Sean Gallup/Getty Images News

C3.ai (NYSE:AI) continues to languish at low valuations amidst the ongoing tech crash. AI once traded deep in the triple-digits but now trades in the low double-digits. This is a secular growth story positioned to benefit from the growth of artificial intelligence. The company holds 50% of its market cap in net cash and has outlined a path towards positive free cash flow over the coming years. With the stock trading at just 7x sales, this is a name worth buying in anticipation of a tech stock recovery.

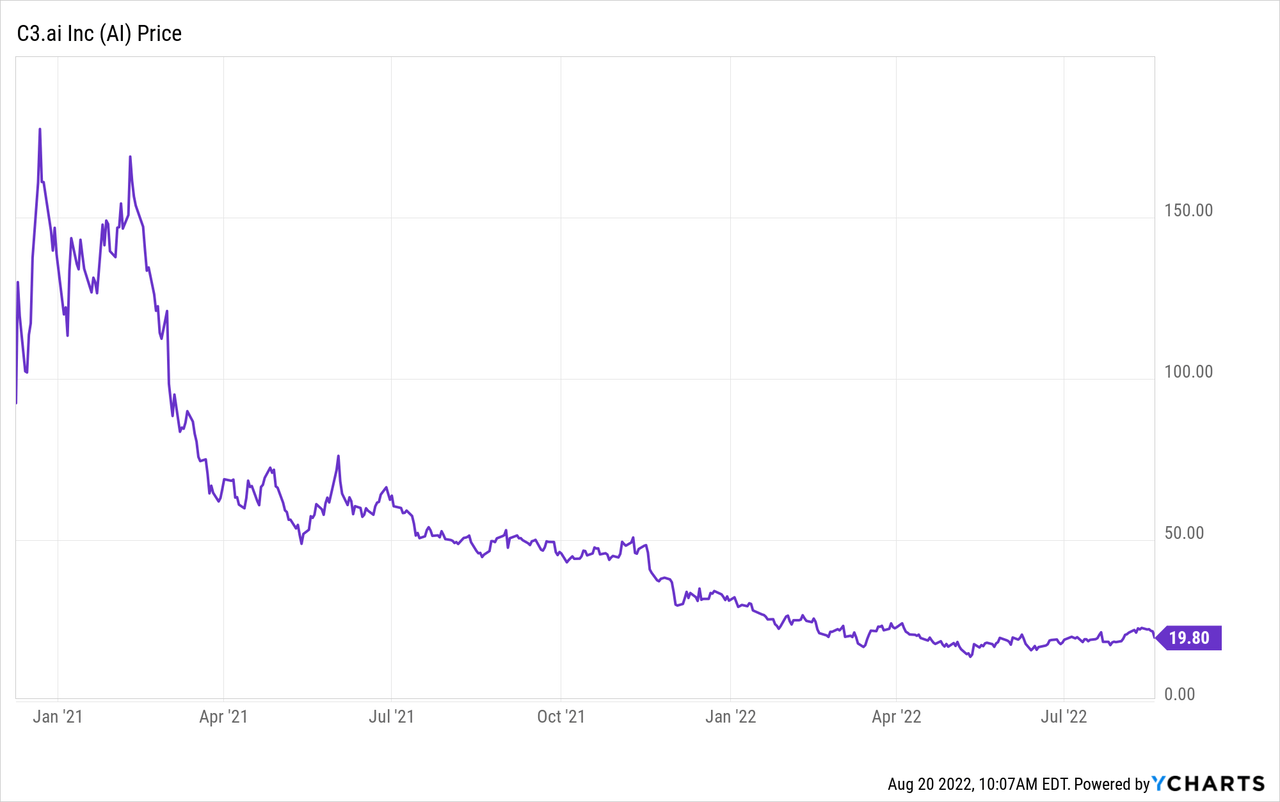

AI Stock Price

AI traded above $100 on its first day of trading and traded as high as $177 per share soon after. The stock has since dropped nearly 90% since then.

I last covered AI in February where I rated the stock a strong buy on account of the low valuation and 40% net cash position. Since then, the stock has dropped another 21% and net cash now makes up 50% of the market cap.

What is AI?

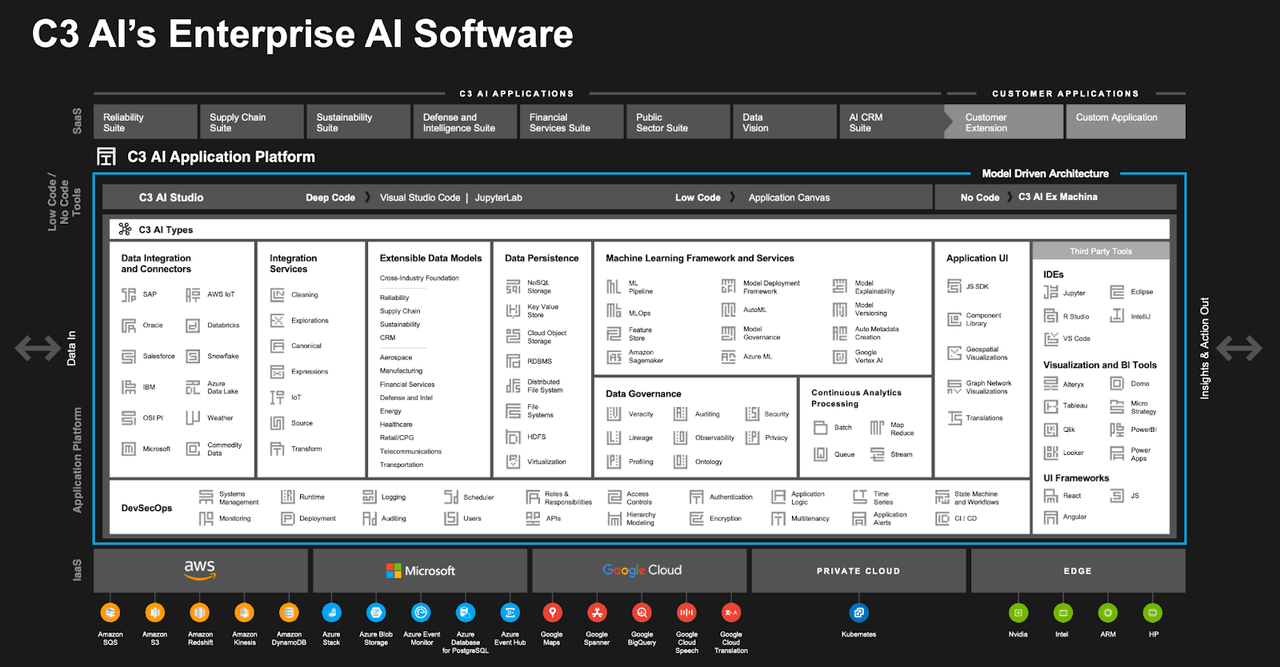

AI offers an enterprise artificial intelligence platform that works across multiple cloud providers and is applicable across a wide variety of applications. “Enterprise” means that AI sells to companies instead to consumers.

FY22 Q4 Presentation

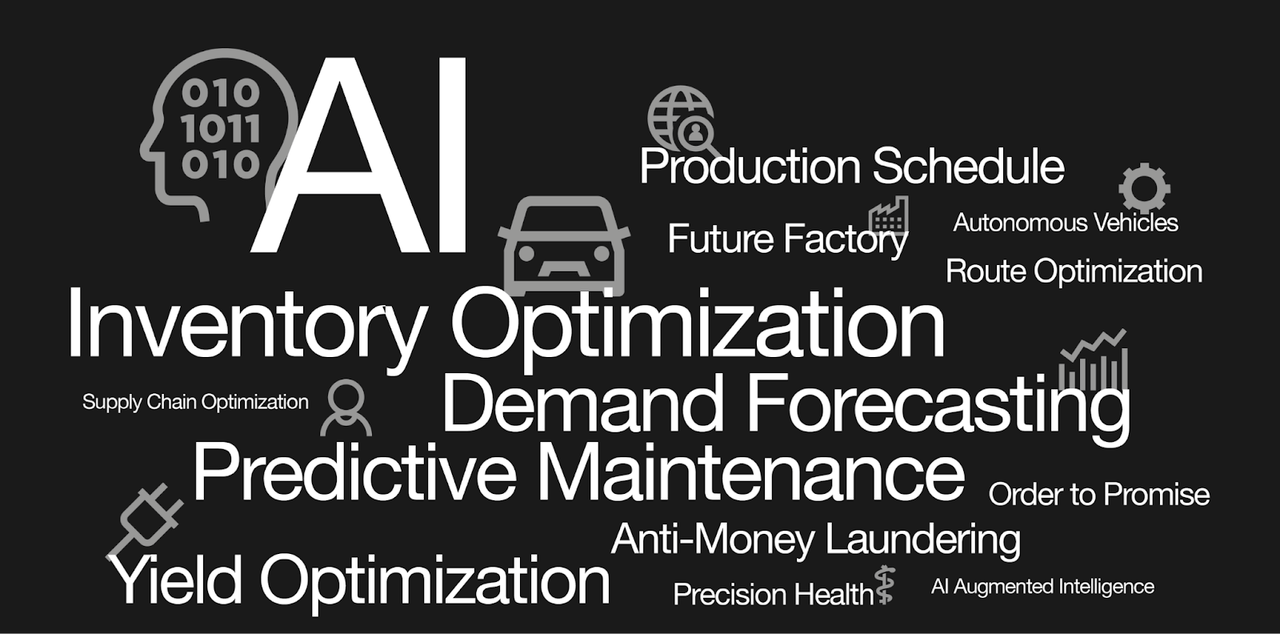

AI’s products help its customers with predictive modeling ranging from things like fraud detection to predicting which aircrafts need to be replaced.

FY22 Q4 Presentation

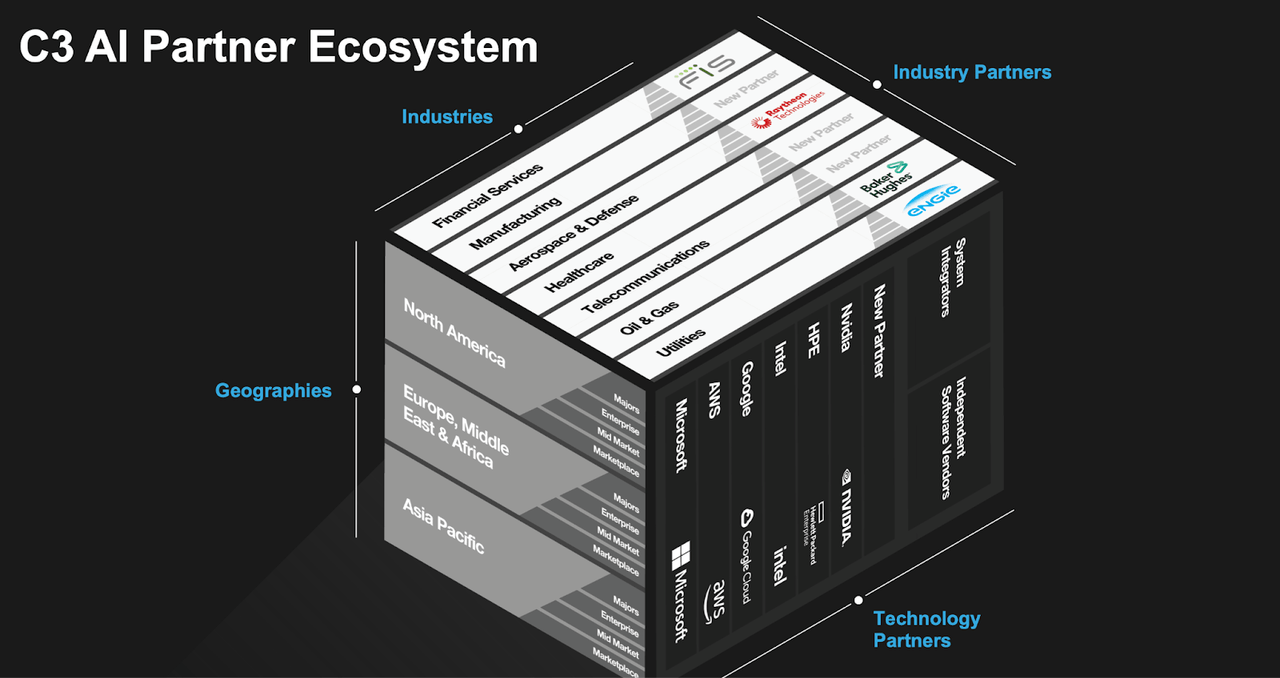

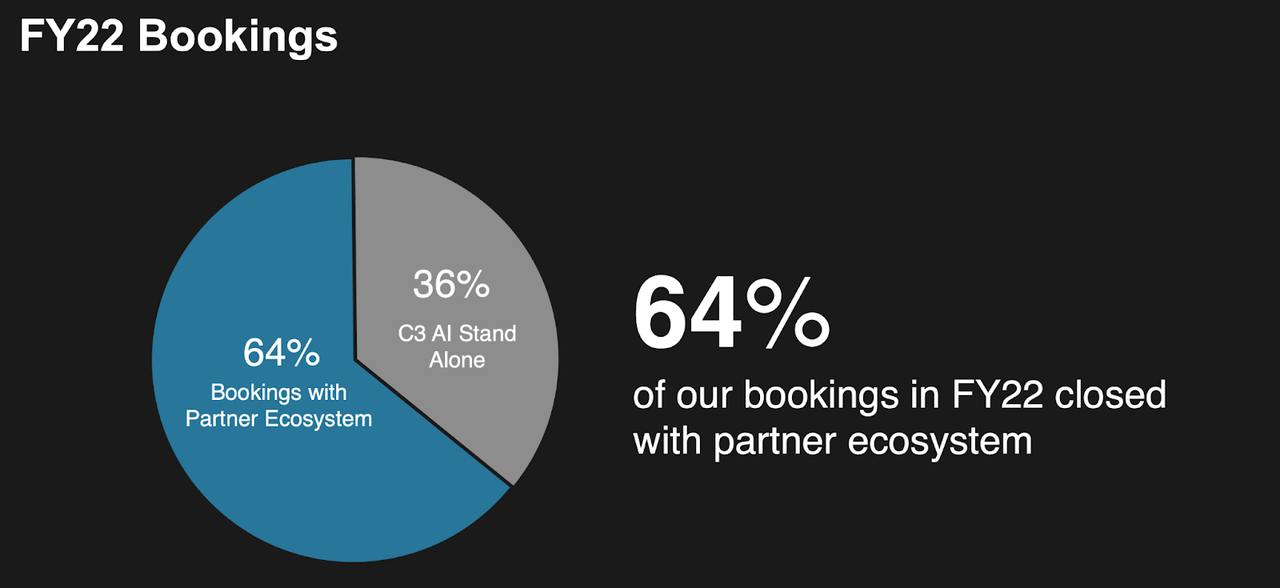

Artificial intelligence remains a nascent concept, and for that reason AI’s go-to-market strategy is quite unique. AI has partnered with industry partners who then re-sell industry-specific applications to their respective industries. The idea is that AI might not be able to create industry-specific products itself – but industry leaders could.

FY22 Q4 Presentation

Over 60% of their bookings in the last fiscal year came through their partner ecosystem.

FY22 Q4 Presentation

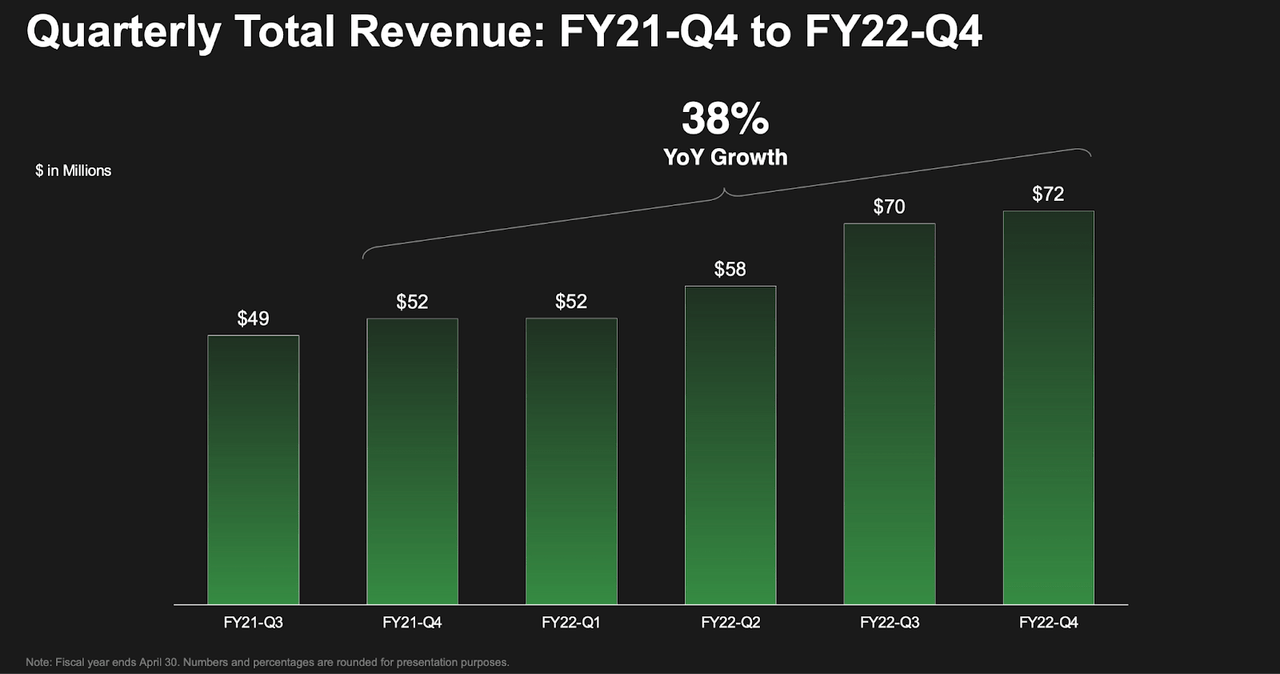

Revenues are likely to remain lumpy as AI continues to enter new industries, as it will take some time for the market to truly appreciate how much artificial intelligence can benefit their companies.

AI Stock Key Metrics

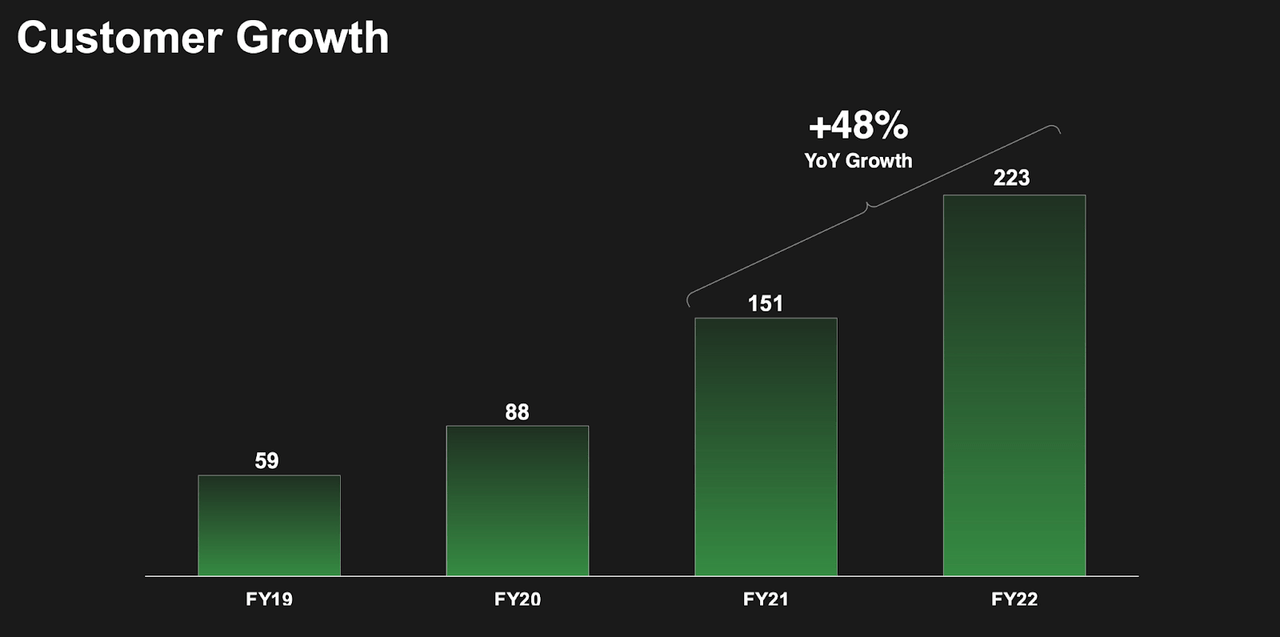

AI saw its customer count grow 48% year-over-year to 223.

FY22 Q4 Presentation

It grew revenue by 38% to $72 million. The greater customer growth may be a foreshadowing of accelerated growth in the future.

FY22 Q4 Presentation

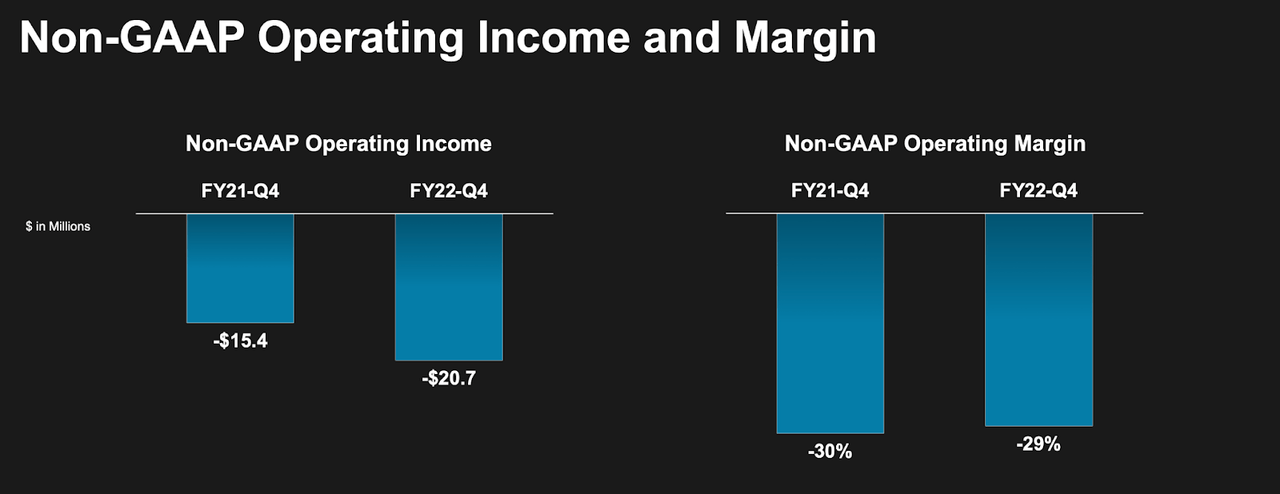

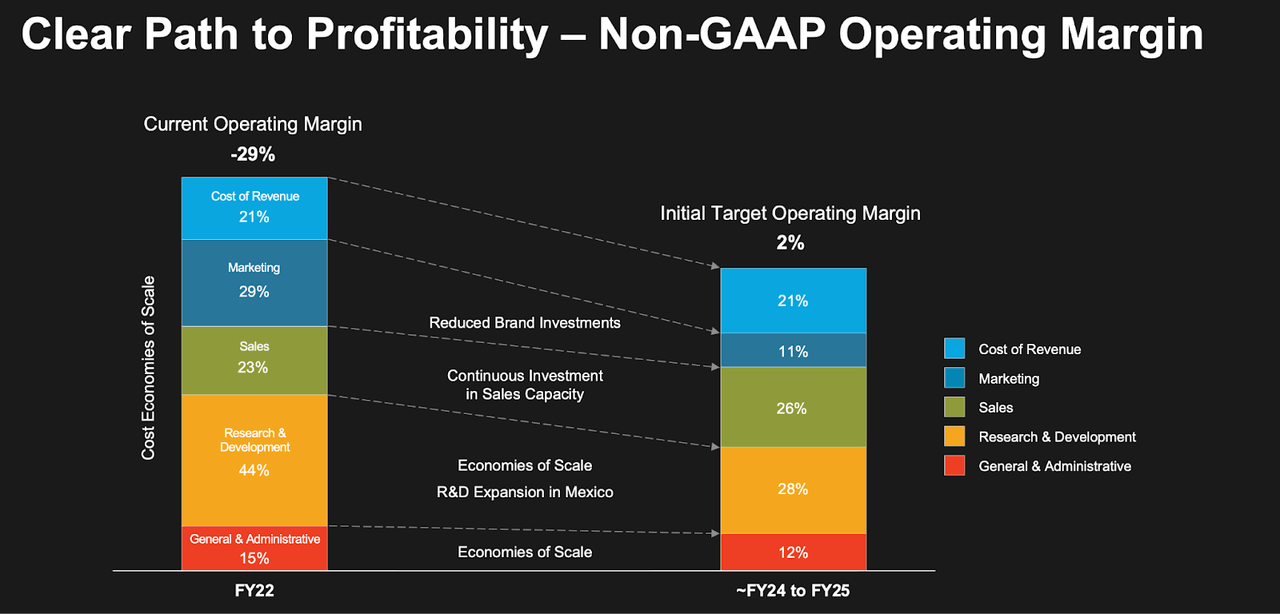

AI is still not yet profitable even on a non-GAAP basis, with its non-GAAP operating margin loss remaining steady at 29%.

FY22 Q4 Presentation

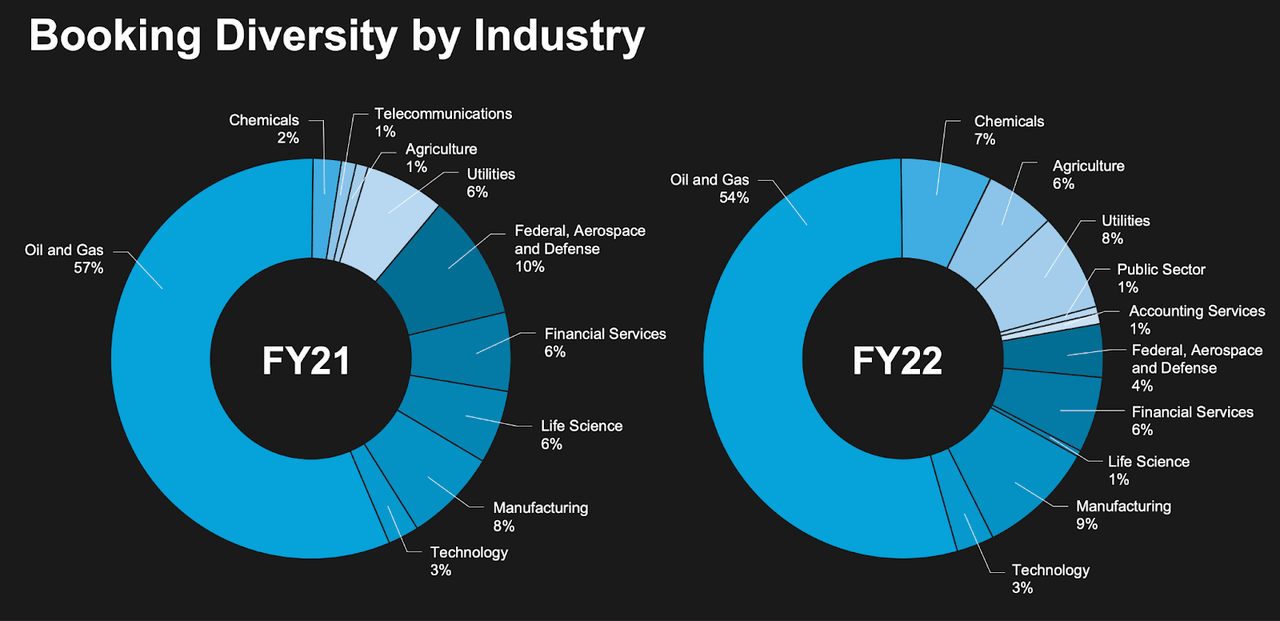

AI’s largest customer remains Baker Hughes (BKR) and this is reflected by the company’s 54% exposure to the oil and gas industry.

FY22 Q4 Presentation

I look forward to the company diversifying away from the energy sector over time, though it should be noted that the energy sector is doing quite well with the historically high energy prices. While it is not necessarily a base case, one should not underestimate the possibility that US energy companies enter a secular growth phase if the world calls upon them to make up for lost output from Russia. AI would be strongly positioned to capitalize on the subsequent growth investments in the energy sector, making AI a sneaky tech play in the energy sector.

AI repurchased 0.7 million shares for $15 million, making up around 0.7% of shares outstanding. The company had authorized a $100 million share repurchase program at the end of 2021. I question the decision to repurchase shares considering that the company remains unprofitable, but thus far the share repurchase program appears to be more conceptual than anything.

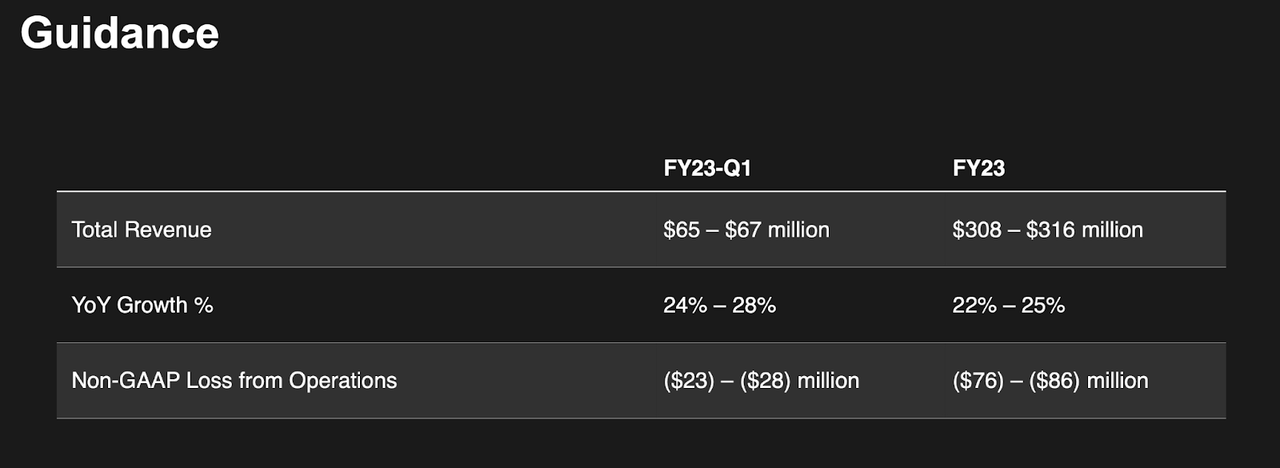

Looking forward, AI has guided for up to 28% revenue growth in the next quarter and up to 25% revenue growth for the full year.

FY22 Q4 Presentation

On the conference call, management stated the following with regards to guidance:

Under stable market conditions, I would guide to a 30% or greater growth rate for fiscal year 2023. With the current economic and political uncertainty, however, and pervasive market passivism, we are inclined to set the expectations by low.

Management also guided to 30% to 35% revenue growth over the long term – again assuming stable market conditions. AI expects to reach positive free cash flow within 8 to 12 quarters, guiding to a 2% non-GAAP operating margin by FY25.

FY22 Q4 Presentation

Is AI Stock A Buy, Sell, or Hold?

Amidst the ongoing tech crash, AI’s lack of operating profits may make it seem like there is no bottom in sight. The stock is now trading at less than 7x sales.

Seeking Alpha

AI ended the quarter with $992 million of cash, making up 50% of the current market cap. The company will undoubtedly consume much of that cash as it funds operating losses, but I note that its cash burn was less than $40 million last year – the current cash reserves should be more than enough to fund ongoing losses as well as share repurchases. For conservatism, we can ignore the net cash position. Assuming a 20% long term net margin and 1.5x price to earnings growth ratio (‘PEG ratio’), AI might trade at 9x sales by April 2025, representing a stock price of $43 per share, or 31% compounded returns over the next 3 years. Yet if AI can prove out its business model, then I could see the stock trading at a 2x to 2.5x PEG ratio due to the long term growth runway of artificial intelligence. On the other hand, it is not clear if AI is the highest quality operator in the artificial intelligence space – Palantir (PLTR) looks like a sizable competitor. While the artificial intelligence market should be very large, there is always the possibility that this becomes a “winner takes most” market. While the market has not been kind to unprofitable tech stocks, AI’s large cash position and modest cash burn profile reduces its financial risk. The more pressing risk is if growth rates do not materialize at the 30% long term profile implied by management, as growth will be needed to realize operating leverage and support a higher valuation. AI is one of the stocks purchased in the 2022 Tech Stock Crash List.

C3.ai Stock: 50% Net Cash, 7x Sales, AI Growth Story (NYSE:AI) & Latest News Update

C3.ai Stock: 50% Net Cash, 7x Sales, AI Growth Story (NYSE:AI) & More Live News

All this news that I have made and shared for you people, you will like it very much and in it we keep bringing topics for you people like every time so that you keep getting news information like trending topics and you It is our goal to be able to get

all kinds of news without going through us so that we can reach you the latest and best news for free so that you can move ahead further by getting the information of that news together with you. Later on, we will continue

to give information about more today world news update types of latest news through posts on our website so that you always keep moving forward in that news and whatever kind of information will be there, it will definitely be conveyed to you people.

C3.ai Stock: 50% Net Cash, 7x Sales, AI Growth Story (NYSE:AI) & More News Today

All this news that I have brought up to you or will be the most different and best news that you people are not going to get anywhere, along with the information Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this made available to all of you so that you are always connected with the news, stay ahead in the matter and keep getting today news all types of news for free till today so that you can get the news by getting it. Always take two steps forward

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links