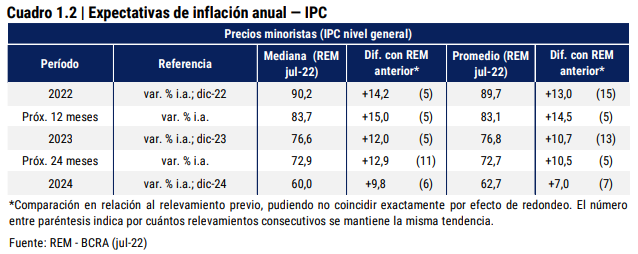

Inflation will reach 90.2% in 2022 According to economic analysts participating in the Survey of Market Expectations (REM) whose forecasts are compiled every month by the Central Bank. this projection implies a huge rise of 14.2 percentage points (pp) in relation to the previous month’s edition of the same survey.

The REM corrected upwards as well its inflation projections for 2023, taking it to 76.6% (12.0 pp more than the previous REM), and by 2024, placing it at 60.0% (9.8 pp higher than the previous survey).

The sharp jump in the projection in just one month is explained by the enormous number of political and financial events that occurred in that period. The former REM, which gave an inflation expectation of 76%was answered by the consultants between June 27 and 30, before the resignation of Martín Guzmán, therefore, it did not contemplate the impacts unleashed from that decision.

Since then, there has been a new political crisis in the Government, a sharp rise in all variants of the dollar (with the “free” one reaching 350 pesos), the ephemeral management of Silvina Batakis at the head of the Ministry of Economy and the arrival at that portfolio of Serge Massawith the absorption of those of Productive Development and Agriculture. This month’s forecast was made between July 27 and 29, so it already considers Massa’s appointment but not the announcement of the first known measures the day before yesterday.

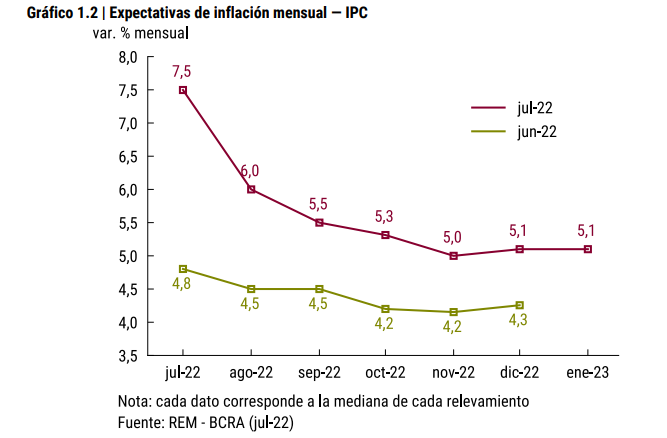

For the inflation of July, which the INDEC will publish next Thursday 11, analysts expect a rise of 7.5%, which would place it in the highest monthly index of the last 20 yearsabove the record of 6.7% registered in March and with a strong rebound after the figures for April, May and June, which stood at 6%, 5.1% and 5.3%, respectively.

The projection of 7.5% for July marks a sharp jump in relation to 4.8% that the consultants expected a month ago. For the following months, the consultants also raised their projections sharply. Are waiting 6% for August (versus 4.5% in last month’s survey)a 5.5% for September (4.5%), a 5.3% for October (4.2%), a 5% for November (4.2%) and a 5.1% for December (4.3%). For January 2023, the forecast of 5.1% is repeated.

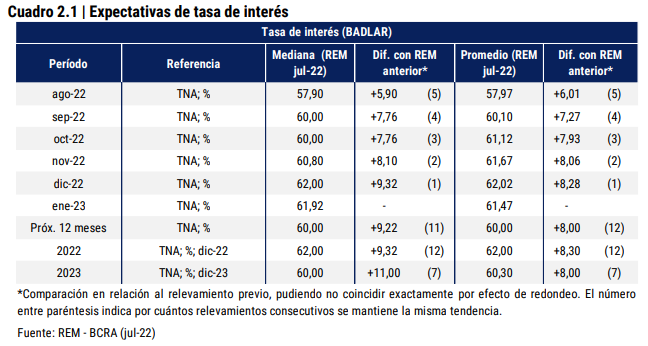

Analysts also increased your projection for the interest ratein line with the strong rise of 800 basis points (from 52% to 60%) that the Central Bank established for the monetary policy rate on July 28. The REM analyzes the Badlar rate, which is the rate paid by private banks for 30-day deposits greater than 1 million pesos. The average of that rate predicted by the consultants for August it is 57.9%, which would place it 683 basis points compared to the average for July (51.07%).

“Compared to the previous survey, there were upward corrections in the surveyed estimates which added between 590 and 932 basic points for all the monthly periods. A level of 62.00% is expected in the month of December 2022. For December 2023, the surveyed projection indicates a nominal annual rate (TNA) of 60%”, stated the BCRA report.

The bad news regarding inflation brought by these forecasts, which averaged the opinion of 39 consultants, think tanks and banks in Argentina, did not reach economic activity. The REM predicts a GDP increase of 3.4% for this year, 0.2 pp above the previous survey. And there the optimism ended. For 2023, on the other hand, the projection fell 0.3 pp to 1.5%. For 2024, analysts maintained their 2% growth forecast.

The GDP growth figures for this year, it should be remembered, have the statistical drag of the strong increase registered in 2021 of 10.3%, which impacts the current year.

The REM also expects that during the second quarter of this year the GDP will have increased by 0.5%, “implying a correction of the forecast of variation of the level of activity of 1.2 pp compared to the previous survey. For the second half of the year, on the other hand, there was a downward correction: “It is expected that during the third quarter of 2022 there will be a contraction of 1.4% se in the level of activity (implying a correction of -0.9 pp compared to the previous survey). The forecast for the fourth quarter of 2022 showed an expectation of -0.7% without seasonality (while a null variation was expected a month ago),” the report said.

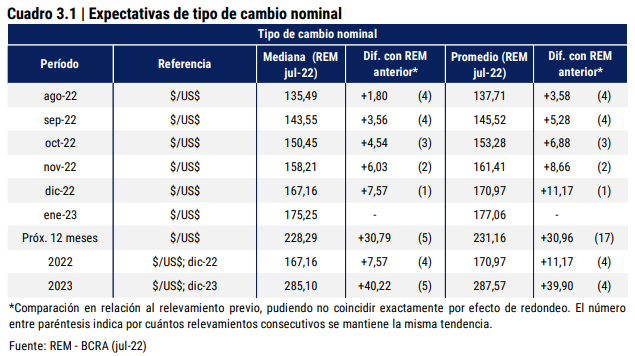

As for the wholesale dollar, the corrections were also upward. The consultants expect a rise of $7 per dollar for August to reach an average value of $135.49 per dollar for the month.

“Regarding the previous survey, upward corrections were evidenced in the following months. For its part, the analysts’ projection for December 2022 was $167.16 per dollar (+$7.57 per dollar compared to the previous survey). Thus, the nominal exchange rate variation forecast by REM participants is 64.1% for December 2022″, the report concluded.

KEEP READING: