Freelance journalist Tarric Brooker has authored an attention-grabbing article estimating how forecast interest rate rate rises would evaluate with Australia’s historic expertise.

Rather than analyzing uncooked interest rate will increase, Brooker has as an alternative calculated the proportion change in mortgage interest repayments from the trough to the height of the interest rate cycle.

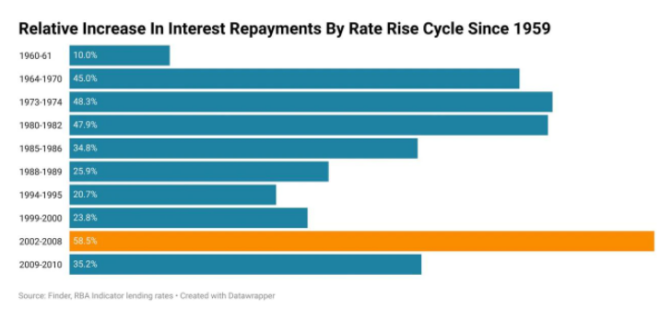

The evaluation exhibits that the 2002-2008 interest rate cycle is at the moment Australia’s largest, with mortgage interest repayments climbing 58.5% over that cycle:

2002 to 2008 holds the record for the most important rise in mortgage interest repayments.

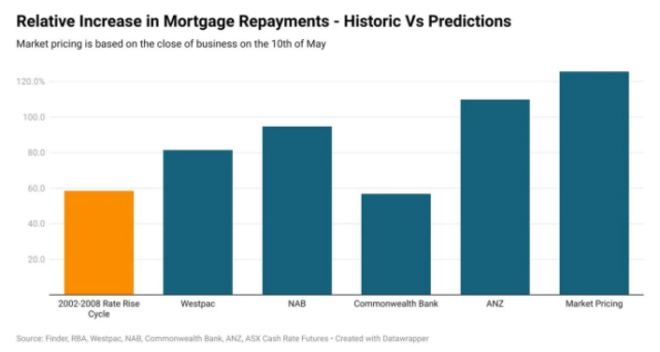

To estimate how the approaching cycle will evaluate, Brooker has measured the influence on mortgage interest repayments that might come up from the Big Four banks’ interest rate forecasts and the futures market, specifically:

- CBA: Cash rate to peak at 1.6%

- Westpac: Cash rate to peak at 2.25%

- NAB: Cash rate to peak at 2.6%

- ANZ: Cash rate to peak at 3%

- Futures Market: Cash rate to peak at 3.56%

According to Brooker, each interest rate forecast apart from the CBA’s would see Australian mortgage interest repayments rise by greater than they did in 2002-2008:

Most economists forecast a record rise in mortgage interest repayments.

CBA’s forecast rise within the money rate would barely undershoot the 2002-2008 rate cycle with a 56.8% enhance in common mortgage interest repayments. By distinction, the opposite forecasts would see mortgage interest repayments enhance by record quantities of between 80% (Westpac’s forecast) and 125% (future’s market forecast).

Tarric Brooker concludes with the next salient assertion:

Australians have by no means seen interest repayments on their mortgages rise a lot in a single rate rise cycle, making this a really unprecedented occasion ought to any of the large financial institution situations come to move excluding that of the Commonwealth Bank…

Ultimately, robust occasions could lay forward for mortgage holders…

I view the CBA’s interest rate forecast as probably the most lifelike for the easy purpose that Australians are so indebted and households will battle to deal with even a 1.6% rise in mortgage charges.

Anything larger dangers a home worth crash, a extreme discount in family consumption spending, and an pointless recession.

Leith van Onselen is Chief Economist on the MB Fund and MB Super. He can be Chief Economist and co-founder of MacroBusiness.

Leith has beforehand labored on the Australian Treasury, Victorian Treasury and Goldman Sachs.

YOU MAY ALSO BE INTERESTED IN

Australia’s housing market braces for record interest rate rise & More Latest News Update

Australia’s housing market braces for record interest rate rise & More Live News

All this information that I’ve made and shared for you folks, you’ll prefer it very a lot and in it we hold bringing matters for you folks like each time so that you simply hold getting information info like trending matters and also you It is our purpose to have the ability to get

every kind of stories with out going by way of us in order that we are able to attain you the newest and finest information for free to be able to transfer forward additional by getting the data of that information along with you. Later on, we’ll proceed

to provide details about extra today world news update varieties of newest information by way of posts on our web site so that you simply all the time hold shifting ahead in that information and no matter form of info might be there, it should undoubtedly be conveyed to you folks.

Australia’s housing market braces for record interest rate rise & More News Today

All this information that I’ve introduced as much as you or would be the most totally different and finest information that you simply individuals are not going to get anyplace, together with the data Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you may get different varieties of information alongside along with your nation and metropolis. You will be capable of get info associated to, in addition to it is possible for you to to get details about what’s going on round you thru us for free

to be able to make your self a educated by getting full details about your nation and state and details about information. Whatever is being given by way of us, I’ve tried to deliver it to you thru different web sites, which you’ll like

very a lot and should you like all this information, then undoubtedly round you. Along with the folks of India, hold sharing such information essential to your family members, let all of the information affect them they usually can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links