northeast B.C. to Kitimat. But the Office of the Wet’suwet’en, ruled by hered-

itary chiefs, opposes the pipeline mission, saying Indigenous authority rests with

leaders, not elected ones, over a giant section of the route.

Royal Dutch Shell PLC is the

largest accomplice in LNG

Canada, with a 40 per cent

stake. The different companions are:

Malaysia’s state-owned

Petronas (25 per cent), Petro

China (15 per cent), Japan’s

Mitsubishi Corp. (15 per cent)

and South Korea’s Kogas

(5 per cent).

brent jang and JOHN SOPINSKI/THE GLOBE AND MAIL, SOURCE: lng

canada; royal dutch shell; coastalgaslink.com

“The honest truth is that if I’m a company and I want to build a pipeline, that is something I have to factor into my analysis,” Mr. Mawji stated.

Russia’s invasion of Ukraine has additionally reignited curiosity in proposals for LNG exports from Canada’s East Coast. LNG Newfoundland and Labrador Ltd. is finding out the feasibility of securing offshore pure gasoline from the Grand Banks. It needs to begin LNG exports to Europe in 2030, however first, it should get regulatory approvals and construct a 600-kilometre pipeline alongside the ground of the Atlantic Ocean.

Ottawa in talks with Repsol, Pieridae Energy about rushing up proposed east coast LNG export terminals

Despite pipeline challenges and different obstacles, the federal authorities goals that Canadian-based export terminals will assist enhance world provides of LNG by the top of this decade. Yet Ottawa can also be nonetheless striving to meet Canada’s net-zero carbon emissions targets by 2050.

“We are wanting to help our allies with energy security, but we are also committed to fighting climate change,” stated Natural Resources Minister Jonathan Wilkinson. “You can do both. You have to be able to walk and chew gum at the same time. We have to be able to think about how we help our allies at a time of great crisis.”

If something, getting Canadian LNG tasks deliberate and financed, and securing regulatory approvals and building permits for pipelines and terminals, is getting more durable.

Of the 24 Canadian LNG proposals tracked by federal authorities in 2017, 18 had been in British Columbia, all centered on exports to Asia. There had been additionally three in Nova Scotia, two in Quebec and one in New Brunswick, every focusing on Europe.

Today, {industry} analysts say simply 9 proposals have a likelihood of success – 5 in B.C., one in Quebec and three in Atlantic Canada.

A actuality examine signifies three have the very best odds of forging forward with building throughout the subsequent three years. All are in B.C.: LNG Canada’s Phase 2 in Kitimat, and two small-scale tasks: Cedar LNG, additionally in Kitimat, and Woodfibre LNG, close to Squamish. There can also be LNG Canada’s Phase 1, on observe for completion in 2025, when it will turn out to be the nation’s first export terminal for the gas.

Meanwhile, the United States is racing forward. In 2015, Canada and the U.S. didn’t have any LNG export terminals. Today, seven are working south of the border, and a minimum of one other 5 services, together with expansions at three present websites, are doubtless to open by 2028.

In a signal of the instances of Canada’s diminished LNG expectations, gatherings for proponents have additionally been scaled again through the years. An worldwide convention staged by the then BC Liberal authorities in 2015 attracted 1,600 delegates in Vancouver. In mid-2017, two weeks after taking workplace, the NDP cancelled a convention deliberate for that fall.

Next week, the Canada Gas & LNG Exhibition and Conference, an industry-backed occasion, is anticipated to appeal to about 500 delegates in Vancouver. That can be barely larger than the earlier private-sector convention held in 2019, however the theme stays the identical: Canada’s LNG alternative.

Why is Canada so shut to changing into a world LNG participant, but nonetheless so far-off?

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/5GILUVR75JA5PGFXPOYHP6XPLI.jpeg)

A ten-storey module arrives at LNG Canada’s export terminal website in Kitimat, B.C., in March, 2022.LNG Canada

At the top of Douglas Channel, building of LNG Canada’s Phase 1 terminal started in 2018 on a Kitimat industrial website on the Haisla Nation’s conventional territory.

A ten-storey module arrived at LNG Canada from China two months in the past, the primary in a sequence of large items that can be put in over the subsequent 18 months.

LNG Canada’s seven years of building for Phase 1 will value $18-billion, and the co-owners of the three way partnership are pondering whether or not to approve Phase 2, which might double the export capability to 28 million tonnes a yr. The Shell PLC-led three way partnership is the one LNG export terminal below building within the nation.

The LNG exports to Asia would not directly assist Europe as a result of these new provides would unlock the gas elsewhere within the world, which may very well be rerouted to European international locations searching for to wean themselves off Russian pure gasoline.

LNG Canada’s engineering includes Canadian and world provide chains. Huge modules are being constructed at China Offshore Oil Engineering Co. Ltd.’s fabrication yard in Qingdao, China. The 10-storey module that arrived in March can be related to the 670-kilometre Coastal GasHyperlink pipeline system to be operated by TC Energy Corp.

While LNG Canada is by far essentially the most superior of any export plans on this nation, critical infrastructure issues stay.

The Coastal GasHyperlink pipeline is being constructed to transport pure gasoline from northeastern B.C. to LNG Canada’s Kitimat website, and it’s pricey and contentious. The pipeline’s present price range is $6.6-billion, although {industry} consultants estimate value overruns of $1-billion. In February, TC Energy reached choice agreements to promote a 10 per cent stake in Coastal GasHyperlink to two teams of elected First Nations alongside the route.

But a vocal group of Wet’suwet’en Nation hereditary chiefs and their supporters say that the pipeline mission nonetheless doesn’t have the consent of these hereditary leaders.

John Ridsdale, a local weather activist whose Wet’suwet’en hereditary chief identify is Na’Moks, stated persevering with demonstrations in opposition to Coastal GasHyperlink are additionally designed to shake investor confidence in different proposed B.C. pipeline routes. Those embody Enbridge Inc.’s Pacific Trail Pipeline and Westcoast Connector Gas Transmission, in addition to TC Energy’s Prince Rupert Gas Transmission.

Plans for Pacific Trail Pipeline name for the route to cross the Wet’suwet’en’s conventional territory on the way in which to delivering pure gasoline to Bish Cove, positioned close to Kitimat. Last yr, Chevron Corp. and Woodside Petroleum Ltd. indefinitely suspended their Bish Cove mission.

“Did we scare them away? I think they woke up to the risk of losing money,” Mr. Ridsdale stated. Chevron and Woodside in the end selected their very own that the economics didn’t make sense for his or her LNG ambitions. No consumers have emerged for the Bish Cove proposal.

Chevron and Woodside disclosed a complete of US$2.32-billion in writedowns associated to asset devaluations from their investments of their three way partnership. The website preparation and different work close to Kitimat, together with developing a new street alongside tough terrain close to Douglas Channel, turned out to be way more pricey and sophisticated than initially anticipated.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/WHDBWN4FGVAXBJL3AVGTQC5J24.JPG)

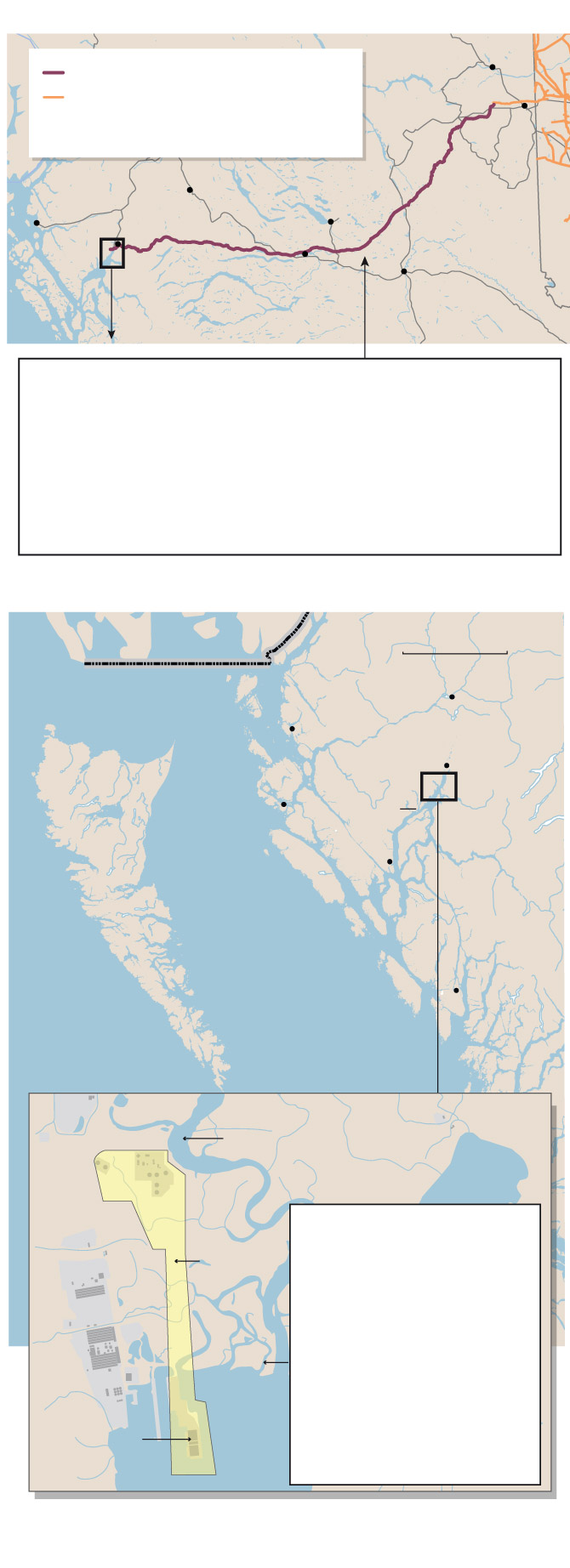

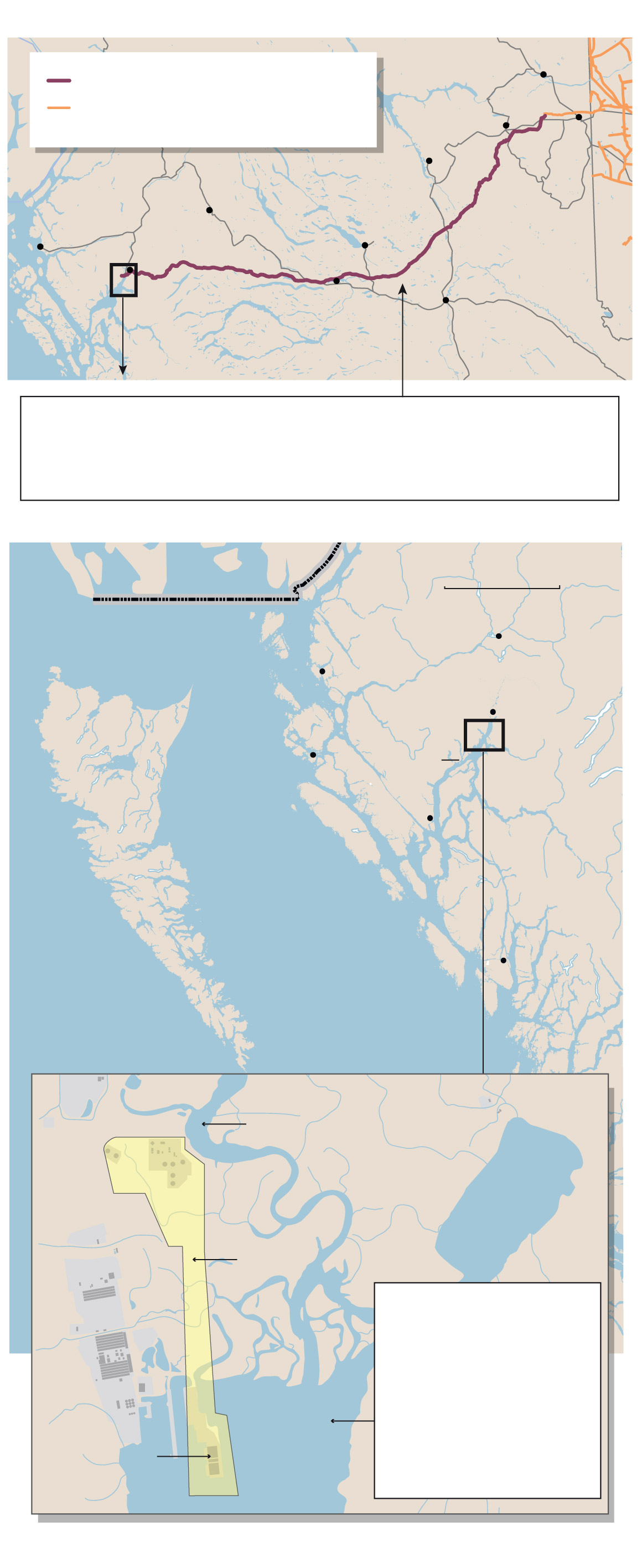

The website of a deliberate non permanent work camp for the proposed FortisBC Eagle Mountain Woodfibre Gas Pipeline Project. The much-delayed mission is privately owned by Singapore-based RGE Pte. Ltd. and managed by Indonesian businessman Sukanto Tanoto.DARRYL DYCK/The Globe and Mail

Besides LNG Canada’s Phase 2, simply 4 different proposals for exporting with devoted LNG vessels stay lively in British Columbia: Cedar LNG, Woodfibre LNG, Ksi Lisims LNG and growth plans by a terminal referred to as Tilbury LNG, which is at the moment centered on manufacturing for home use and storage. One area of interest participant in B.C., Port Edward LNG close to Prince Rupert, is contemplating exporting LNG in containers on a very small scale: 300,000 tonnes a yr.

A gaggle of producers often called Rockies LNG is selling the Ksi Lisims LNG mission, in collaboration with the Nisga’a Nation. Rockies LNG has narrowed its pipeline route throughout northern B.C. to both Westcoast Connector Gas Transmission or Prince Rupert Gas Transmission. Whatever route is chosen is certain to be controversial.

Groups corresponding to My Sea to Sky, the Wilderness Committee and the Canadian Association of Physicians for the Environment have opposed LNG proposals in B.C.

Construction on the Coastal GasHyperlink pipeline mission is almost 55-per-cent accomplished. The pipeline system is already designed to have the capability to accommodate Cedar LNG’s wants and LNG Canada’s potential Phase 2, topic to including extra compressor stations.

The Haisla Nation co-owns the Cedar LNG enterprise in Kitimat with Pembina Pipeline Corp., which joined the mission final yr. “Adding Pembina to our team has definitely solidified our confidence,” stated Haisla elected Chief Councillor Crystal Smith.

Haisla leaders say LNG poses far fewer environmental dangers than crude oil, noting that they vehemently opposed the now-defunct Northern Gateway oil pipeline plans. Cedar LNG plans to use a floating manufacturing facility, and depend on electric-drive know-how – which is dearer than natural-gas-fired generators – to liquefy three million tonnes a yr.

Electric drive powered by hydro emits far decrease ranges of greenhouse gases, and Susannah Pierce, Shell Canada president and nation chair, is receptive to the know-how for Phase 2, which might be a change from the natural-gas-fired generators in Phase 1. Shell PLC owns 40 per cent of LNG Canada and can work with its 4 three way partnership companions (JVPs) to study the feasibility of hydroelectricity for Phase 2, Ms. Pierce stated.

“It is something that the JVPs have to really take a look at themselves,” she stated. “They’re going to look at their options around the world, they’re going to look at the affordability and the economics of this particular second phase and go from there.”

Peter Tertzakian, ARC Energy Research Institute’s deputy director, stated the growth of LNG Canada is, in some ways, essentially the most promising mission proper now. “The pro of LNG Canada is that a lot of the infrastructure will be in place already,” he stated.

The West Coast additionally has aggressive benefits over the East Coast due to a lot shorter distances for pure gasoline to be transported from northeast B.C. and Alberta, via varied connecting traces.

FortisBC’s 50-kilometre pipeline route would begin within the Eagle Mountain area, close to the Vancouver suburb of Coquitlam, and finish at Woodfibre LNG. FortisBC’s Mr. Marshall stated the idea of getting two pipelines as an alternative of 1 contained in the tunnel via Monmouth Ridge Mountain and the Squamish space would supply a backup system in case of any hassle with one of many pipes.

But the price of FortisBC’s proposed nine-kilometre tunnel and the 2 pipelines inside is estimated at $341-million. That’s sharply larger than for the unique plans, which had been subsequently dropped due to the chance of environmental harm to the estuary. The new estimate doesn’t even embody the remainder of the 50-kilometre pipeline route.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/I57JYZ3GRBG2XN4NYH7VZLZTX4.JPG)

The website of a deliberate non permanent work camp for the proposed Woodfibre Gas Pipeline Project in Squamish, B.C. The firm expects to home greater than 500 non-local staff on the camp throughout the peak of building.DARRYL DYCK/The Globe and Mail

The much-delayed Woodfibre LNG mission is privately owned by Singapore-based RGE Pte. Ltd. and managed by Indonesian businessman Sukanto Tanoto. It would have an export capability of two.1 million tonnes a yr, or one-seventh the scale of LNG Canada’s Phase 1. Floating LNG storage tanks could be positioned on the waters of Howe Sound, with the onshore terminal to run on hydroelectric energy.

FortisBC, the most important distributor of pure gasoline to houses in British Columbia, lately submitted its revised pipeline plans to the B.C. Environmental Assessment Office and the Squamish Nation, which is able to assessment the main points earlier than deciding whether or not to approve the modifications.

As Canada struggles, U.S. LNG exports soar. Supplies of pure gasoline from the plentiful Permian Basin in Texas and New Mexico are a comparatively brief distance to 5 export terminals alongside the U.S. Gulf Coast.

The Calcasieu Pass mission in Louisiana started exporting in February, changing into the seventh U.S. LNG export facility in operation. There are three terminals in Louisiana, two in Texas, one in Maryland and one in Georgia. At least 5 extra are anticipated to be on stream inside six years.

Golden Pass LNG, a three way partnership between Qatar and Exxon Mobil Corp., is eyeing an export begin date in Texas in 2024.

The array of U.S. LNG tasks on the horizon alarms local weather activists. “A flurry of new gas export facilities that will ship fuel primarily to Asia and Europe will wreak havoc on Louisiana’s Gulf Coast,” in accordance to a grassroots group organized by the Louisiana Bucket Brigade.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/NVJEWOPDFZMYTASWZTZ2AWQYJM.JPG)

A drill rig within the Permian Basin close to Stanton, Texas. Supplies of pure gasoline from the plentiful basin are a comparatively brief distance to 5 export terminals alongside the U.S. Gulf Coast.TAMIR KALIFA/The New York Times News Service

Clark Williams-Derry, a Seattle-based analyst with the Institute for Energy Economics and Financial Analysis, ranks the Plaquemines LNG proposal in Louisiana as one in every of 4 front-runners striving to get a shovel within the floor within the U.S. The different high prospects are expansions of present terminals: Cameron LNG in Louisiana and Corpus Christi Liquefaction and Freeport LNG in Texas.

Compared with the U.S. front-runners, LNG Canada’s Phase 2 nonetheless has a good distance to go earlier than changing into actuality, Mr. Williams-Derry stated. By the time that LNG Canada’s Phase 1 begins exporting in 2025, will probably be 9 years after the primary U.S. LNG facility began working. Cheniere Energy Inc.’s Sabine Pass LNG mission in Louisiana opened in 2016, making its preliminary cargo to Brazil.

On Canada’s East Coast, Repsol SA’s Saint John LNG in New Brunswick, Pieridae Energy Ltd.’s Goldboro LNG in Nova Scotia and LNG Newfoundland and Labrador are potentialities.

Quebec, New Brunswick and Nova Scotia would stand a higher likelihood if the tasks in these provinces might safe pure gasoline from the U.S. Northeast, particularly from the Marcellus shale deposits in Pennsylvania that are a part of the Appalachian basin.

But the U.S. has its personal home competitors for pure gasoline, which means Quebec, New Brunswick and Nova Scotia have to depend on Western Canada for his or her gas supply.

Canada’s lack of infrastructure stays a main impediment to East Coast terminals. Upgrades and expansions could be wanted on TC Energy’s pipeline system via Ontario and Quebec, so as to join to a snaking route that leads to the Maritimes & Northeast Pipeline from New England to Nova Scotia.

Unless modifications are made to enhance and develop the system, the lacking hyperlink threatens to be a showstopper for proposals in Quebec, New Brunswick and Nova Scotia, given the reliance on transporting pure gasoline lengthy distances from Western Canada.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/RYQ6LP3ICJEZXOELZQMH62SEJY.JPG)

Howe Sound is seen trying south from the Spit in Squamish, B.C. The finish of a tunnel for the proposed FortisBC pipeline growth to the Woodfibre LNG website on Howe Sound is deliberate to be positioned within the space.DARRYL DYCK/The Globe and Mail

Still, Ottawa has been touting East Coast proposals as a method to immediately assist Europe throughout a time of vitality shortages.

Mr. Wilkinson, the Natural Resources Minister, stated LNG proponents face time pressures. “We are interested in opportunities on the East Coast to help our European friends if it can be done within the relevant time frame,” he stated. “We also have to be clear that that we don’t want to create stranded assets because we cannot continue to burn natural gas in a significant way around the world if we’re going to achieve net zero by 2050.”

Leo Power, president of LNG Newfoundland and Labrador, stated an overhaul of the nation’s regulatory system in 2019 means higher scrutiny of LNG export tasks by the Canada Energy Regulator and the Impact Assessment Agency of Canada.

“Demand for LNG is growing so fast,” Mr. Power stated. “We need certainty that investors can have the confidence that this project will get permitted and get through the regulatory system.”

GNL Québec Inc.’s Énergie Saguenay proposal appeared to have been shelved final yr. But after Russia’s invasion of Ukraine, hopes have been rekindled for exporting LNG from Quebec, regardless of the unique plans being rejected by the Quebec authorities and federally.

Last month, the Quebec authorities successfully banned oil and gasoline exploration within the province, so Énergie Saguenay’s slim prospects proceed to hinge on acquiring pure gasoline from Western Canada.

Pieridae has vastly scaled again plans for Goldboro LNG, switching to a proposed floating facility as an alternative of a giant terminal that will have been constructed on land. Pieridae chief government officer Alfred Sorensen stated Goldboro LNG wants Ottawa to intervene to assist resolve problems associated to inadequate pipeline capability in Ontario and Quebec.

Pieridae is searching for a monetary accomplice and expects to make a last funding determination by the top of 2022 on whether or not to press forward with Goldboro LNG.

“Canada would be lucky to get all of the projects done, but I think that’s going to be difficult until some of the transportation issues are resolved,” Mr. Sorensen stated, though it isn’t too late for Canada to catch the subsequent LNG boat of alternative.

“We certainly missed the last boat,” he stated.

Your time is efficacious. Have the Top Business Headlines e-newsletter conveniently delivered to your inbox within the morning or night. Sign up as we speak.

Canada’s problems getting LNG to a thirsty world are allowing U.S. competitors to thrive & More Latest News Update

Canada’s problems getting LNG to a thirsty world are allowing U.S. competitors to thrive & More Live News

All this information that I’ve made and shared for you individuals, you’ll prefer it very a lot and in it we hold bringing matters for you individuals like each time so that you just hold getting information info like trending matters and also you It is our objective to have the opportunity to get

all types of stories with out going via us in order that we will attain you the newest and finest information without spending a dime in an effort to transfer forward additional by getting the knowledge of that information along with you. Later on, we’ll proceed

to give details about extra today world news update varieties of newest information via posts on our web site so that you just at all times hold shifting ahead in that information and no matter form of info can be there, it’ll positively be conveyed to you individuals.

Canada’s problems getting LNG to a thirsty world are allowing U.S. competitors to thrive & More News Today

All this information that I’ve introduced up to you or would be the most totally different and finest information that you just individuals are not going to get anyplace, together with the knowledge Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you will get different varieties of information alongside together with your nation and metropolis. You can be in a position to get info associated to, in addition to it is possible for you to to get details about what’s going on round you thru us without spending a dime

in an effort to make your self a educated by getting full details about your nation and state and details about information. Whatever is being given via us, I’ve tried to deliver it to you thru different web sites, which you’ll like

very a lot and should you like all this information, then positively round you. Along with the individuals of India, hold sharing such information obligatory to your family members, let all of the information affect them and so they can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links