71% of parents really feel that Canada is becoming unaffordable as the associated fee of residing rises, survey says

Publishing date:

May 20, 2022 • 1 hour in the past • 4 minute learn • 7 Comments

Reviews and suggestions are unbiased and merchandise are independently chosen. Postmedia might earn an affiliate fee from purchases made by hyperlinks on this web page.

Article content material

Good morning!

Advertisement 2

This commercial has not loaded but, however your article continues beneath.

Article content material

Canada’s inflation price elevated 6.8 per cent in April from a yr earlier – one of the quickest because the early Nineteen Eighties – and parents are feeling the pinch.

As the associated fee of residing rises, a majority (71 per cent) of parents really feel that Canada is becoming unaffordable, based on a survey by PolicyMe, a digital life insurance coverage agency for parents.

The survey discovered that just about half (47 per cent) of parents are at the moment extra fearful about their private funds than in earlier years.

“Being a parent often means you are faced with added financial strain,” PolicyMe co-founder and CEO Andrew Ostro stated in a press launch. “With skyrocketing home prices and higher mortgage rates, today’s parents are faced with difficult decisions around homeownership; for many, the dream of homeownership is becoming a distant reality or a daily struggle.”

Advertisement 3

This commercial has not loaded but, however your article continues beneath.

Article content material

Most (63 per cent) Canadians with a mortgage are involved concerning the impact of surging rates of interest on their mortgage funds whereas over half (51 per cent) of renting parents usually are not planning on shopping for a house within the subsequent 5 years.

Meanwhile, 88 per cent of the remaining 49 per cent who wish to buy a house within the subsequent 4 to 5 years are going through vital monetary boundaries, reminiscent of problem saving for a down fee or restricted reasonably priced choices in the marketplace.

Overall, a quarter of Canadians imagine that homeownership being unaffordable for middle- and lower-income households is essentially the most vital financial-social difficulty within the nation right this moment.

Homeowners at the moment spend a mean of 27 per cent of their month-to-month family revenue on their mortgage fee. That will increase to a mean of 37 per cent for renters.

Advertisement 4

This commercial has not loaded but, however your article continues beneath.

Article content material

The survey discovered that a majority (70 per cent) of Canadians would have an emergency fund of six months or much less to show to in the event that they misplaced their primary supply of revenue – with one in three Canadians having just one month or much less.

Ostro stated having life insurance coverage is one of one of the best methods to make sure households will have the ability to make mortgage or rental funds nicely into the long run.

“Whether you’re a parent who is renting or a parent who owns a home, life insurance is one of the most affordable financial tools at your disposal to ensure peace of mind and a stronger financial cushion in case of the passing of an income-earning parent,” stated Ostro.

A separate PolicyMe research discovered that many Canadians rely solely on employer-provided insurance coverage, which is usually not sufficient to cowl hire or mortgage funds in the long run. That’s why Ostro believes re-evaluating life insurance coverage premiums is key.

Advertisement 5

This commercial has not loaded but, however your article continues beneath.

Article content material

“With the cost of living rising quickly, we recommend taking the time to look at how much life insurance you have and make a decision if you need to increase it to match your current financial situation,” Ostro stated. “If you don’t have life insurance, but you’re a parent with dependent children, now is certainly the right time to look into it.”

Posthaste will return May 24 after the vacation.

_____________________________________________________________

Was this article forwarded to you? Sign up right here to get it delivered to your inbox.

_____________________________________________________________

HARVEST OPTIMISM GROWS Canadian National Railway Co. is bracing for a surge in grain shipments throughout the nation this yr — a signal of hope that this yr’s harvest might be higher than the final one, when excessive drought devastated crops throughout the Prairies, writes the Financial Post’s Jake Edmiston. “Every kernel that’s harvested this year is going to want to move,” Canadian National Railway Co.’s new CEO Tracy Robinson advised the Bank of America’s transportation convention on May 17. “We need to be ready for that.” Read on for the total story. Photo by The Canadian Press/AP/Charlie Riedel

Advertisement 6

This commercial has not loaded but, however your article continues beneath.

Article content material

___________________________________________________

- G7 finance ministers and central financial institution governors assembly ends. Deputy Prime Minister Chrystia Freeland will maintain a media teleconference from Munich, Germany

- Today’s information: Monthly credit score aggregates, U.S. quarterly companies survey

- Earnings: Aecon Group Inc., Silver Bear Resources Inc., Heritage Cannabis Holdings Corp.

___________________________________________________

_______________________________________________________

Advertisement 7

This commercial has not loaded but, however your article continues beneath.

Article content material

___________________________________________________

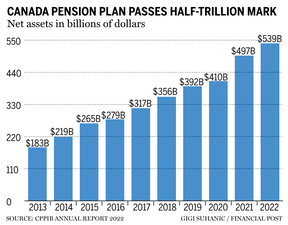

The Canada Pension Plan Investment Board crossed the half-trillion threshold in its most up-to-date fiscal yr, reaching $539-billion in property as of March 31, writes the Financial Post’s Barbara Shecter. The web return for the yr was 6.8 per cent on final yr’s $497-billion, with $8-billion of the $42-billion enhance coming within the type of web transfers from the Canada Pension Plan. The CPP fund’s five-year return is 10 per cent, with the 10-year return coming in at 10.8 per cent. Read on for the total story.

____________________________________________________

The market doesn’t appear capable of finding a backside. The S&P 500 has fallen about 16 per cent yr so far, whereas the tech-centric Nasdaq is down 26 per cent over the identical timeframe. But CNBC’s Jim Cramer sees a lot of alternative amid the market downturn. In reality, the Mad Money host just lately revealed two shares that he needs to purchase proper now. Our content material associate MoneySmart takes a fast take a look at each of them.

____________________________________________________

Today’s Posthaste was written by Noella Ovid, with further reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story thought, pitch, embargoed report, or a suggestion for this article? Email us at [email protected], or hit reply to ship us a observe.

Listen to Down to Business for in-depth discussions and insights into the newest in Canadian enterprise, accessible wherever you get your podcasts. Check out the newest episode beneath:

Share this text in your social community

Advertisement

This commercial has not loaded but, however your article continues beneath.

Financial Post Top Stories

Sign as much as obtain the day by day prime tales from the Financial Post, a division of Postmedia Network Inc.

Thanks for signing up!

A welcome e mail is on its approach. If you do not see it, please test your junk folder.

The subsequent difficulty of Financial Post Top Stories will quickly be in your inbox.

We encountered a difficulty signing you up. Please strive once more

Posthaste: Canada is becoming unaffordable for a majority of parents & More Latest News Update

Posthaste: Canada is becoming unaffordable for a majority of parents & More Live News

All this information that I’ve made and shared for you individuals, you’ll prefer it very a lot and in it we maintain bringing matters for you individuals like each time so that you just maintain getting information data like trending matters and also you It is our objective to have the ability to get

all types of information with out going by us in order that we will attain you the newest and greatest information for free as a way to transfer forward additional by getting the data of that information along with you. Later on, we are going to proceed

to present details about extra today world news update sorts of newest information by posts on our web site so that you just all the time maintain transferring ahead in that information and no matter sort of data might be there, it should positively be conveyed to you individuals.

Posthaste: Canada is becoming unaffordable for a majority of parents & More News Today

All this information that I’ve introduced as much as you or would be the most totally different and greatest information that you just persons are not going to get wherever, together with the data Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you may get different sorts of information alongside together with your nation and metropolis. You will have the ability to get data associated to, in addition to it is possible for you to to get details about what is happening round you thru us for free

as a way to make your self a educated by getting full details about your nation and state and details about information. Whatever is being given by us, I’ve tried to carry it to you thru different web sites, which you’ll like

very a lot and should you like all this information, then positively round you. Along with the individuals of India, maintain sharing such information essential to your family members, let all of the information affect them and so they can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links