When Joe Biden scrapped a allow for the big Keystone XL pipeline simply hours after getting into the White House final yr, a dying knell appeared to be ringing for Canada’s oil sands, by far the largest provider of international oil to the US.

The challenge, which might have carried Alberta’s heavy, bituminous crude oil to Gulf Coast refineries in Texas, had been opposed for years by environmentalists, owing to the oil sands’ related ecological affect and excessive emissions (higher than these of many European nations).

Even earlier than the cancellation, huge European oil firms, insurers and some Wall Street buyers had began fleeing a sector that was changing into a villain of the environmental, social and governance investing motion. Then, the Covid-19 pandemic triggered an oil crash that deepened the harm, forcing operators to sack hundreds of staff, throttle manufacturing and slash capital spending.

In Alberta, a province the place nearly everybody is associated to somebody who works in the oilfield, the new US president’s determination deepened the gloom.

Yet, 18 months later, the temper is brightening as surging oil costs begin to revive the financial system. Alberta’s producers — pressured to take care of sub-zero oil costs only a couple of years in the past — are utilizing the windfall from $100 a barrel crude to restore their stability sheets and beef up dividends. Production is rising once more. So is export capability: a pipeline system to the Midwest has been expanded and one other to the west coast is due on-line subsequent yr. Across the province’s oil patch, enterprise is instantly brisk.

“Everything’s just totally switched,” says Tim Valleau, proprietor of 1441 Energy Services, an oilfield upkeep firm in Wainwright, a city near the Saskatchewan border. When the pandemic hit in 2020, he dismissed the 11 males who labored for him. Now he is struggling to search out sufficient staff. “Folks are punching wells all over the place. It’s right back to where it was in 2014 — and in 2014 it was nuts,” he says, referring to the final time oil topped $100 a barrel, earlier than costs crashed.

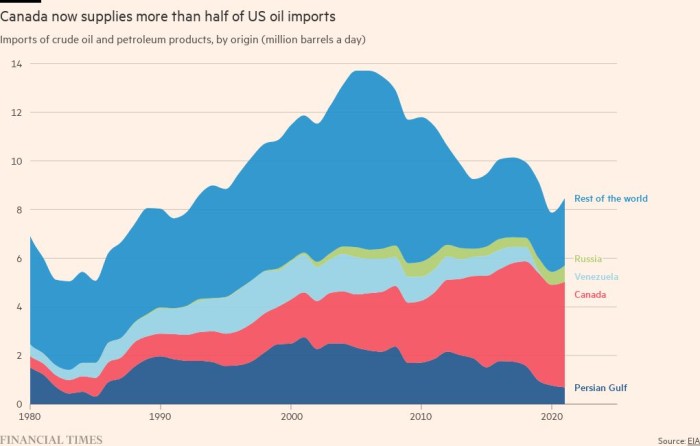

Alberta’s premier, Jason Kenney, says Russia’s invasion of Ukraine has triggered a brand new nervousness about power safety that gives “perverse vindication” for the province and its controversial oil sands sector. Political hostility is starting to melt as leaders are “mugged by reality”, he says. “We’ve been saying all along — we cannot allow some of the world’s worst regimes to have a dominant role in global energy markets.”

Last month, Kenney testified to a US Senate committee listening to about nearer co-operation on power between Canada and its southern neighbour. “Senators, Calgary is a lot closer to Washington than Riyadh,” Kenney informed the committee. “And you don’t need the US Navy’s Fifth Fleet to patrol the Great Lakes.”

Yet, even when the political winds are altering, there is an even bigger take a look at going through the oil sands: whether or not its operations might be greened sufficiently to stay viable in a future that will demand a lot much less oil, and definitely loads much less carbon.

Producers say they’ll, and have outlined formidable carbon seize plans to take action, with an aggressive timeline that may ship outcomes (or not) inside the decade. Analysts are additionally hopeful, saying the tasks, which at the moment produce some of the world’s dirtiest oil with a per-barrel carbon content material increased than different kinds of crude, may quickly supply a lot cleaner provides. Environmentalists stay sceptical.

You are seeing a snapshot of an interactive graphic. This is most certainly attributable to being offline or JavaScript being disabled in your browser.

The final result will matter exterior Canada too, revealing whether or not or not one of the world’s greatest fossil fuel producers, sitting on the planet’s third-largest trove of oil, might help soothe rapid anxieties about power safety with out worsening its long-term local weather downside.

Alberta ought to get squarely behind the effort to make its trade extra sustainable, says Samir Kayande, a former power guide now working for the provincial meeting as a candidate for the progressive New Democratic Party: “As long as the world is using oil, I want them to be using our oil, because that’s better for the world — and it’s definitely better for us.”

Life on the oil sands

A red-tailed hawk circles above the white oil storage tanks on the south-east financial institution of the Battle River. Lorries cruise down Highway 13, their juddering retarder brakes piercing the calm of a prairie spring day. “You dream it, we’ll create it,” reads the signal at the florist on 51st avenue.

Until Biden cancelled the US leg of KXL’s allow final yr, Hardisty, Alberta — inhabitants 456 — was the place 830,000 barrels of oil a day would have entered the C$8bn ($6.3bn) pipeline for cargo to American Gulf Coast refineries with the coking services to deal with the heavy crude. The city had anticipated a building growth.

The loss of the allow was a blow to the entire province. Kenney had ploughed greater than C$1bn into KXL — a transfer many mentioned was a failed gamble on the re-election of Donald Trump, who had pledged to get the challenge constructed. Lobbyists mentioned the pipeline was important to underpin oil sands progress. Environmental campaigners wished to cease it for the exactly the identical purpose.

Both sides could also be incorrect. Oil sands manufacturing is rising once more even with out KXL, as different pipeline routes are expanded to supply export capability. One of them, the federally owned Trans Mountain enlargement to Canada’s Pacific coast, is due by subsequent yr after a surge in building prices. A challenge including capability to Enbridge’s community to the US Midwest is already full.

Alex Pourbaix, chief government of Cenovus Energy, one of the oil sands’ largest operators, mentioned the new pipeline capability had “put the industry in pretty good shape for a number of years”.

Biden’s opponents at house cite the scrapping of the KXL allow once they blame him for hovering fuel costs. Yet the oil trade itself is not clamouring to revive it. Producers are hardly dashing to plough extra money into exploration and manufacturing, and buyers need their firms to make use of this yr’s oil-price windfall for beefier dividends, no more manufacturing. The period when builders plotted big new tasks appears to be over.

Even Canadian Natural Resources, the sector’s most aggressive producer, which raised its deliberate capital expenditure for 2022 by nearly 25 per cent, is committing to speculate a lot lower than in the earlier growth years. Spending commitments from different operators are additionally nicely shy of peak years. Oil sands capex ran at about C$30bn yearly earlier than 2014, based on Alberta’s power regulator. It was a interval of excessive crude costs and a rush of inward funding. By 2021, although, the determine was lower than C$9bn. It is not anticipated to rise above C$15bn a yr in the subsequent decade.

Kevin Birn, head of emissions co-ordination and chief analyst of Canadian oil markets at S&P Global Commodity Insights, reckons that present tasks, at the moment producing about 3.1mn barrels a day, can add about one other 500,000 b/d by 2030 — a price of progress nicely beneath that seen in the US shale sector in current years.

“I do think we’re going to see more growth,” says Jackie Forrest, government director at Calgary’s Arc Energy Research Institute. “But I don’t think you’re going to see another big oil sands mine.”

The trade’s critics, in the meantime, sense a deeper change afoot in the mentality of the builders — or a minimum of their shareholders — as they start to take care of the implications of a world power transition.

Alberta’s authorities doesn’t like to speak about the risk that demand for the province’s oil could fall — Kenney insists oil and gasoline will stay the mainstay of Alberta’s financial system “possibly for the next 30 or 40 years”. But Canada’s Liberal authorities is taking a distinct tack beneath the management of prime minister Justin Trudeau.

The authorities might be “very active in looking to drive down demand for oil in the world”, mentioned Jonathan Wilkinson, Canada’s pure sources minister, in a current interview. It is a stance that hews nearer to that of the International Energy Agency, which has mentioned international oil consumption should drop 75 per cent, to only 24mn barrels a day, if the world is to hit its local weather targets.

That could not go away a lot room for Canada’s higher-cost, higher-emissions oil. While oil sands producers aren’t on the identical path as European supermajors comparable to BP, which has talked of lowering output and forecasts sharp falls in international fossil fuel demand, their funding stance could mirror that actuality, argues Jan Gorski, a director at the Pembina Institute, a clear power think-tank in Alberta. “Nobody is going to be building new pipelines, new projects,” he says. “The future is bleak for the product.”

Greener horizons

If oil sands operators are to guard themselves and avert that bleak future, their effort will begin in locations like Christina Lake.

Deep in Alberta’s northern muskeg wilderness, pipes snake by groves of aspen and tamarack, carrying steam in one course and bituminous emulsion, extracted by wellheads on drilling pads scattered by the forest, in the different. Black bears roam round the employee camps close by.

The Christina Lake challenge can pump about 250,000 b/d of oil — greater than the whole output of some Opec nations. It is one of a number of “in situ” oil sands operations, a technique of manufacturing involving the injection of steam deep underground to assist coax the heavy oil away from the packed pay dust. From the floor, this seems like standard drilling — and it is loads simpler on the eye than the big open-pit mines round Fort McMurray, a pair of hours’ drive additional north, whose scale and ecological affect have blackened the oil sands’ fame.

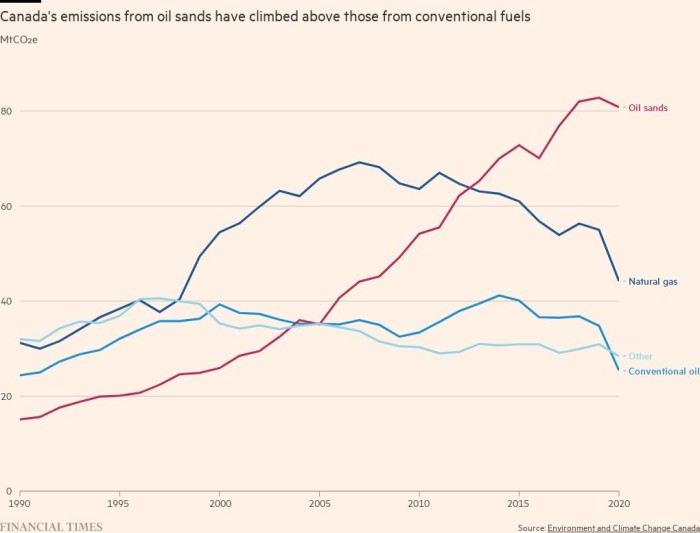

But even Christina Lake, one of Alberta’s best tasks, wants two barrels of steam for every barrel of oil it produces. Burning the pure gasoline to make that steam, throughout the oil sands’ in situ tasks, emits loads of CO₂. Total greenhouse gasoline emissions from the oil sands tasks are working at about 80mn tonnes a yr, based on the federal authorities — greater than Austria’s annual emissions. As manufacturing rises over the subsequent few years, so will the air pollution.

The Canadian authorities is cracking down on emissions as half of its pledges in the direction of worldwide local weather targets. For the nation’s oil and gasoline sector, it is calling for a 42 per cent emissions lower from 2019 ranges by 2030. An escalating carbon tax is already in place, priced at C$50 per tonne now and attributable to rise to C$170 by 2030.

Ottawa is additionally planning to ascertain a complete emissions cap on the sector, though the structure grants the provinces management over the useful resource, which can make any enforcement tough. And oil sands producers say the federal targets should not possible.

“We made it very clear,” says Martha Hall Findlay, a former federal Liberal social gathering politician who is now Suncor Energy’s chief local weather officer, “those numbers for our industry by 2030 — there’s no way that we’re going to make them.”

You are seeing a snapshot of an interactive graphic. This is most certainly attributable to being offline or JavaScript being disabled in your browser.

Instead, the oil sands producers have set their very own targets. Last yr, a number of of the greatest operators shaped the Oil Sands Pathways to Net Zero initiative, pledging to succeed in impartial emissions from their operations (although not these from the combustion of the oil they promote, which quantities to a far larger supply of CO₂) by 2050 with an preliminary aim of chopping 22mn tonnes a yr by 2030. This goal is extra modest than the authorities’s, however assembly it might nonetheless be a major local weather breakthrough. It is a recognition that they need to lower air pollution shortly or lose their market, their shareholders and their social licence to function, say analysts.

Cash in the coffers

Decarbonising Alberta’s oil trade will take some doing — and loads of cash. The first section of the producers’ plan entails constructing the world’s most formidable carbon seize and storage facility.

There are three major sources of CO₂ emissions from the oil sands — these from the manufacturing, these from upgrading the heavy sludge into artificial crude oil, and people created from refining the crude oil into fuels. The carbon from these processes can be captured at every facility, they are saying, and despatched by a brand new trunk line to be saved beneath Cold Lake in east-central Alberta.

But regardless of years of trade discuss, environmentalists say carbon seize and storage is unproven and never possible at scale and that oil firms are touting it as a strategy to preserve pumping extra fossil fuels, whether or not the expertise works or not.

It is nonetheless costly to put in and function. Hall Findlay says the carbon seize ingredient of the challenge may value C$14bn in capital and working prices. Pourbaix, at Cenovus, estimates the whole plan out to 2050 will run at a price of C$2.5bn per yr.

The federal authorities has supplied an funding tax credit score value as much as 50 per cent of the capital prices for the challenge. But firms additionally need Alberta’s provincial authorities to assist out. “This industry is in the process of putting a whack of cash into the Alberta coffers,” says Hall Findlay, “and what we’re doing here is ensuring the longer term viability of this industry, which is really important to Alberta.”

Indeed, says Arc’s Forrest, carbon seize may “extend the runway” for the oil sands, that are getting into a profitable royalty payout section for the Alberta authorities. It can be of “huge economic value to the citizens of Alberta to get those royalties for longer”, she says.

But the timeline is tight — and political uncertainties make the means forward unsure. Regulatory approval for the carbon seize proposals may take a pair of years, says Hall Findlay. And a distinct future authorities may scrap the carbon tax. In Alberta, Kenney lately resigned after a revolt in his Conservative social gathering in opposition to his management, although he stays in energy for the time being, creating new doubts about future provincial power coverage.

The firms have but to take the plunge. But if they’re to fulfill their very own 2030 goal, operators have to take choices now, says Chris Severson-Baker, a senior director at Pembina. “Every day that they don’t . . . makes it seem that they aren’t genuine,” he says.

But Pourbaix is adamant. “We’re absolutely going to do everything in our power to decarbonise,” he says, and, in doing so, to attempt to win again US favour.

There are indicators that these efforts should not in useless. At the Senate committee listening to final month Alaska’s Republican senator Lisa Murkowski echoed the oil producers’ rationale: “Sometimes our solutions are right in our back yard. Look to your neighbours first. For some strange reason, we have not done that,” she mentioned.

Canada’s oil sands: why some of the world’s dirtiest fuel is now in hot demand & More Latest News Update

Canada’s oil sands: why some of the world’s dirtiest fuel is now in hot demand & More Live News

All this information that I’ve made and shared for you folks, you’ll prefer it very a lot and in it we preserve bringing matters for you folks like each time so that you just preserve getting information data like trending matters and also you It is our aim to have the ability to get

every kind of information with out going by us in order that we will attain you the newest and greatest information without cost as a way to transfer forward additional by getting the data of that information along with you. Later on, we are going to proceed

to offer details about extra today world news update sorts of newest information by posts on our web site so that you just all the time preserve shifting ahead in that information and no matter variety of data might be there, it’s going to positively be conveyed to you folks.

Canada’s oil sands: why some of the world’s dirtiest fuel is now in hot demand & More News Today

All this information that I’ve introduced as much as you or might be the most totally different and greatest information that you just persons are not going to get wherever, together with the data Trending News, Breaking News, Health News, Science News, Sports News, Entertainment News, Technology News, Business News, World News of this information, you may get different sorts of information alongside along with your nation and metropolis. You will be capable of get data associated to, in addition to it is possible for you to to get details about what is occurring round you thru us without cost

as a way to make your self a educated by getting full details about your nation and state and details about information. Whatever is being given by us, I’ve tried to deliver it to you thru different web sites, which you will like

very a lot and when you like all this information, then positively round you. Along with the folks of India, preserve sharing such information essential to your family members, let all the information affect them they usually can transfer ahead two steps additional.

Credit Goes To News Website – This Original Content Owner News Website . This Is Not My Content So If You Want To Read Original Content You Can Follow Below Links