Black_Kira

It’s not treason if you win. ― Lisa Shearin, Bewitched & Betrayed

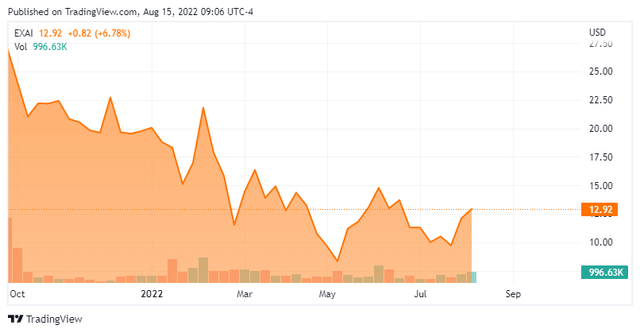

Today, we put Exscientia (NASDAQ:EXAI) in the spotlight for the first time. The developmental biotech concern has a fairly unique method of drug discovery and is headquartered across the pond. The shares came public less than a year ago but are not in ‘Busted IPO‘ territory. What lies ahead for Exscientia? An analysis follows below.

Seeking Alpha

Company Overview

Exscientia is located in Oxford in the United Kingdom. The company is focused on developing small molecule drug candidates. Exscientia’s AI developmental platform enables it to design candidate drug molecules, as well as to provide patients with drug therapies. The firms provides end-to-end solution of AI and technologies for target identification, drug candidate design, translational models, and patient selection. The stock currently trades under $13.00 a share and sport a market capitalization just under $1.6 billion.

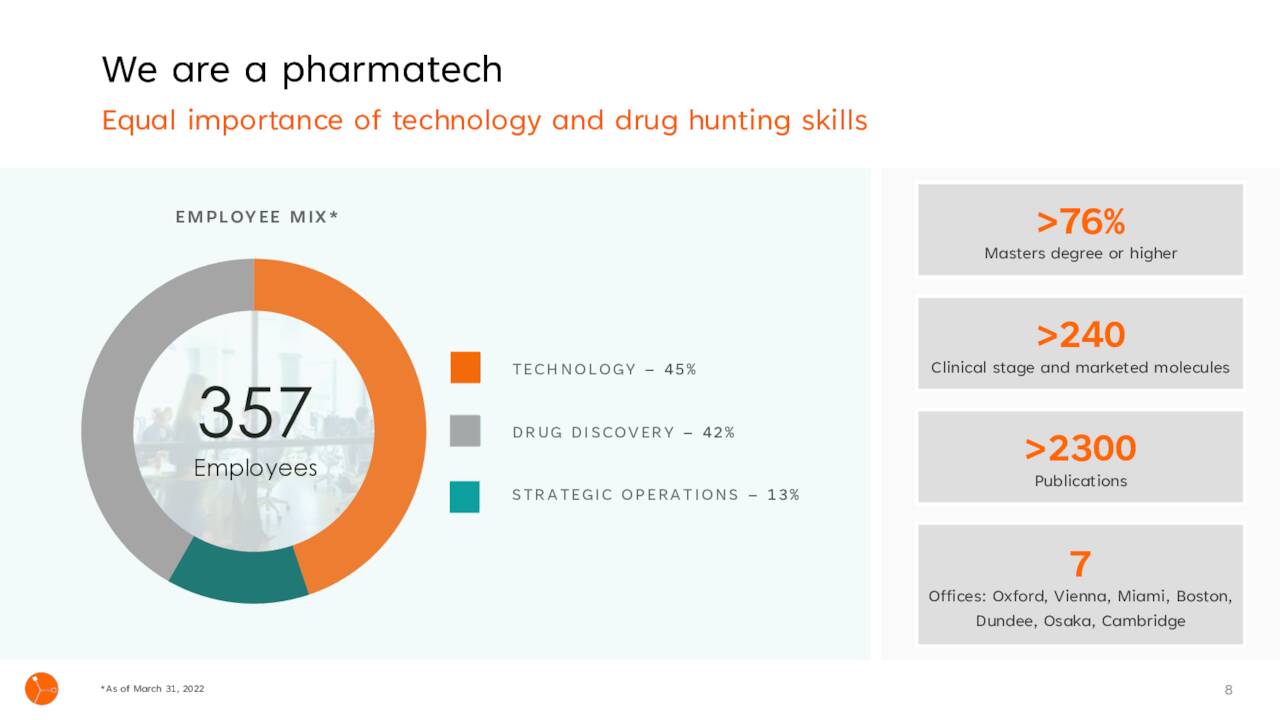

June Company Presentation

The company is bringing together a team of industry scientists and technologists which are looking to streamline the drug discovery process by extensively using AI to design and develop better molecules.

June Company Overview

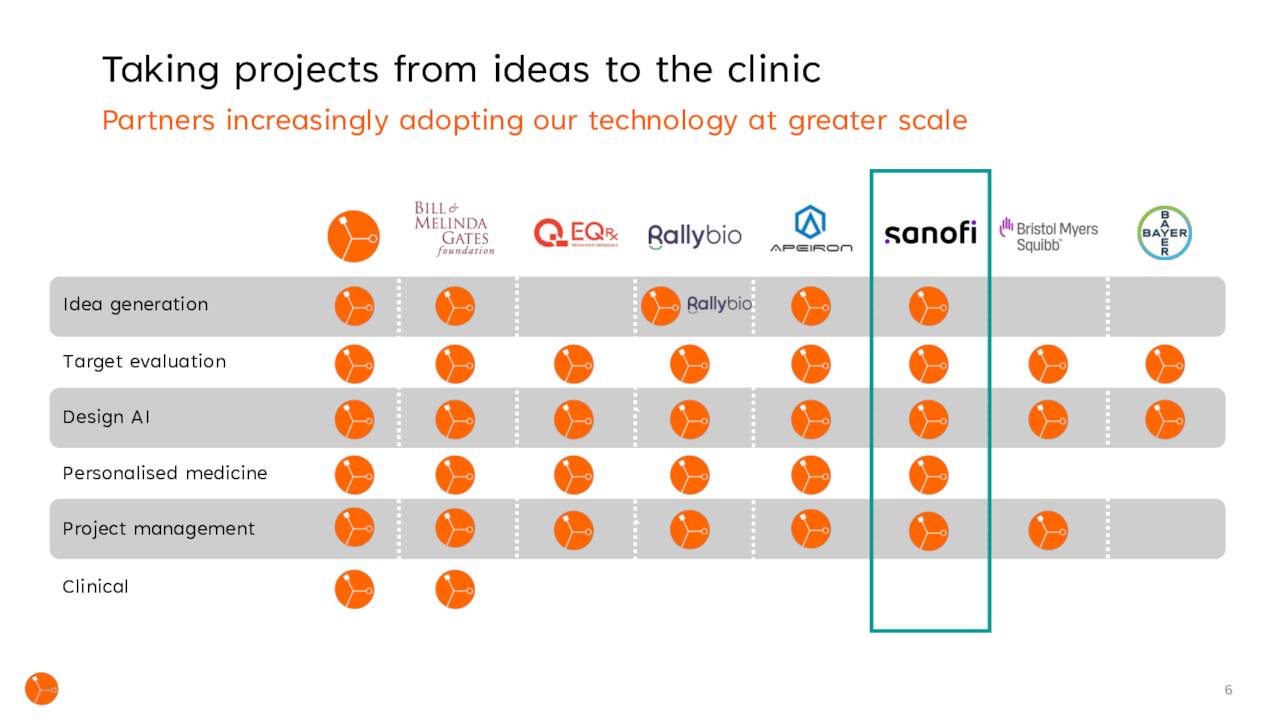

The company has numerous collaboration partners including Bristol-Myers Squibb Company (BMY), the Bill & Melinda Gates Foundation, and Sanofi (SNY), which came on board this year.

June Company Presentation

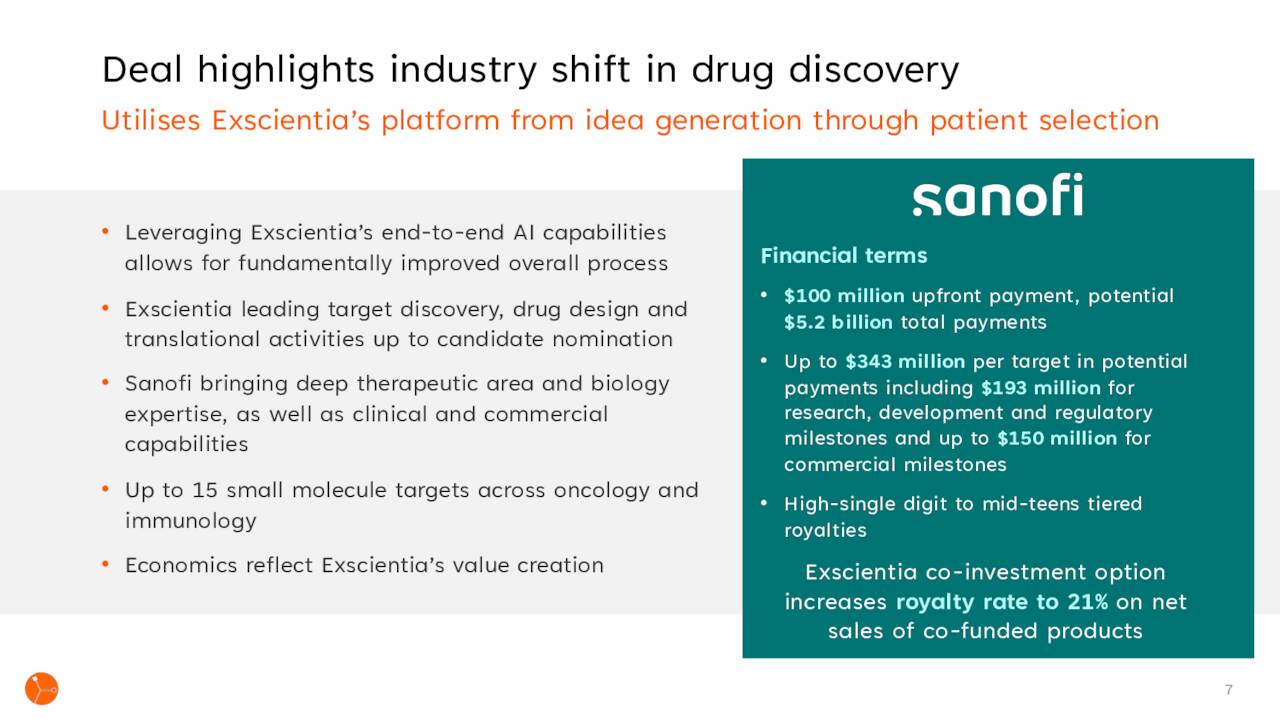

In fact, the new partnership with Sanofi is the biggest news around Exscientia so far in 2022. This agreement provides for the development of up to 15 novel small molecule candidates across oncology and immunology in early January.

June Company Presentation

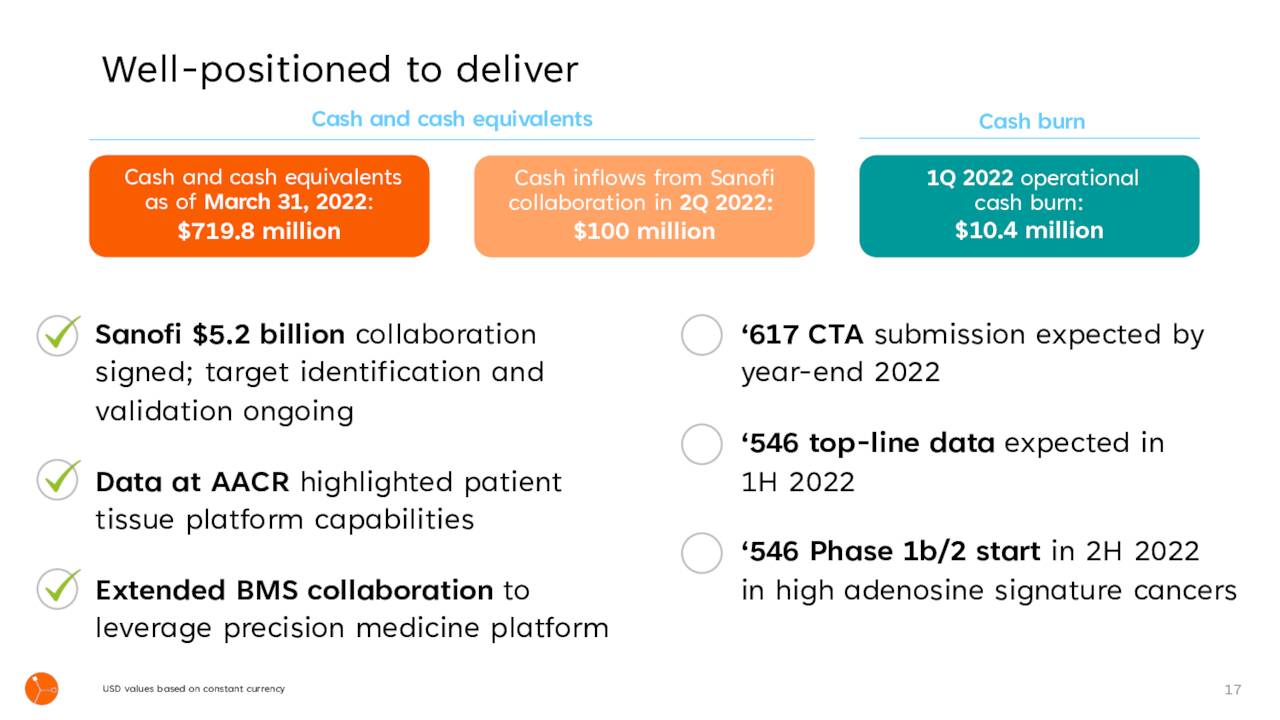

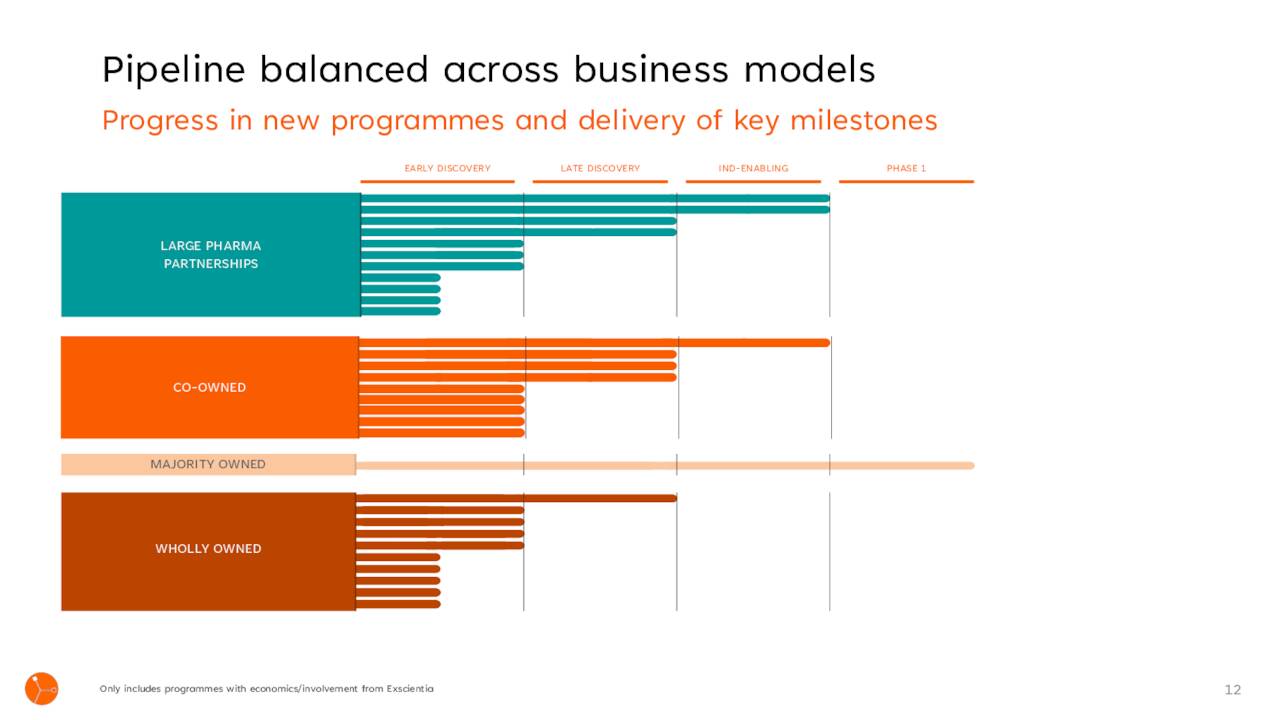

The deal provided a $100 million upfront payment to Exscientia which it recorded in April. The company can also earn up to $5.2 billion in additional milestone payments as well sales royalties in the high-single-digits to mid-teens. The agreement also provides an option for clinical co-investment by Exscientia to increase the royalty rate up to 21% on net sales of co-funded products. As can be seen below, this is one of many collaboration deals the company has in place.

June Company Presentation

Analyst Commentary & Balance Sheet

Despite a market cap north of one and a half billion dollars, the company gets little intention from Wall Street. Most likely because of an overseas domicile. On June 13th, Morgan Stanley maintained its Equal Weight rating on the stock and lowered its price target a buck a share to $20. A month prior, Goldman Sachs had reissued its Buy rating and $20 price target on EXAI. That is the only analyst ratings I can find on the stock so far in 2022.

June Company Overview

Just over two percent of the stock’s outstanding float is currently held short. The company ended the second quarter with nearly $720 million in cash and marketable securities after posting a GAAP net loss of -£0.41 a share in the quarter. The company only burned through a bit over $10 million in cash to fund all operations during the last quarter.

Verdict

The current analyst consensus has the company losing 90 cents a share on $69 million in revenue in FY2022. In FY2023, losses are expected to increase to nearly $1.50 a shares as revenues fall. It should be noted, that few firms have projections on Exscientia’s and there is a very wide range to earnings and revenue estimates. Given that all revenues in coming year will come from either developmental milestones within existing collaboration deals or upfront payments from new collaboration agreements, one can’t blame analyst firms for having a very difficult time modeling future revenue streams.

June Company Presentation

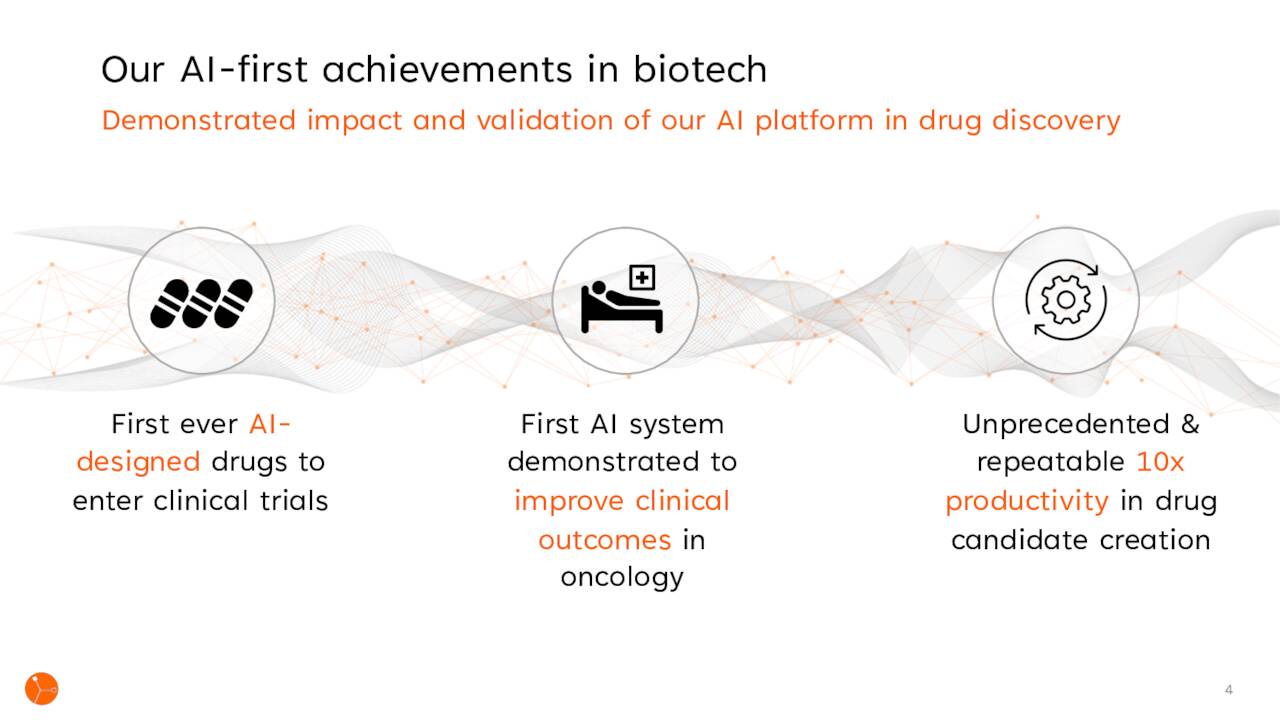

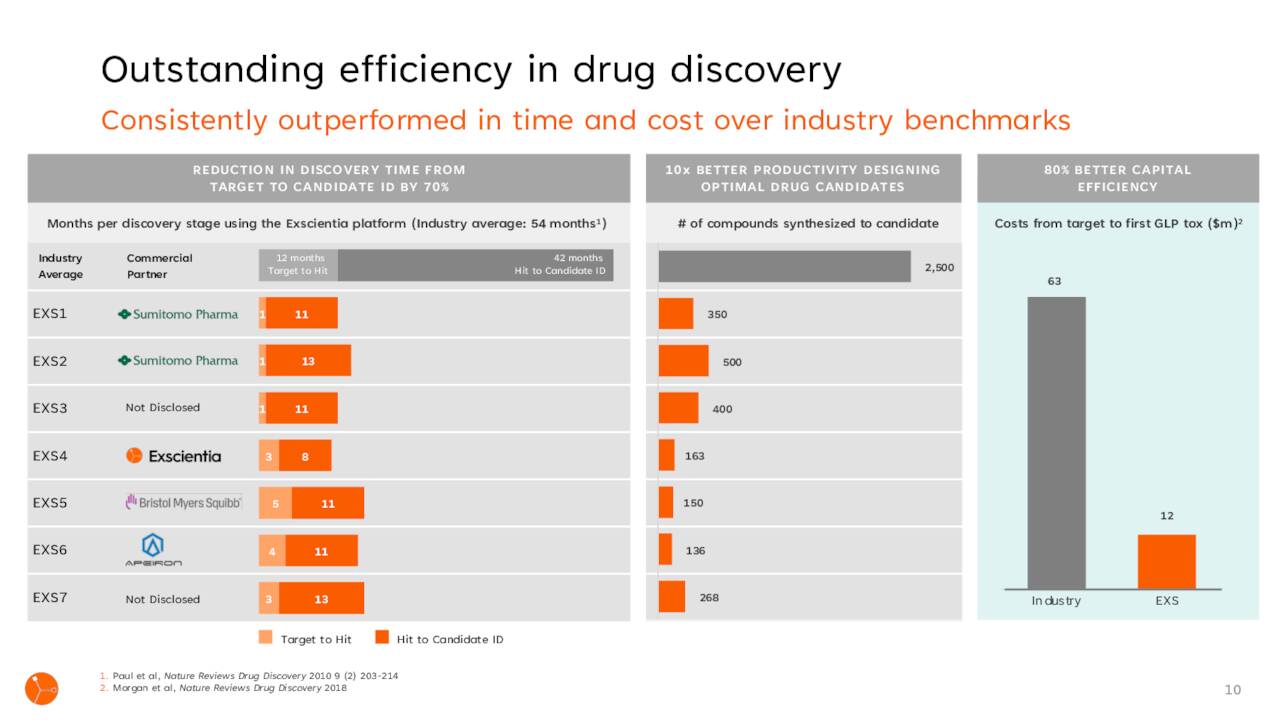

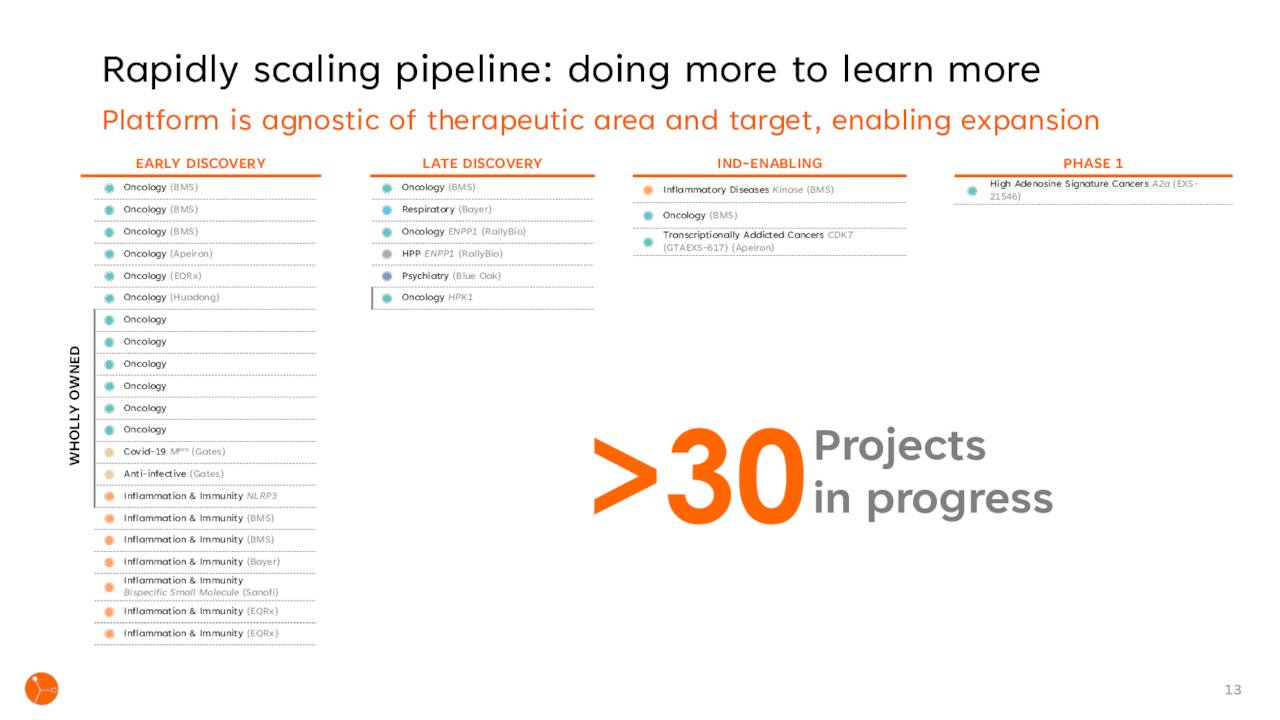

The company has made some good progress in showing that its AI enabled platform can more effectively identify promising early stage drug candidates. This is a key reason it has garnered an impressive list of collaboration partners.

June Company Presentation June Company Presentation

The problem as can be seen above is that while the company has a deep stable of potential drug candidates, all of its potential pipeline assets are in extremely early stage development. As such, the company is many, many years from potential commercialization. Until then, Exscientia will have to lean on its cash hoard and milestone payments to advance its pipeline on multiple fronts.

Therefore, EXAI is at best a ‘watch item’ position for very long term investors that want some exposure to AI development in the biotech space. That said, I look forward to circling back to this interesting story in 18 to 24 months to see how its pipeline is developing.

Treason is an easy word to speak. A traitor is one who fights and loses. Washington was a traitor to George III. ― Thomas Dixon Jr.

Exscientia: Using AI To Power Drug Development (NASDAQ:EXAI) & Latest News Update

Exscientia: Using AI To Power Drug Development (NASDAQ:EXAI) & More Live News

All this news that I have made and shared for you people, you will like it very much and in it we keep bringing topics for you people like every time so that you keep getting news information like trending topics and you It is our goal to be able to get

all kinds of news without going through us so that we can reach you the latest and best news for free so that you can move ahead further by getting the information of that news together with you. Later on, we will continue

to give information about more today world news update types of latest news through posts on our website so that you always keep moving forward in that news and whatever kind of information will be there, it will definitely be conveyed to you people.

Exscientia: Using AI To Power Drug Development (NASDAQ:EXAI) & More News Today

All this news that I have brought up to you or will be the most different and best news that you people are not going to get anywhere, along with the information Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this made available to all of you so that you are always connected with the news, stay ahead in the matter and keep getting today news all types of news for free till today so that you can get the news by getting it. Always take two steps forward

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links