hapabapa

With the Q2’22 earnings release, Advanced Micro Devices, Inc. (NASDAQ:AMD) finally provided a split-out of product lines to specifically detail data center revenues. Research firms had long detailed the estimated revenues for the different sectors, but now the market has a clear view of the data center growth and opportunity to take more market share. My investment thesis remains highly bullish due to the ability of AMD to see significant gains in both the data center space and the new embedded category acquired from Xilinx.

More Share Gains Ahead

While the media is focused on the potential monetary benefits to Intel (INTC) from the CHIPS Act, AMD is still poised to steal significant market share while the chip giant is busy building new fabs for the next few years. BoA analyst Vivek Arya sees Intel obtaining $10 to $15 billion in assistance from the U.S. bill alone, with Italy and other European countries lining up with handouts for other fabs.

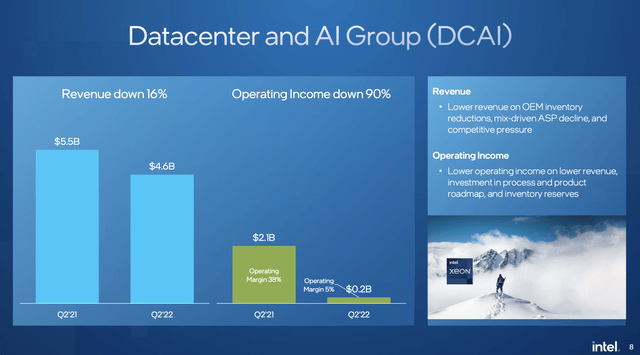

While the U.S. chip giant is building new fabs and trying to catch up to the chip manufacturing leadership of Taiwan Semiconductor Manufacturing Company Limited (TSM), AMD will be selling data center chips. According to the Q2’22 report, Intel still had a major market share lead in the data center space selling $4.6 billion worth of chips. The number was down from $5.5 billion in the prior Q2.

Intel Q2’22 Presentation

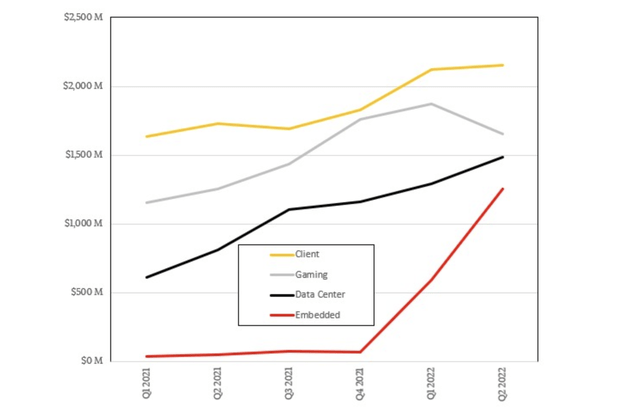

TheNextPlatform documented the new AMD breakout provided in this handy chart of the business segments. The company reported 83% growth in the Data Center segment to reach $1.5 billion in quarterly revenues. The embedded category is made nearly entirely of former Xilinx revenues and reached $1.3 billion.

TheNextPlatform

On just a revenue basis, AMD has a ~25% market share of the data center market, with Intel still controlling 75% of the market. Considering the trajectory of the 2 businesses, AMD controlling the market over the next couple of years appears likely. In such a scenario, the company would actually be the one reporting $4+ billion in quarterly data center revenues, with Intel lucky to maintain $1.5 billion per quarter. This amounts to a $10+ billion a year shift in revenues from this one category alone.

Even with the Client segment weak due to lower PC demand and the Gaming segment possibly stagnant with a forecast for 1% growth, AMD appears set to grow the Embedded division. The former Xilinx focused business appears to have been underinvested and was very supply constraint heading into the merger, providing a big boost to the business now under the better operations of AMD.

On the Q2’22 earnings call, CEO Lisa Su again confirmed AMD was supply constrained in parts of the business, oddly led by the embedded portfolio from Xilinx:

We are still a bit constrained in certain parts of the Xilinx portfolio, although we continue to make good progress. And I expect additional supply to come on, especially towards the latter part of the year and into 2023. Our view of the business, again, is I think the quality of the design wins, the quality of the overall diverse market is very strong, and so I think that as we are able to continue to relieve some of those supply constraints into the second half of the year, I think we will see a good growth trajectory for the business.

A lot of investors were concerned that the Xilinx business would slow the growth rate of the overall AMD, but the details now suggest Xilinx was reporting underwhelming growth due to supply constraints. The larger company has helped secure more capacity and orders, but AMD still can’t fulfill the demand.

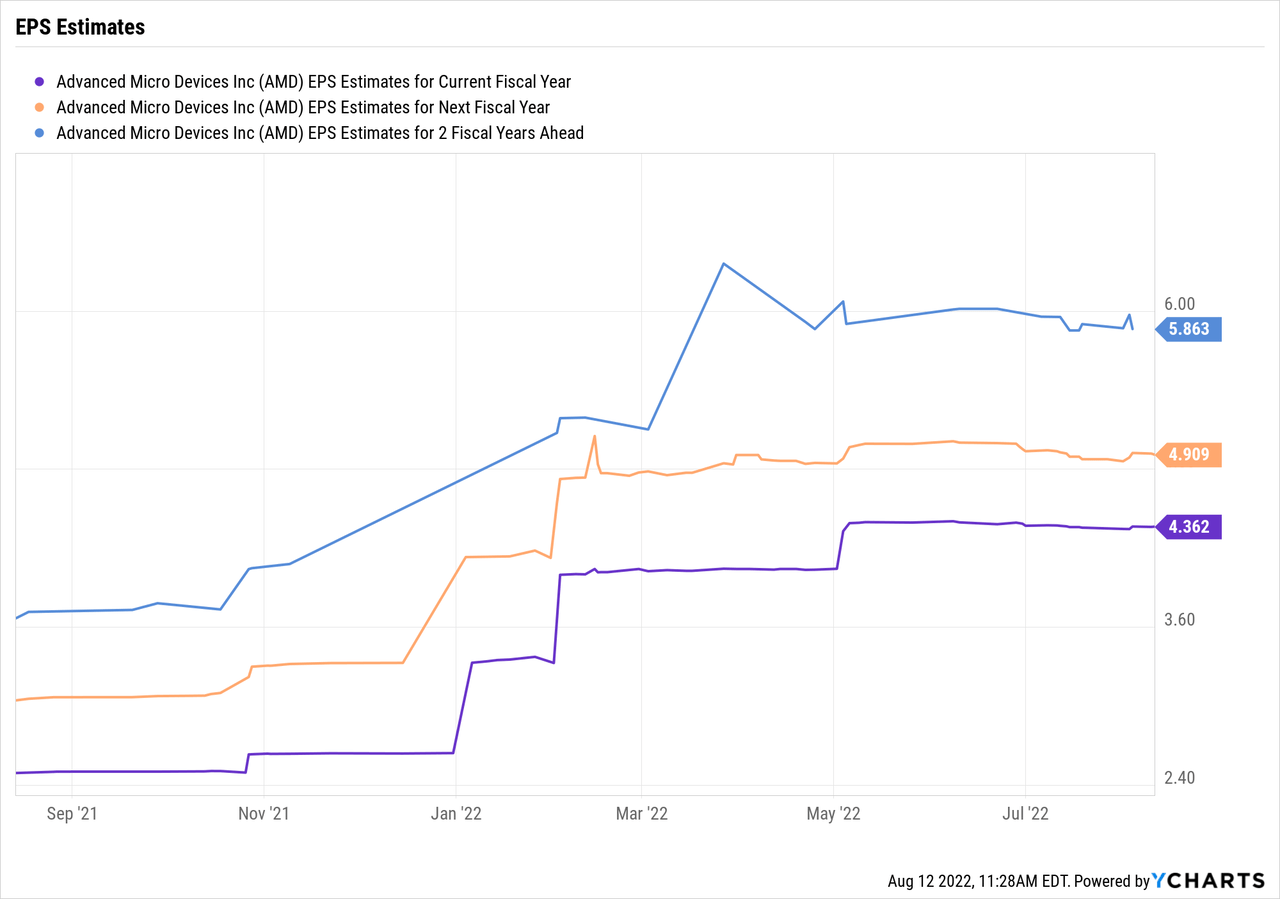

Cheap At $100

Somehow, the stock traded all the way down to $71 on fears of a slowdown in chip demand. Analysts only have earnings approaching $5 for 2023 placing AMD trading at a roughly 20x forward P/E multiple.

Our previous research has AMD on the path to a $6+ EPS next year. The major difference is the forecasts are for revenues to grow at a 20% clip next year to reach $32 billion while the consensus analyst estimates are estimating only 14% growth to reach almost $30 billion in 2023 revenues.

Note, pro forma revenues for the year are targeted at around $26.7 billion when adding the $450+ million in Xilinx revenues to the numbers from the period prior to the deal closing on February 14. Using this number, the analyst revenue target only amounts to 11% actual growth in the business.

Between the massive opportunity to just take market share from Intel in the Data Center space and the growth in the Embedded segment, AMD is likely to grow revenues from far in excess of only $3 billion next year. A 20% growth rate as the economy rebounds next year appears a far better base case for the business.

In such a scenario, AMD only trades at 16x EPS targets of $6+ for 2023 with the stock at $100. The stock could easily trade at double the forward P/E multiple with this growth rate. Besides, even analysts have 2024 EPS targets heading towards the $6 level providing support for AMD, if our more aggressive growth targets aren’t met in 2023.

Takeaway

The key investor takeaway is that AMD remains far too cheap here at $100. The company doesn’t even need macro growth to grow revenues at a 20% clip next year providing support for a much higher EPS target pushing the stock back to prior highs. AMD appears immune to a market slowdown due to market share gains.

AMD Stock: Market Immunity (NASDAQ:AMD) & Latest News Update

AMD Stock: Market Immunity (NASDAQ:AMD) & More Live News

All this news that I have made and shared for you people, you will like it very much and in it we keep bringing topics for you people like every time so that you keep getting news information like trending topics and you It is our goal to be able to get

all kinds of news without going through us so that we can reach you the latest and best news for free so that you can move ahead further by getting the information of that news together with you. Later on, we will continue

to give information about more today world news update types of latest news through posts on our website so that you always keep moving forward in that news and whatever kind of information will be there, it will definitely be conveyed to you people.

AMD Stock: Market Immunity (NASDAQ:AMD) & More News Today

All this news that I have brought up to you or will be the most different and best news that you people are not going to get anywhere, along with the information Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this made available to all of you so that you are always connected with the news, stay ahead in the matter and keep getting today news all types of news for free till today so that you can get the news by getting it. Always take two steps forward

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links