|

| Singapore has opened its borders to totally vaccinated guests. Source: iStock |

Singapore’s banks are possible to see sooner mortgage development and improved profitability as Southeast Asian economies open up for enterprise and journey after two years.

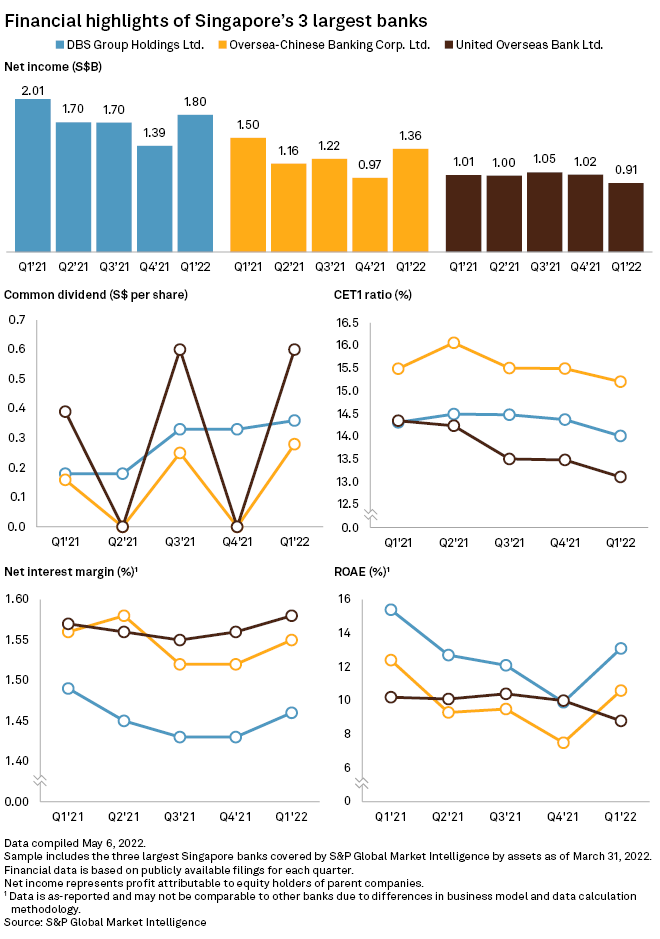

Loans throughout the three Singaporean banks — DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. Ltd., or OCBC, and United Overseas Bank Ltd. — rose by 8% to 9% yr over yr within the first quarter of 2022, in accordance to their not too long ago introduced outcomes. That was a major enchancment from a 5% mortgage development reported every by DBS and UOB within the first quarter of 2021, whereas OCBC’s loans had been flat, dragged by the COVID-19 pandemic.

DBS expects a mid-single-digit development in loans this yr, and UOB expects a mid- to high-single-digit enhance.

Loans are anticipated to grow as Southeast Asian economies open borders, increase infrastructure spending and enhance manufacturing capability, stated Thilan Wickramasinghe, head of analysis and head of regional financials at Maybank Kim Eng Singapore. “This should drive loan demand higher,” Wickramasinghe stated.

The three Singapore banks are closely centered on Southeast Asia and derive most of their earnings from the area. In 2021, DBS generated round 70% of its working revenue from Singapore, and South and Southeast Asia, in accordance to S&P Global Market Intelligence knowledge. OCBC and UOB derived round 80% of their working revenue from the city-state and Southeast Asia.

Regional mannequin

An increase in mortgage demand, in accordance to Wickramasinghe, “bodes well for the Singapore banks who have been investing in integrated regional models that could take advantage of cross-border credit and banking services demand.”

Singapore itself totally reopened its borders to all vaccinated guests from April 1. The authorities expects the city-state’s financial system to grow by 3% to 5% in 2022, following a 7.6% enlargement in 2021, in accordance to the Ministry of Trade and Industry. The Monetary Authority of Singapore tightened coverage forward of many world friends and set the native greenback on a steeper appreciation path in opposition to a basket of currencies of the nation’s key buying and selling companions. As most world central banks, together with the U.S. Federal Reserve, elevate charges to curb inflation, the outlook for banks may enhance.

Loan development is predicted to prop up banks’ earnings alongside the impact of rising web curiosity margins — a key metric to banks’ profitability — which were helped by rising rates of interest. NIMs throughout the three banks have risen by 2 to 3 foundation factors quarter over quarter, indicating a restoration after having fallen for 3 years amid the pandemic-induced slowdown.

Prudent provisions

Singapore banks largely maintained provisions to trip by way of market uncertainties and defend in opposition to an increase in unhealthy loans, in accordance to their first-quarter outcomes.

“The provision levels for the banks are prudent with provisioning coverage at close to 100%, or 1 times, on nonperforming assets,” stated Michael Wu, senior fairness analyst at Morningstar. “Despite the expectation of slower growth, the overall economic conditions should still [improve] that is supportive of asset quality.”

In addition, the banks have maintained their “management overlay,” an extra quantity agreed upon by banks to complement provision necessities from the central bank.

“Although risks of negative credit cost guidance revisions remain, large management overlay buffers reduce the likelihood of significant earnings downgrades,” in accordance to a May 3 word from CGS-CIMB.

As of May 11, US$1 was equal to S$1.39.

Singapore bank loans to grow as Southeast Asia reopens after pandemic & More Latest News Update

Singapore bank loans to grow as Southeast Asia reopens after pandemic & More Live News

All this information that I’ve made and shared for you individuals, you’ll prefer it very a lot and in it we preserve bringing matters for you individuals like each time so that you just preserve getting information info like trending matters and also you It is our purpose to have the option to get

all types of stories with out going by way of us in order that we are able to attain you the newest and greatest information without cost with the intention to transfer forward additional by getting the data of that information along with you. Later on, we’ll proceed

to give details about extra today world news update sorts of newest information by way of posts on our web site so that you just all the time preserve shifting ahead in that information and no matter sort of info will probably be there, it should undoubtedly be conveyed to you individuals.

Singapore bank loans to grow as Southeast Asia reopens after pandemic & More News Today

All this information that I’ve introduced up to you or would be the most totally different and greatest information that you just persons are not going to get anyplace, together with the data Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you will get different sorts of information alongside together with your nation and metropolis. You will probably be ready to get info associated to, as effectively as it is possible for you to to get details about what’s going on round you thru us without cost

with the intention to make your self a educated by getting full details about your nation and state and details about information. Whatever is being given by way of us, I’ve tried to carry it to you thru different web sites, which you’ll like

very a lot and should you like all this information, then undoubtedly round you. Along with the individuals of India, preserve sharing such information essential to your family members, let all of the information affect them they usually can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links