In line along with her “Smart Nation” initiative and its imaginative and prescient to be the regional ‘FinTech’ hub, Singapore has constantly inspired monetary innovation. While FinTech carries super potential to revolutionize the monetary business and alter lives for the higher, if left unchecked, it additionally poses actual dangers out there, and the dearth of complete regulation for this evolving market could lead to issues which have an effect on market integrity and shopper safety. As such, in encouraging FinTech revolution, Singapore additionally locations emphasis on mitigating dangers introduced by FinTech by way of regulatory reforms and institutional enhancements along with business gamers.

Further, the rise of FinTech has additionally resulted in appreciable change within the payment services panorama, presenting new dangers that come up from actions past the scope of the repealed legal guidelines(1) governing such services. This led to the enactment of the Payment Services Act 2019 (PSA), which got here into impact on 28 January 2020.

PSA was launched to streamline payment services below a single laws with the principle purpose of selling better confidence amongst customers and retailers to undertake digital funds. It addresses, amongst others, money-laundering and terrorism financing; lack of funds owed to customers or retailers; fragmentation and limitations to interoperability; and know-how and cyber danger administration necessities.(2)

In this text, we’ll set out the licensing framework below the PSA in addition to exploring the brand new developments within the payment services panorama in Singapore.

Regulated Services and Licenses

As talked about in our introductory article(3), PSA adopts an activity-based method in regulating seven kinds of payment services:

- Account issuance service: The service of issuing a payment account or service relating to any operation required for working a payment account(4).

- Domestic cash switch service: Provision of native funds switch service in Singapore.

- Cross-border cash switch service: Provision of outbound or inbound remittance service in Singapore.(5)

- Merchant acquisition service: The service of processing payment transactions from the service provider and processing payment receipts on behalf of the service provider(6).

- E-money issuance service: The service of issuing of e-money for the aim of permitting the person to make payment transactions, together with to pay retailers or switch to others(7).

- Digital payment token (DPT) service: The service of dealing in, or facilitating the alternate of, DPTs.

- Money-changing service: The service of shopping for or promoting international foreign money notes.

Accordingly, most suppliers of e-money and e-wallets might be regulated for account issuance, home cash switch and e-money issuance services. Merchant acquirers that course of payment transactions for retailers will fall below service provider acquisition service. Entities that purchase or promote DPTs (generally generally known as cryptocurrencies) or present a platform to enable customers to alternate DPTs are regulated below DPT service. As for moneychangers and remittance brokers, they’ll proceed to be regulated as money-changing service suppliers and cross-border payment service suppliers respectively.

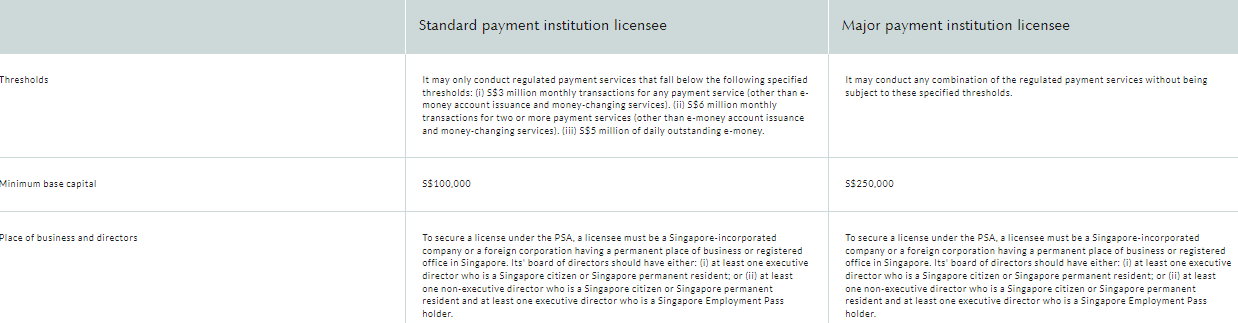

Payment service suppliers can conduct a number of payment services below one license. Depending on the kinds of services, a service supplier is required to maintain both a (1) money-changing license(8), (2) customary payment establishment license, or (3) main payment establishment license. In relation to payment establishments, the important thing eligibility standards are summarised as follows:

Every licensee below the PSA should additionally adhere to the continued compliance obligations, corresponding to audit, cyber hygiene and Anti-Money Laundering and Countering the Financing of Terrorism necessities set out below the notices and pointers issued by the Monetary Authority of Singapore (MAS) from time to time. A licensee can also be required to pay an annual license payment and the relevant charges(9) in respect of every sort of payment service (besides account issuance service) that it’s licensed to conduct.

One must also observe that licensees below the PSA are prohibited from participating in banking actions, corresponding to lending to people or sole proprietorships. Likewise, e-money issuers are prohibited from on-lending buyer cash or utilizing buyer cash to materially finance their enterprise actions; and e-wallet suppliers are prohibited from offering money withdrawal services.

What’s Next for PSA?

Payment services ecosystem is a fast-evolving panorama in Singapore and globally. The regulators in Singapore are at all times watching out for rising services and actions. In doing so, the regulators have been actively pursuing the goals of selling monetary improvements in addition to sustaining market integrity with measures to mitigate new dangers purchased by the event of FinTech.

One of the notable examples is the ‘buy now, pay later’ (BNPL) scheme, which has change into a brand new pattern within the e-commerce house. BNPL just isn’t regulated by below the PSA, and MAS has been relying on business self-regulation to handle the dangers for now. That stated, a code of conduct for the BNPL business might be launched quickly setting out the expectations required of BNPL suppliers.(10) Such code could doubtlessly require BNPL suppliers to present safeguards in opposition to ‘financial imprudence’ and over-indebtedness by customers, for cases, setting a minimal age of BNPL customers, a cap on the curiosity and late charges, and imposing a ‘freeze’ on making additional BNPL purchases as soon as customers miss a payment. MAS has not dominated out the necessity for regulation but and can maintain monitoring the event on this house.

MAS can also be actively finding out the stablecoins’ market. Stablecoins mix the credibility of fiat currencies with the benefits of the blockchain. However, stablecoins don’t fall below a selected class presently regulated by the PSA. Though MAS has indicated that normally stablecoins don’t meet the definition of “e-money” and it might meet the definition of DPT, MAS is presently taking a ‘technology-neutral’ stance and can study additional the traits of stablecoins.(11) As stablecoins are gaining reputation out there, we anticipate that MAS might be trying to roll out the brand new laws to regulate such modern merchandise.

Not all payment services are regulated below the PSA. MAS utilized a risk-based method to determine payment services that pose enough danger to warrant regulation. As such, it’s anticipated that extra laws and steering might be launched to regulate the payment services panorama in Singapore as and when the regulators deem crucial. As such, each licensee ought to maintain abreast of the regulatory adjustments to be certain that it’s offering payment services in compliance with the legal guidelines.

A quick guide to Singapore’s payment services ecosystem & More Latest News Update

A quick guide to Singapore’s payment services ecosystem & More Live News

All this information that I’ve made and shared for you individuals, you’ll prefer it very a lot and in it we maintain bringing matters for you individuals like each time so that you just maintain getting information data like trending matters and also you It is our purpose to have the ability to get

every kind of reports with out going by way of us in order that we will attain you the most recent and greatest information at no cost so that you could transfer forward additional by getting the data of that information along with you. Later on, we’ll proceed

to give details about extra today world news update kinds of newest information by way of posts on our web site so that you just at all times maintain transferring ahead in that information and no matter form of data might be there, it can undoubtedly be conveyed to you individuals.

A quick guide to Singapore’s payment services ecosystem & More News Today

All this information that I’ve introduced up to you or would be the most totally different and greatest information that you just individuals are not going to get wherever, together with the data Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you may get different kinds of information alongside together with your nation and metropolis. You might be ready to get data associated to, in addition to it is possible for you to to get details about what’s going on round you thru us at no cost

so that you could make your self a educated by getting full details about your nation and state and details about information. Whatever is being given by way of us, I’ve tried to carry it to you thru different web sites, which you will like

very a lot and when you like all this information, then undoubtedly round you. Along with the individuals of India, maintain sharing such information crucial to your family members, let all of the information affect them and so they can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links