Argentina has gross international reserves close to USD 37,000 million at your Central Bank. This amount is equivalent to just under 7% of GDPestimated at about USD 550,000 million -at the official exchange rate-, and almost nine months of imports.

However, a detailed analysis shows that the BCRA’s external assets are mostly made up of loans -such as the currency swap with China- and private deposits. If these are discounted, the net reserves are reduced to about USD 5,000 million, while the strictly liquid reserves are zero. These USD 5,000 million represent 1% of GDP and only cover one month of imports.

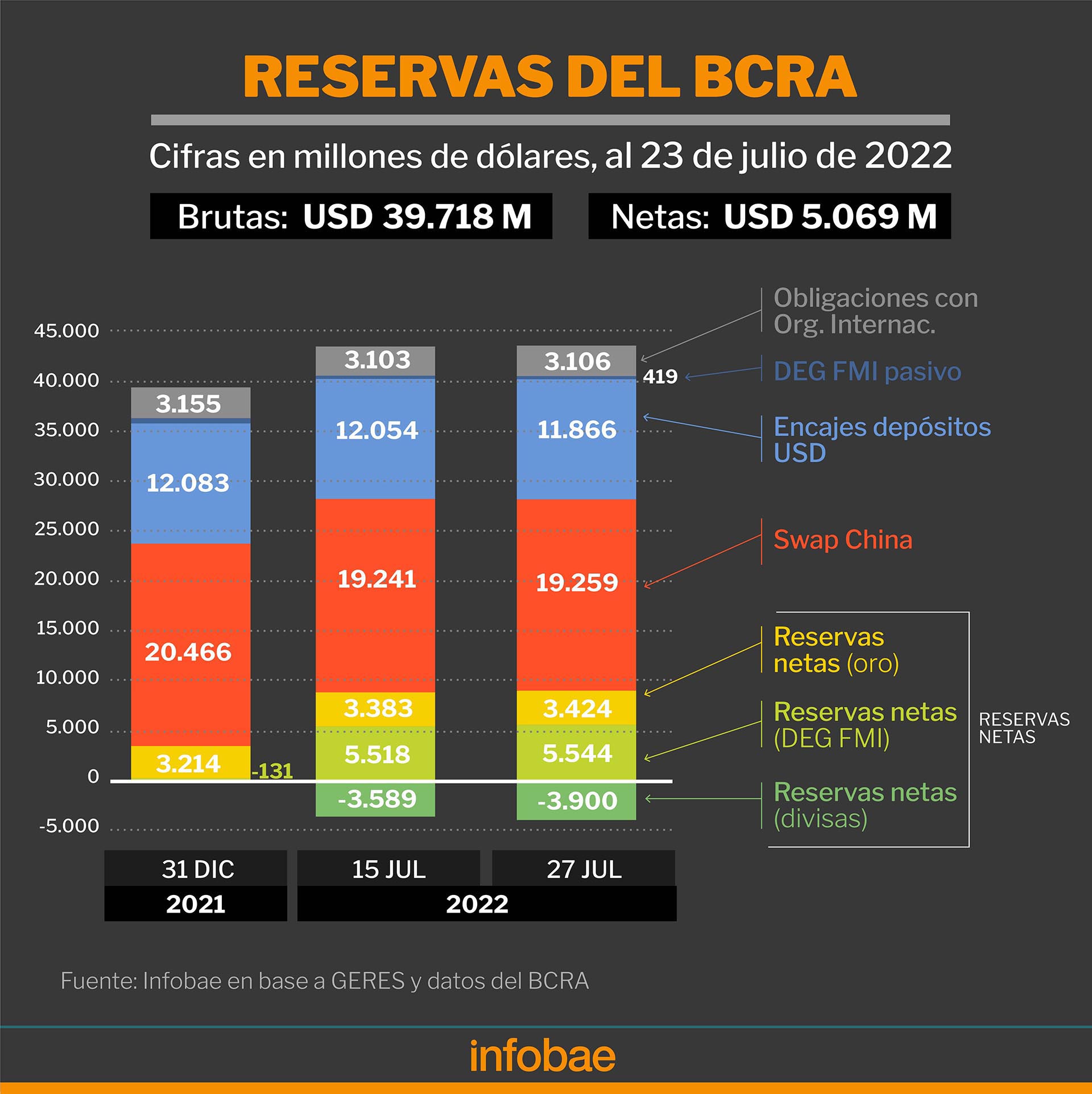

A report of Geres (Group of Studies of the Economic and Social Reality) highlights that according to the latest balance of the Central Bank, updated to July 23, total reserves reached USD 39,718 million, while net reserves accounted for about USD 5,069 million. This last item includes USD 3,424 million corresponding to gold and USD 5,544 million equivalent in SDRs (Special Drawing Rights) of the IMF. Without these contributions, the strictly liquid position falls into the negative zone at 3.9 billion dollars.

How do they fare in a regional comparison?

The gross international reserves of Brazil reach USD 353,169 million, which represent the 24.4% of GDP, estimated at $1.44 trillion. The foreign exchange position amounts to USD 306,127 million, 86.7% of the total.

In Chili they reach USD 45,810 million, of which 91.4%, about USD 41,880 million are foreign currency, the total is equivalent to 13.7% of the Chilean GDP, estimated at about 305,000 million dollars. In August 2021, Chile received SDRs (Special Drawing Rights) from the IMF for the equivalent of USD 2,371 million, which make up reserves.

In terms of GDP, the foreign exchange reserves of Brazil and Paraguay are three and a half times those of Argentina, and those of Colombia two and a half times and those of Chile double

In Colombia gross reserves reach USD 57,170 million and net reserves -without loans- reach USD 56,602 million. They mean the 18.2% of GDPestimated at about USD 314.320 million. According to the Banco de la República, “international reserves are external assets under the control of the monetary authorities, expressed mainly in foreign currency -foreign currency and foreign currency deposits and securities-, monetary gold, Special Drawing Rights (SDR), the IMF reserve position and other assets. For a foreign asset to be part of the international reserves, it is required that the authorities have direct and effective control over the asset, and available immediately in order to correct imbalances in the balance of payments”.

The Central Bank of Uruguay reports reserves for USD 16,290 million, of which, just under half, about USD 7,265 million, corresponds to the net position, that is, external assets without counterpart of the public and financial sectors.

The Central Bank of Paraguay realized that a balance of Net International Reserves of USD 8,459 million, which grows to USD 9,661 million if the holding of gold is added. According to data from Reuters, this amount represents almost eight months of imports. Also, equal to 23% of GDPestimated at about 41,935 million dollars.

The Central Reserve Bank of the Peru has gross international assets of USD 73,420 million, equivalent to 34% of the PBI, estimated at about USD 217,000 million; already 7 months of imports.

The Central Bank of bolivia informs its International Monetary Reserves, which reach some USD 4,753 million, equivalent to 12% of GDP and that “allow to cover six months of imports, above the traditional international metric to evaluate the minimum level of reserves in relation to imports established in three months, thus becoming an important support for the economy”, according to the entity. Of this amount, some USD 326 million correspond to 230 million IMF SDRs.

The rain of dollars that was around us did not touch us because we are a ‘flight’ country of capitals, because we have stocks (Abram)

If we add the holding of gold valued at USD 2,527 million, the Bolivia’s total international reserves amount to USD 6,752 million. The Bolivian Central Bank also explains that “it invested the International Reserves maintaining the criteria of security, liquidity and diversification, through investments of high credit quality, guaranteeing the adequate provision of foreign currency in the country.”

The exchange “stocks”, the greatest enemy

Why is it difficult for Argentina to accumulate reserves, while its neighbors in Latin America maintain both stability in the assets of their central banks and in their currencies and low inflation, particularly in terms of the size of the GDP and the ability to pay for imports?

One big difference is fiscal prudence. The strong red of Argentina’s public finances, financed with monetary issue, multiplies by six the domestic inflation rate with respect to the Latin American average. The second, and more obvious, is the Argentine capital control or “cepo”. The exchange regulation delays the value of the dollar with respect to inflation, which becomes a promotion of imports and a punishment of exports, with the consequent imbalance in the balance of payments and fall in reserves. A third distortion that hinders the entry of foreign currency comes from the side of foreign trade regulations -many items need to import to be able to export- and the withholdings that grind export income.

Aldo Abramdirector of the Fundación Libertad y Progreso, told Infobae that a strong monetary issue was carried out from the US starting in 2020 to contain an economy in recession due to the pandemic. “The (global) inflation is showing that there was a flood of hard currency, excess liquidity. That’s where you start to understand why. the rest of the world actually did not have a hard time maintaining reserves and even increased them, because when there is excess liquidity due to the issuance of the central banks of developed countries, the yields are negligible in safe countries. So that flow of funds goes to emerging countries basically, that they are riskier but give more return”.

In seven months of 2022, the BCRA bought in the market less than 10% of the foreign currency that it accumulated in the same period last year

“This made dollars ‘rain’ in all the economies of Latin America, in the emerging ones,” added Abram, who emphasized that this flow made the prices of Argentine exports rise, but “the rain of dollars that was around us did not touch us because we are a capital ‘flight’ country, because we have stocksthat to the extent that it is sustained over time leads to an increasing shortage of dollars. And on the other hand, the Government policies lead to an increasing flight of savings and investments of Argentines and foreigners.

“The root of the problem lies largely in the incentives faced by both exporters and importers. While the former are affected not only by the exchange rate differential but also by withholdingsthe latter take advantage of the subsidized dollar to advance purchases abroad, which is presented today as the best alternative to manage excess liquidity in the absence of investment instruments that offer real returns and do not represent a high exposure to sovereign or inflation risk”, he considered. Esteban Domecqfrom Invecq Consulting.

“The reality shows that continuing to apply patches in an economy that works on the basis of contradictory incentives only makes the problem worse”, said Domecq, for whom “the macroeconomic situation reveals the absence of a plan by the government, the non-compliance and shortcomings of the program with the IMF and the lack of effective responses by the new economic management”.

Despite having the best settlement of agriculture in Argentine history, the Central Bank has not managed to recover ground in the foreign exchange market (Consultatio Plus)

“Despite having the best agricultural liquidation in history Argentina, in the period from January to June the Central Bank fails to recover ground in the foreign exchange market: its accumulated intervention is located more than USD 6,000 million below last year and in July it had to sell USD 1,000 million”, they recorded from Consultation Plus.

“The crisis exacerbated a dynamic that was already worrying, but what is more alarming is that the picture going forward does not improve. If the current exchange policy is maintained -and with seasonality against it-, the BCRA is shaping up to end 2022 with negative net reserves and very far from the goal agreed with the IMF,” they added from Consultatio Plus.

“The balance weakness of the monetary authority approaches the levels that had triggered the 2018 crisis and precipitated a devaluation to strongly liquefy monetary liabilities. Of course, at that time, the macro context was different: there was no trapthe unified dollar was worth $124 at today’s prices and there were USD 30 billion net reserves in the coffers of the Central”, he evaluated Nery PersichiniHead of Research & Strategy at GMA Capital.

KEEP READING: