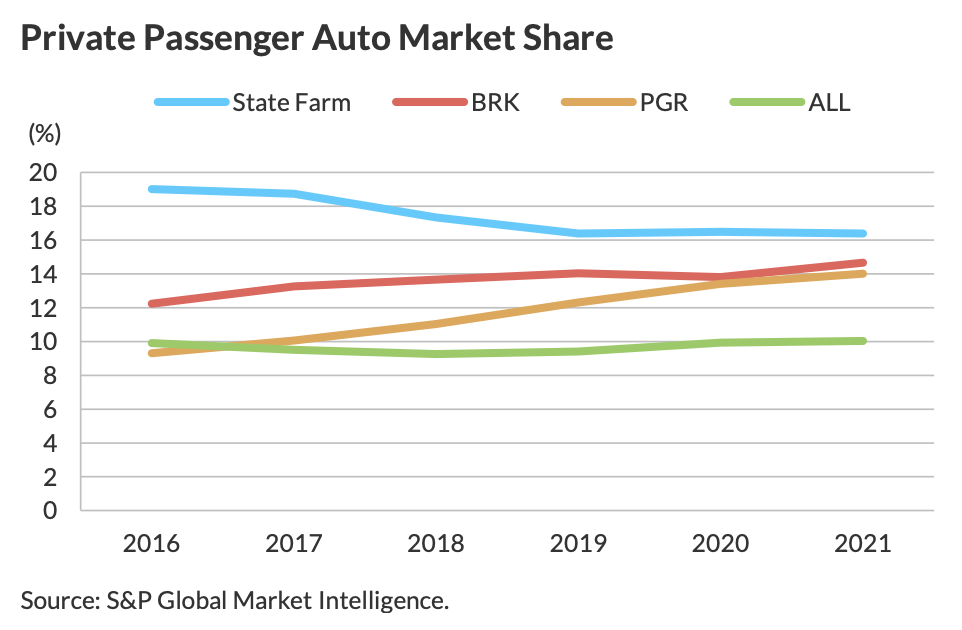

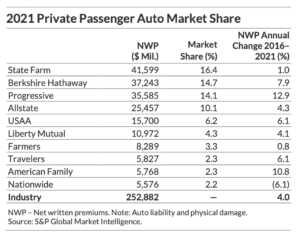

Personal auto insurance continues to move toward a “more concentrated” market, with the 10 largest carriers controlling 76% of the market at the end of 2021, Fitch Ratings said in its recently released “U.S. Personal Lines Market Update.”

State Farm, the largest auto insurer in the US, saw no growth in its premiums, paring its share of the market to 16.4% based on net written premiums. However, both GEICO and Progressive “expanded revenues faster than the overall market,” climbing to shares of 14.7% and 14.1%, respectively.

Given premium growth rates over the past three to five years, Fitch predicts that both GEICO and Progressive will pass State Farm in market share in 2023. “A larger question is which of these two companies will be the longer term market leader as [Progressive] recently reported faster auto growth,” the report, based on data from S&P Global Market Intelligence, said.

The report offered no analysis of the carriers’ changes in market share.

During an annual shareholders meeting in May, Ajit Jain, vice chairman of insurance operations for Berkshire Hathaway, GEICO’s parent company, noted that Progressive is far ahead of GEICO in using telematics.

“There’s no question that recently Progressive has done a much better job than GEICO … both in terms of margins and in terms of growth,” Jain said, according to an Investopedia article. “There are a number of causes for that, but I think the biggest culprit is as far as GEICO is concerned …is telematics.”

Forbes reports that Jain “expects to catch up with Progressive in a year or two.” And the Insurance Journal quoted Jain as saying, “Progressive has been on the telematics bandwagon for, I don’t know, more than 10 years, 20 years. GEICO until recently wasn’t involved in telematics. It’s been only the last two years that we made a very serious effort in terms of using telematics for segmentation and trying to match rate and risk.”

Auto insurers facing continued losses

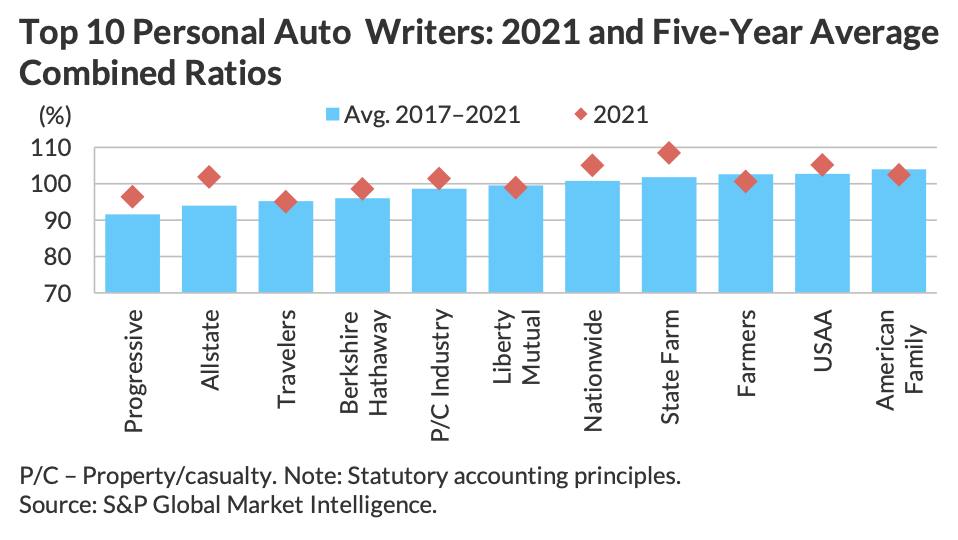

The combined ratio (CR), the number of dollars paid out in claims divided by the number of dollars of earned premium, for auto insurers deteriorated “sharply” to 101.4% in 2021, Fitch said.

In the pandemic year of 2020, stay-at-home orders significantly reduced the number of miles driven, leading to a CR of 92.5% for auto insurers, “the best result in at least 25 years,” the report said.

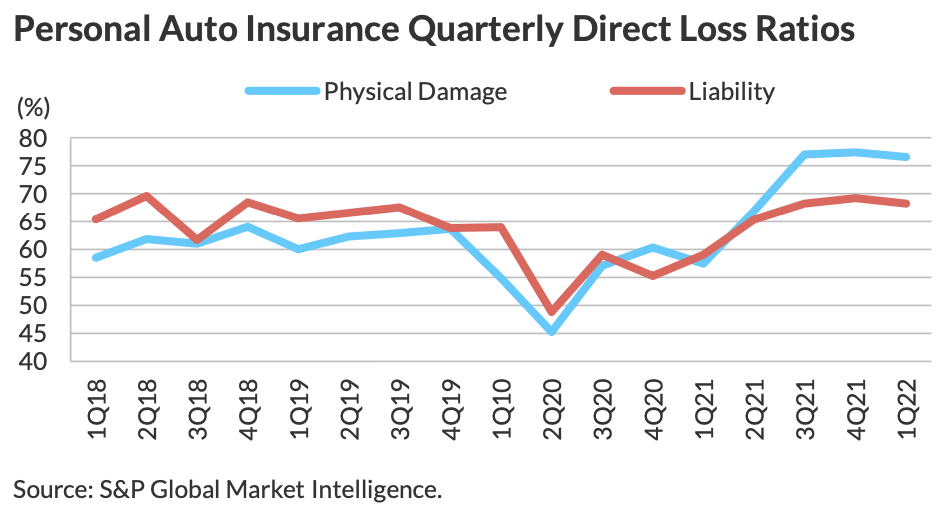

Since then, there has been a material escalation in claims severity from higher inflation and supply chain shortages, “particularly in physical damage coverage.”

“While 2021 results were anticipated to deteriorate as driving activity and claims frequency recovered toward historical norms from unusual pandemic-related experience, the segment CR increased more sharply by 9 points to over 101% for the year,” the report said.

According to Fitch, Progressive, GEICO, Liberty Mutual, and Travelers were the only auto insurers in the top 10 to post combined ratios lower than 100 last year.

According to Fitch, Progressive, GEICO, Liberty Mutual, and Travelers were the only auto insurers in the top 10 to post combined ratios lower than 100 last year.

Although carriers have moved to adjust pricing and underwriting, “improvement may be slow to materialize,” Fitch said. “Direct statutory loss ratios remain escalated in auto liability, but auto physical damage direct loss ratios were at a 20-year high of approximately 77% through the latest three quarters ending 1Q22.”

“Rates will need to move further in the near term to match loss-cost trends that are likely to remain above historical norms. Regulatory and political factors in several key states, including California, may inhibit a swifter return to pricing adequacy,” the report said.

Auto claims frequency has not fully returned to pre-pandemic levels, but severity moved “sharply higher” in bodily injury, collision and physical damage coverage, Fitch said. It said the causes were “higher inflation, supply chain issues, tighter labor markets and ongoing higher litigation costs.”

In particular, the physical damage segment, traditionally stable, showed “wider volatility,” with a CR spiking from 89% in 2020 to 104% in 2021 – “the segment’s worst result in 20 years.”

Trend toward IT, analytics

Advanced IT and analytics represent a way for carriers to boost operating efficiencies, enhance customer experience, and improve risk assessment and pricing, the study said.

Fitch argued that many consumers have become more accepting of telematics usage in auto insurance, giving carriers the potential for “more optimal, timely claims settlement.”

“The pandemic promoted greater virtual interaction between policyholders and insurers. Investments in technology provide ongoing opportunities for auto writers to gain operating efficiencies and improve underwriting and claims decision-making abilities,” the study said. “Information and scale advantages provide the largest auto insurers with the best chance to leverage these investments into growth and operating success.”

Fitch said that having access to “unstructured third-party data” to assess driving behavior can help carriers better differentiate risks and set prices accordingly. It noted that drivers’ acceptance of the use of telematics to assess driving behavior accelerated during the pandemic, giving carriers “an abundance of information” to use.

It also said that policyholders “gained comfort” with virtual interaction with carriers during the pandemic, although analysts, such as LexisNexis, have pointed out that consumers are frustrated by systems that do not meet their expectations.

More information

Berkshire chairman notes Progressive ahead of GEICO with telematics; GEICO sees Q1 underwriting loss

LexisNexis: Digital claims processes frustrate consumers; UBI adoption remains low

Images

Featured image: A State Farm office in Arizona. (Gregory Clifford/iStock)

Chart and graphs provided by Fitch Ratings

Share This:

Related

Market concentration in auto insurance increases; GEICO, Progressive projected to pass State Farm in 2023 & Latest News Update

Market concentration in auto insurance increases; GEICO, Progressive projected to pass State Farm in 2023 & More Live News

All this news that I have made and shared for you people, you will like it very much and in it we keep bringing topics for you people like every time so that you keep getting news information like trending topics and you It is our goal to be able to get

all kinds of news without going through us so that we can reach you the latest and best news for free so that you can move ahead further by getting the information of that news together with you. Later on, we will continue

to give information about more today world news update types of latest news through posts on our website so that you always keep moving forward in that news and whatever kind of information will be there, it will definitely be conveyed to you people.

Market concentration in auto insurance increases; GEICO, Progressive projected to pass State Farm in 2023 & More News Today

All this news that I have brought up to you or will be the most different and best news that you people are not going to get anywhere, along with the information Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this made available to all of you so that you are always connected with the news, stay ahead in the matter and keep getting today news all types of news for free till today so that you can get the news by getting it. Always take two steps forward

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links