Small and medium-sized enterprises (SMEs) play a significant function in Singapore’s economic system, forming 99 per cent of complete enterprises, contributing 43 per cent of value-added and providing employment to 70 per cent of the workforce. For Singapore to realize financial enlargement of two to three per cent per yr over the following decade, it’s crucial to help enterprises, and particularly, SMEs, to spice up productiveness by way of digital applied sciences adoption. In this facet, the monetary sector, and particularly the impression of fintech lending, may lend help to the event of SMEs.

These insights had been shared by the Singapore Management University’s (SMU’s) Associate Professor of Economics (Practice), Tan Swee Liang, at “Economics in the News”, a digital one-day occasion held on 27 May 2022 and organised by the Economic Society of Singapore, in collaboration with ESSEC Business School Asia-Pacific. Prof Tan addressed college students, teachers, economics professionals and members of the general public throughout her hour-long presentation, titled “Can fintech help SMEs’ drive Singapore’s productivity?”

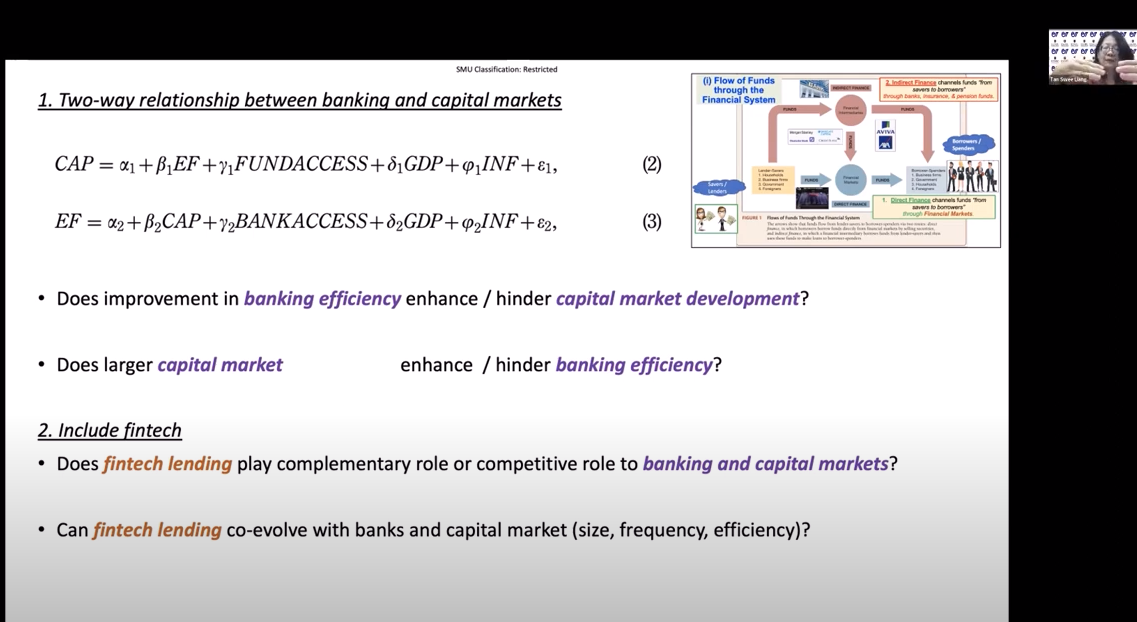

“Bank lending aside, an alternative form of financing has emerged in the last decade – fintech lending. Fintech (shortened from financial technology) is about combining the latest technological developments such as artificial intelligence (AI), distributed computing, cryptography, mobile access internet with financial services and applications in areas of payment, savings, borrowing, managing risks, and seeking financial advice,” commented Prof Tan.

“Different types of fintech credit models have emerged,” defined Prof Tan. “One example is the peer-to-peer P2P lending platform (or, crowdfunding) which provides an online market for lenders (creditors) to trade directly with borrowers. What makes crowdfunding attractive for the SMEs compared to bank loans is that the loans are usually not collateralised, of a smaller quantum and of a shorter loan duration, with faster approval time. Of interest in the last two years during the pandemic is the platform’s capability to mitigate asymmetric information problems of adverse selection and moral hazard using AI, big-data, machine learning, and digitalisation to screen and monitor borrowers when there is economic downturn.”

In Singapore pre-pandemic, there have been 19 crowdfunding platforms as of 2018. Loans amounting to US$191 million was raised through crowdfunding, amounting to 0.29% of banks’ lending to SMEs. In different international locations, crowdfunding shares to financial institution credit score are additionally small. Prof Tan elaborated that fintech lending in Singapore and Asia is a comparatively new improvement and the Monetary Authority of Singapore (MAS) seeks to stability enhancing entry to capital for companies and mitigating the monetary stability dangers arising from fintech actions. MAS additionally adopts a proportionate strategy to regulating crowdfunding, by making use of risk-appropriate rules to the precise actions which are carried out, be it lending to firms or people.

The emergence of latest digital applied sciences has enabled non-bank entities to offer monetary providers to components of society which are un(der)-served. These entities (fintech) maintain the potential to deal with obstacles that SMEs face in accessing credit score. Whether fintech lending performs a complementary or aggressive function, or co-evolve with banks, when it comes to measurement, frequency, effectivity, can decide the effectiveness of funding for SMEs.

Prof Tan opined that function identification is particularly vital for a maturing economic system akin to Singapore. A complementary function solely serves to deal with financing gaps that may be missed by the standard lenders, whereas competitors could result in pointless risk-taking behaviours of banks and fintech lenders, resulting in monetary instability. She commented that co-evolving relationships with constructive suggestions loops can result in measurement, frequency, and effectivity features between financial institution and fintech lending, which in flip will help SMEs broaden. Prof Tan concludes insurance policies to facilitate environment friendly funding of scarce capital by selling conventional and progressive channels to co-evolve collectively, will turn into vital for Singapore to realize financial enlargement of two to three per cent per yr over the following decade.

Prof Tan was collaborating on the occasion in step with SMU’s strategic precedence space of “Growth in Asia”, the place the University sought to supply a deep understanding of Asia’s economic system, polity and society.

Can fintech help SMEs’ drive Singapore’s productiveness? & More Latest News Update

Can fintech help SMEs’ drive Singapore’s productiveness? & More Live News

All this information that I’ve made and shared for you folks, you’ll prefer it very a lot and in it we preserve bringing subjects for you folks like each time so that you just preserve getting information data like trending subjects and also you It is our purpose to have the ability to get

all types of reports with out going by way of us in order that we will attain you the newest and greatest information without cost so that you could transfer forward additional by getting the knowledge of that information along with you. Later on, we are going to proceed

to present details about extra today world news update forms of newest information by way of posts on our web site so that you just at all times preserve shifting ahead in that information and no matter sort of data shall be there, it would positively be conveyed to you folks.

Can fintech help SMEs’ drive Singapore’s productiveness? & More News Today

All this information that I’ve introduced as much as you or would be the most completely different and greatest information that you just persons are not going to get wherever, together with the knowledge Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you will get different forms of information alongside along with your nation and metropolis. You will be capable to get data associated to, in addition to it is possible for you to to get details about what’s going on round you thru us without cost

so that you could make your self a educated by getting full details about your nation and state and details about information. Whatever is being given by way of us, I’ve tried to deliver it to you thru different web sites, which you will like

very a lot and should you like all this information, then positively round you. Along with the folks of India, preserve sharing such information essential to your family members, let all of the information affect them they usually can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links