Nordroden/iStock through Getty Images

Article Thesis

United States Steel Corporation (NYSE:X) has been very risky in current months. With shares buying and selling greater than 30% beneath current highs, let’s delve into the explanations for this sell-off. The macro image has worsened to a point, however United States Steel is extraordinarily low-cost at present costs. I do imagine that there’s a affordable likelihood that shares will recuperate a sizeable portion of the current decline within the coming months so long as the macro image doesn’t worsen dramatically.

Why Did United States Steel Stock Drop?

United States Steel is, like its friends, a macroeconomically delicate firm. Demand for metal is dependent upon the energy of the general economic system to a big diploma. During a recession, shoppers and companies purchase fewer automobiles and vehicles, which results in decrease metal demand by vehicle producers. During a recession, constructing exercise additionally slows down, which results in much less metal getting used for constructing houses, workplace buildings, and so forth. Other sectors that may be macroeconomically delicate are shipbuilding, infrastructure, and so forth. which require metal as effectively.

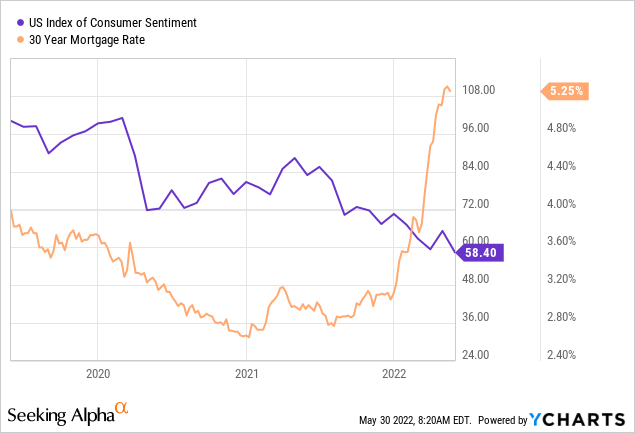

It is thus not too shocking, generally, to see metal shares pull again throughout instances when the financial outlook worsens. With a recession turning into extra possible within the US in line with many analysts from Wall Street corporations, and with shopper sentiment worsening, the dangers of an financial slowdown have appreciated within the current previous:

Due to excessive inflation, shopper sentiment is at present at a multi-year low — even decrease than in the course of the preliminary section of the pandemic round two years in the past. At the identical time, mortgage charges are at a multi-year excessive of greater than 5% for 30-year mounted mortgages. That implies that residence consumers have much less spending energy for discretionary objects, as their mortgages eat up extra of their earnings. This results in weaker spending on different objects, and in addition reduces homebuying exercise general. We have seen the primary indicators of weak point within the US housing market, and it’s affordable to imagine that this may finally end in considerably decrease metal demand from the trade.

Another issue to think about is that many US-based metal producers are at the least considerably depending on provides from both Russia or Ukraine, e.g. for pig iron. This has made buyers fear that provide chain issues, attributable to the present Russia-Ukraine battle, might harm the enterprise outlook for metal producers reminiscent of United States Steel Corporation.

There are thus a number of causes one can deliver as much as clarify the current drop in United States Steel’s worth, though it ought to be famous that this doesn’t but consider valuation. Even earlier than the autumn beneath $30, United States Steel was not priced for perfection in any respect — as a substitute, it already was priced for a giant downturn, buying and selling for lower than 4x web earnings on the current highs. Today, following the pullback now we have seen from the high-$30s to the mid-$20s, United States Steel is buying and selling for simply 2.3x ahead web earnings. Even although the enterprise outlook has worsened to a point, the current worth decline might thus be overdone, I imagine. The market did dump X based mostly on a considerably worsening outlook whereas not contemplating {that a} downturn was already priced into the corporate’s shares earlier than the sell-off.

X Stock Key Metrics

United States Steel Corporation reported its most up-to-date quarterly outcomes on April 28. The firm reported its best-ever first-quarter earnings, as earnings rose by 800% to virtually $900 million. Annualized, the corporate is incomes round $3.5 billion on the Q1 run charge. On a per-share foundation, United States Steel earned $3.05 in the course of the first quarter, which implies that the present share worth of $26.50 could be absolutely earned in lower than 9 quarters, or a bit of greater than two years.

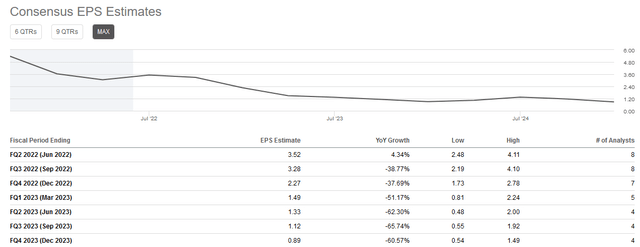

United States Steel additionally indicated that its second-quarter earnings could be sturdy as effectively. The firm foresees that its Q2 outcomes shall be its best-ever report for any second quarter in its historical past, indicating that the great instances haven’t ended for now. Of course, the hazard of an financial slowdown doesn’t have a right away affect, because it takes a while for the affect of fewer housing begins to work its manner by means of metal producers, for instance. We can thus say that ends in the very close to time period will nonetheless be very sturdy, though it seems like they won’t be maintained on the present stage endlessly. That can be mirrored within the analyst group’s estimates for United States Steel’s earnings per share over the subsequent couple of quarters:

Seeking Alpha

We see that earnings per share are forecasted to say no comparatively steadily over the subsequent couple of years. While Q2 and Q3 are forecasted to be very sturdy nonetheless, This fall and past will see significant deceleration versus the present run charge. However, buyers ought to word that that is by far not a catastrophe per se. In 2023, United States Steel is forecasted to earn $4.83 nonetheless — with a 7x earnings a number of, that may nonetheless permit for a inventory worth within the mid-$30s, for instance.

It can be essential to notice that present analyst estimates could possibly be too conservative. In July 2021, analysts have been forecasting that United States Steel would earn $4 per share in 2022. As it turned out, that was a manner too conservative estimate, as United States Steel has possible earned that quantity over the primary 4 months of the present yr already. Steel costs remained greater for an extended time frame, in comparison with what analysts had predicted. It is at the least attainable that the identical holds true going ahead, and that the affect of the financial slowdown is much less extreme in comparison with what analysts are modeling as we speak. In that case, X would possibly be capable of earn $5, $6, or $7 per share subsequent yr, as a substitute of what analysts are predicting as we speak — it could not be the primary time that analyst estimates have been too low.

United States Steel’s sturdy profitability in the course of the first quarter additionally resulted in sturdy free money era. Even once we account for capital expenditures, the corporate nonetheless generated surplus money flows of greater than $400 million in the course of the quarter, or about 6% of the corporate’s present market capitalization — 24% on an annualized foundation. Management said that this might permit the corporate to “meaningfully increase [their] direct returns to stockholders in the second quarter“. The dividend has not been hiked to date. Instead, it was maintained on the fairly low stage of $0.05 per share per quarter, which makes for a dividend yield of simply 0.8%. Due to the present relatively low valuation, United States Steel will possible concentrate on buybacks for now, which is feasible underneath its present $500 million buyback program that was introduced earlier this yr. It is value noting that the $400 million in free money move was attainable regardless of headwinds from working capital buildup, which signifies that free money era could possibly be even stronger over the subsequent couple of quarters when this pattern normalizes.

Can United States Steel Stock Rebound?

Based on the present very low valuation, the potential for better-than-expected earnings within the coming quarters — if the slowdown is extra benign than at present feared — and once we think about X’s potential to ramp up its buybacks significantly, I do imagine that United States Steel might certainly rebound to $30 and above. There isn’t any assure of that, nonetheless. Rather a lot is dependent upon the trajectory of metal costs, which is dependent upon a variety of things — how giant will the housing slowdown be? How a lot provide shall be misplaced as a result of present Russia-Ukraine battle? Will the federal government improve infrastructure spending?

A extra benign downturn might permit for nonetheless fairly sturdy earnings for United States Steel and its friends, which might possible end in upside potential for its shares. On the opposite hand, a harsher-than-expected downturn might result in a steeper drop in earnings, which makes a rebound in X’s inventory much less possible.

Is X Stock A Buy, Sell, Or Hold?

For these which might be bearish on the economic system, cyclical shares reminiscent of X are possible not an excellent purchase as we speak. On the opposite hand, United States Steel could possibly be a considerably dangerous and risky, however probably rewarding purchase for those who do imagine that the macro image for metal will stay stable going ahead, despite the fact that earnings will in all chance not stay on the present report ranges endlessly. But even when earnings drop by two-thirds from the present stage, X might have significant upside potential if metal costs and earnings stabilize at that stage. A $30+ share worth wouldn’t be demanding for a corporation incomes $4 per share per yr, which might be the case in that situation. Depending on one’s general view of the economic system and your threat tolerance, United States Steel might thus be a purchase or not.

Why Did United States Steel Stock Drop And Can It Rebound To $30? (NYSE:X) & More Latest News Update

Why Did United States Steel Stock Drop And Can It Rebound To $30? (NYSE:X) & More Live News

All this information that I’ve made and shared for you individuals, you’ll prefer it very a lot and in it we maintain bringing matters for you individuals like each time so that you just maintain getting information info like trending matters and also you It is our purpose to have the ability to get

every kind of stories with out going by means of us in order that we are able to attain you the most recent and greatest information totally free in an effort to transfer forward additional by getting the knowledge of that information along with you. Later on, we are going to proceed

to offer details about extra today world news update kinds of newest information by means of posts on our web site so that you just all the time maintain transferring ahead in that information and no matter form of info shall be there, it’ll positively be conveyed to you individuals.

Why Did United States Steel Stock Drop And Can It Rebound To $30? (NYSE:X) & More News Today

All this information that I’ve introduced as much as you or would be the most totally different and greatest information that you just individuals are not going to get wherever, together with the knowledge Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you may get different kinds of information alongside along with your nation and metropolis. You will be capable of get info associated to, in addition to it is possible for you to to get details about what’s going on round you thru us totally free

in an effort to make your self a educated by getting full details about your nation and state and details about information. Whatever is being given by means of us, I’ve tried to deliver it to you thru different web sites, which you will like

very a lot and when you like all this information, then positively round you. Along with the individuals of India, maintain sharing such information essential to your family members, let all of the information affect them and so they can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links